Bitcoin Mining is Gobbling Up New York's Precious Renewable Energy

Bitcoin is a popular cryptocurrency (photo: Kanchanara)

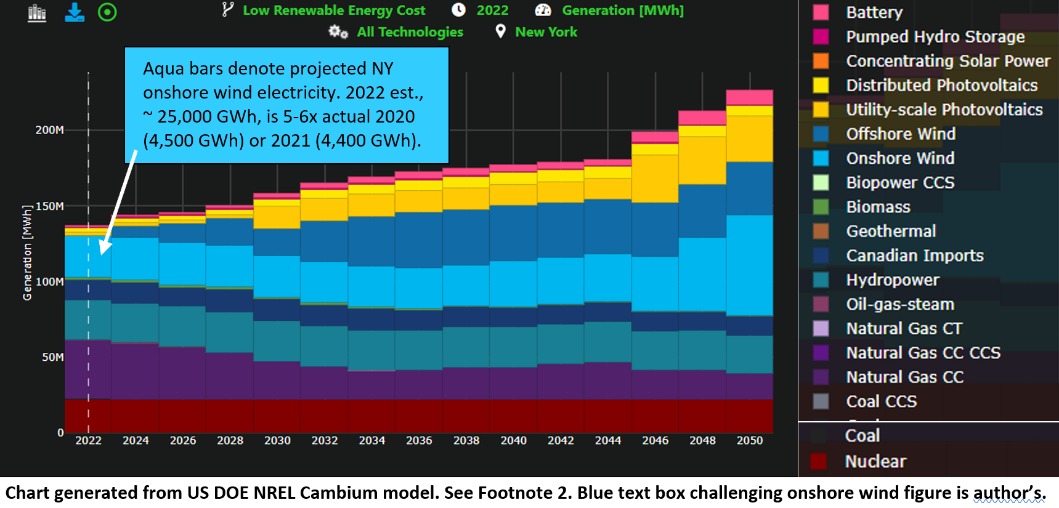

Like time in Steve Miller’s classic-rock song, New York’s decarbonization targets keep slipping into the future.

Highway widenings are spurring more driving. Suburban resistance to upzoning is locking in energy-demanding sprawl. Electricity from the state’s wind turbines shrank last year1, even as climate advocates, relying on dodgy U.S. Energy Department modeling, overstate future carbon reductions from “electrifying everything.”2

Promising developments like offshore wind leasing and new transmission to carry hydroelectricity from Quebec barely compensate, if at all, for carbon emissions unleashed by closing the Indian Point nuclear plant. As I have pointed out elsewhere, shutting existing zero-carbon power sources means that new ones don’t actually cut emissions; at best, they keep us running in place, punching huge holes in pledges to achieve a carbon-free power grid by 2040.

To this dreary picture, add crypto mining — enormous networks of electron-eating computers running 24-7 so that digital currencies like Bitcoin and Ethereum can maintain virtual “coins” or “tokens” in encrypted ledgers that bypass traditional third parties like banks.

From Buffalo and the Finger Lakes to the state’s northern tier, crypto entrepreneurs are building new generators or firing up retired ones to power their crypto mining operations. Other crypto sites draw on the grid.

Self-sourced or not, the requisite electricity ends up forcing additional burning of fossil fuels, as Sierra Club researchers documented in extensive comments this week to the President’s Office of Science and Technology Policy, pushing the state’s ambitious decarbonization goals further out of reach. To what end?

In Uber’s Footsteps

Enigmatic, opaque, futuristic — crypto-currency cries out for historical analogues. Here’s one: Uber.

Uber burst on the scene in the early 2010s not as a new form of transportation but a new kind of network enabling a reconfiguration of transportation. Its appeal was tailored around three promises: it would enhance traffic efficiency by eliminating cruising for fares; it would extend convenient for-hire vehicle service outside Manhattan; and it would end service refusals to people of color.

The packaging — sleek and app-enabled — augured a frictionless, digital future. With a few taps New Yorkers could summon a chariot.

The results were mixed. We now know that stockpiling of Ubers in Manhattan has wrought even more gridlock than taxi cruising. But Uber did broaden access to for-hire vehicles, even as it bled ridership from the MTA and, worse, rained economic ruin on the incumbent yellow-cab industry.

Bitcoin and other crypto-currencies come with their own glossy promises, though these are more chameleon-like. (Earlier this year New York Times columnist Paul Krugman disparaged them as “word salad.”) Among them, as Annie McDonough reported recently in City & State, is the prospect of liberation from ingrained discriminatory banking and lending by U.S. financial institutions.

“[Crypto backers] see the technology as an economic equalizer,” writes McDonough. “A tool not just for the rich to get richer, but for people who have been discriminated against by banking institutions or locked out of investment opportunities, including people of color and low-income communities.”

Really? In New York, and almost certainly anywhere else, unbanked households overwhelmingly lack the requisite credit history or liquid assets — bank accounts, debit cards, credit cards — to purchase cryptocurrency tokens. Moreover, scammers and grifters are finding crypto fertile territory for high-tech swindles, as New York Times columnist Farhad Manjoo noted this month. An arguably safer and more effective way to root out credit segregation would be to speed Biden administration rulemaking to add teeth to the Community Reinvestment Act — the 1977 law intended to repair decades of redlining.

The emergence of crypto-front groups like the National Policy Network of Women of Color in Blockchain demonstrates the industry’s readiness to exploit deep-seated bitterness over legacy redlining. So does the participation in crypto lobbying of Bradley Tusk, the one-time Mike Bloomberg consigliere who a decade ago deftly deployed Black fury over persistent taxi discrimination to help Uber eradicate cabbies’ exclusive right to pick up street hails in Manhattan and subsequently helped fend off serious regulation of the app-ride industry for several crucial years.

Let’s Burn Up The Grid

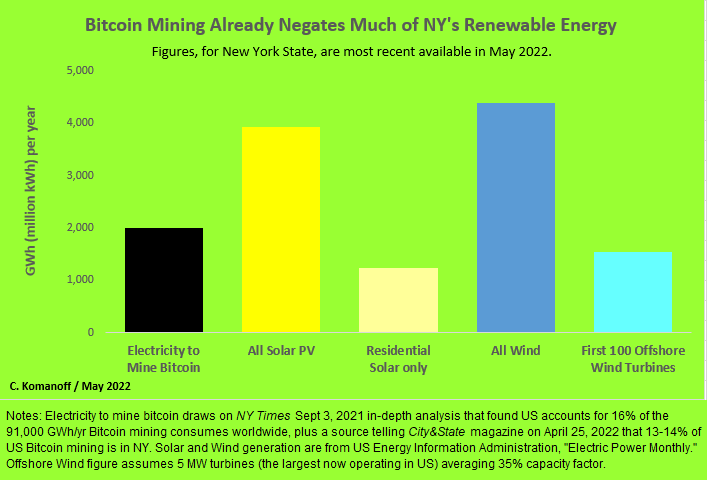

There is no registry of electricity consumed by crypto mining in New York State. Worldwide, though, crypto burns through an estimated 91,000 gigawatt-hours (or, 91 billion kilowatt-hours) of electricity annually, according to a New York Times survey of crypto last September. Some 16% of that, or 15,000 GWh, is said to be consumed in the United States.

While New Yorkers are accustomed to thinking of our state as resource-poor, crypto miners are now exploiting half-a-dozen hydro power sites and formerly boarded-up fossil-fuel plants in northern and western New York. One industry source cited by City & State estimates that 13-14% of his company's U.S. crypto mining takes place in our state. Extrapolating that share across the industry, crypto is annually consuming 2,000 GWh of electricity in New York State — a figure that could grow not just with increased transactions but with ever-more complex digital encryption.

Even holding at 2,000 GWh, that’s a lot of juice: more than the electricity generated last year from all the solar panels on residential buildings in the state, or more than what will come from the first 100 promised offshore wind turbines once that industry launches (see graph below). And, though crypto in New York consumes less electricity than all current solar or wind, that comparison is of no comfort, as those renewable sources need to be displacing fossil fuels (primarily fracked gas) from the state’s grid — which they can’t do if their output is effectively being consumed mining Bitcoin.

The operative word, “effectively,” encompasses two distinct but complementary dynamics. Grid dynamics dictate that any new locus of demand such as Bitcoin forces utilities to draw more heavily on fossil-fuel generators, because the non-carbon sources — nukes as well as renewables — already run as flat-out as they can. The climate dynamic is that from a statewide perspective, additional use of fossil-fuel generators negates the carbon-reduction benefits that wind and solar and nuclear would otherwise provide.

This perspective casts a harsh light on claims that a particular crypto installation is being renewably sourced. Connecting crypto to a refurbished hydro dam or solar or wind farm may sound green, but all those whirring hard drives are really siphoning off carbon-free electricity that now “won’t be available to power a home, a factory or an electric car,” as the Times’ 2021 story put it. (One hopes that the irony of crypto adherents miscounting green electrons doesn’t carry over to their currency bookkeeping.)

Carbon Tax vs. Crypto?

A stiff New York State carbon tax could slow and even reverse the rise of cryptocurrency here (likewise nationwide).

The rise in electricity prices would undermine whatever competitive advantage Bitcoin miners gain from locating in New York. Some miners would leave, new ones would stay away, and those who stay would endeavor to blunt the impact of the tax by upgrading their efficiency.

Not only that, crypto miners seeking zero-carbon generation increasingly would find themselves competing with non-crypto businesses seeking to contain their power costs. Other businesses, less power-intensive per dollar of revenue, would be in position to outbid the crypto companies.

The prospective flight to other jurisdictions could help build momentum to tax carbon emissions there as well, as more states and countries come to conclude that crypto jobs and revenues aren’t worth straining their grids, not to mention trashing their air-sheds and stealing their quiet.

This isn’t to hold out carbon taxing as a one-bullet crypto killer — we need many bullets for that, the bigger the better — but to illustrate its broad potential to stop frivolous (and in this case imbecilic) new uses of electricity before they can gain a foothold.

Why not regulate crypto away? That battle would consume years, tying down policy resources while emissions continued to spew. Worse, we have neither the time nor the ability to see around corners required to enact, piecemeal, restraints on each new locus of energy demand.

Even as energy-efficiencies continue to do wonders — total U.S. electricity use last year was just a few percent higher than in 20053 — underpriced electricity elicits new hellspawns of needless use that undo much of that progress.

Carbon taxes by themselves can’t solve everything that ails climate. But they could, for a change, get the solutions out in front of the problems.

***

Charles Komanoff, long-time New York policy analyst and environmental activist, directs the Carbon Tax Center. On Twitter @Komanoff.

Note: The column has been corrected to reflect the fact that New York's estimated 13-14% share of U.S. crypto mining applies to a single crypto company rather than industry-wide. The extrapolation to other companies is the author's, not the source's.

1US Energy Information Administration, "Electric Power Monthly," Table 1.14.B, “Utility Scale Facility Net Generation from Wind,” shows 4,522 GWh in New York State in 2020 and 4,387 GWh in 2021.

2To estimate future carbon reductions from the December 2021 New York City ban on gas heating and cooking in new buildings, the law’s proponents and the Dec. 15, 2021 New York Times story reporting on it both cited a Dec. 10, 2021 post, Stopping Gas Hookups in New Construction in NYC Would Cut Carbon and Costs, by the consultancy RMI. The RMI authors note that their calculations employed future electricity grid emission factors modeled by U.S. DOE’s National Renewable Energy Lab’s “Cambium” dataset. Examination of that dataset reveals, inter alia, that it assumes a non-existent five-fold increase in New York State on-shore wind-generated electricity from 2020 to 2022.

3Figures from US Energy Information Administration, "Electric Power Monthly," Table 7.2a Electricity Net Generation: Total (All Sectors)” supplemented by Table 10.6 (“Electricity Net Generation from Distributed Solar”) indicate total U.S. electricity generation of 4,164,565 GWh in 2022 and 4,055,785 GWh in 2005. For those interested, the implied compound annual average growth rate over those 17 years is a minuscule 0.17 percent.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

What To Do with Billions of Dollars Beyond Projections That Keeps Flowing into New York State Coffers

Gov. Hochul presents the budget (photo: Mike Groll/Office of Governor Kathy Hochul)

The State adopted its budget on April 9 with substantial investments across the board in helping New Yorkers, from big increases in school aid and child care to homeowner rebates, gas tax relief for motorists, more funding to avoid evictions, bonuses for health care workers, and relief for hospitals and the health care system. Governor Hochul and the Legislature based the revenue and spending assumptions on an update from the Governor in late February, modified by an early March agreement between the Legislature and Governor called the Consensus Revenue Forecast.

Notwithstanding all the healthy increases in spending, from State Comptroller Thomas DiNapoli reported that $3.3 billion more than had been expected in February had flowed into the State Treasury by the closeout of the State fiscal year on March 31.

There are now billions of dollars, unbudgeted and unappropriated, newly available for the state to utilize beyond those funds in the April 9 adopted budget for the fiscal year that began April 1. These funds don’t include $12 billion in federal aid from the American Rescue Plan already available to the state over the next several years, or $5 billion in surplus state funds already realized, saved, and budgeted as of March 31. The new funds are at least $2.1-$2.5 billion more than the Consensus Revenue Forecast had established as the finalized basis for the State’s budget, and that is even before the month of April 2022 started.

In California, which has not yet adopted its budget, Governor Newsom and legislative leaders are arguing about how to distribute their original $9 billion relief package of gas tax relief and transit aid, versus direct checks to the taxpayers, even as the state’s surpluses keep expanding. Other states across the nation are sending out tax rebates and other forms of relief.

The New York State Division of the Budget has until May 19 to produce the financial plan based on the adopted budget and provide all the baselines for revenue and spending. There are already other indicators, however, beyond the State Comptroller’s report, that the flow of unanticipated largesse will continue. The New York City Comptroller, Brad Lander, reported on May 2 that April is likely to be a record for New York City personal income tax collections.

The close linkage between the New York State and New York City personal income taxes suggests that April’s state tax collections would be comparably healthy, perhaps even billions of dollars more than anticipated. The State Comptroller also reported that local government sales tax collections rose 21% in the first quarter of 2022 compared to that period in 2021. The public should know very soon what the state’s April tax receipts were.

What should the state do with another $4 billion in tax receipts that have come in higher than anticipated, just in March and April? In addition to simply sending out checks, California is considering offering free mass transit. There is also another New York State gas tax that motorists don’t see listed at the pump, because it’s embedded as a wholesale price and is named the Petroleum Business Tax. These offer further avenues for relief before the Legislature leaves Albany in June.

One month’s current revenue from the riders of all MTA systems is a modest $400 million. I handled mass transit in budget negotiations for six years as Chair of the Assembly Committee on Corporations, Authorities, and Commissions, and MTA operations comprise as much as 90% of total mass transit statewide, meaning the rest of all the public bus systems’ revenue for one month in the state would be a mere $50 million. In order to avoid chaos from riders flowing through transit systems for free, each system could offer one free fare for every paid fare, and give all riders four months at a 50% discount for a cost that would not exceed $900 million. The state could advance the funds to the MTA and other mass transit systems and work on implementing two months of a 50% discount after Labor Day.

The state budget provided for 16 cents off the gas tax beginning June 1 for six months, by temporarily suspending the sales and motor fuel taxes on gasoline, providing $584 million in relief. Since the money from those taxes helps pay to cover road and bridge repairs, and some mass transit subsidies, the budget provided that the state’s General Fund cover those needed subsidies for the duration of the suspension.

The petroleum business tax, at the wholesale level, adds another 17 cents on a gallon of gas. The amount of money collected on gasoline sales from this tax is comparable to the amount suspended from the sales and motor fuel taxes ($600 million for six months), and the state could suspend this tax too. It might be too late to implement the suspension by June, but it is implementable by August. Together, the suspension of the three taxes would provide 33 cents a gallon in tax relief for the state’s motorists. The state’s General Fund would have to compensate for the lost subsidies for roads, bridges, and mass transit for the PBT, as it did for the other taxes.

Together, the two new forms of transportation relief would cost the state $1.5 billion, and leave about $2.5 billion of unbudgeted revenue already recognized to appropriate to assist New Yorkers.

What to do with that money? Some states across the nation are simply sending checks to people, with different schemes for assuring almost everybody gets something. The Governor, the Legislature, the Division of the Budget, and the State Department of Taxation and Finance ought to be able to devise a plan. New York full-time residents filed 9.5 million tax returns, and one-third of those filers had no tax liability. This year’s state budget is already delivering relief to many taxpayers in different kinds of ways, but the timing of this relief varies.

In October homeowners making less than $250,000 a year will get a total of $2.2 billion in rebate checks from the state connected to the STAR program property tax relief system. Roughly 2.5 million homeowners are expected to get checks, from a few hundred dollars to up to $1,000, depending on their specific property taxes.

The state is accelerating an income tax reduction begun under former Governor Cuomo, called a middle-class tax cut, with most of the reduction taking place in calendar year 2023 because adjusting the state’s income tax tables and withholding from employers takes time to implement. The benefits might not be very noticeable, a saving of a few hundred dollars a year, spread out over 52 weeks of employer withholding a little less when you get paid.

The state is also increasing the child care tax credit and earned income tax credit benefits. These are good to do, but residents who benefit may have to wait until filing next year’s tax returns to see the additional savings. State taxpayers received the current benefits from these programs at the time they filed their taxes this year.

The state may want to send checks to help residents along very basic lines. For example:

Full-time residents who filed single taxpayer returns, who were not claimed as a dependent on another return, whose incomes are below $75,000 a year, could receive $250 in October. Those who are homeowners already receiving rebate checks could receive a more limited amount. Married couples filing jointly with incomes below $150,000 could receive one check for $400, with those getting homeowner rebates receiving less. Heads of household under $100,000 could receive $250, and all households claiming a dependent could receive $100 per dependent. The total value of the checks could not exceed $2.5 billion, so my template will surely need adjusting.

When it comes to spending money, there is no lack of ideas. The critical point is that there is much more money coming into the state treasury than previously anticipated, and a window to give more relief to New Yorkers before the Legislature leaves for the year in just a few weeks.

***

Jim Brennan was a member of the New York State Assembly for 32 years, where he chaired four committees. On Twitter @JimBrennanNY.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

To Truly Address Homelessness, New York City Must Take on Housing Voucher Discrimination

Welcome home (photo: Ed Reed/Mayoral Photography Office)

In 2021, the values of New York City's largest housing voucher program, known as CityFHEPS, were significantly raised. This victory, passed by the City Council and Mayor de Blasio, was accomplished thanks to the tireless efforts of housing advocates and opened up tens of thousands of new housing units for tenants holding these vouchers — among the most vulnerable New Yorkers.

We must now turn our attention to ensuring that the landlords and brokers of these newly-eligible units are not discriminating against CityFHEPS voucher holders, and that our housing enforcement agencies have the resources to combat voucher discrimination.

For context, the CityFHEPS program provides thousands of families who are experiencing homelessness or on the brink of eviction the opportunity to pay an affordable rent in the private market. In New York City and New York State it is illegal for landlords, owners, and real estate brokers to discriminate against prospective or current tenants based on their lawful source of income. Morally, these laws exist to protect families, seniors, people with disabilities, and other at-risk populations from homelessness and the trauma of housing instability. Fiscally, they reduce the enormous cost of homelessness, which manifests itself in our homeless shelter system, healthcare system, legal system, unemployment system, foster care system, and in many other ways.

Our national housing watchdog group, Housing Rights Initiative, recently finished a six-month-long investigation into discrimination against CityFHEPS voucher holders. We began this investigation in response to reports we had received from housing advocates and tenants who experienced discrimination, and also inspired by previous investigations conducted by our organization. In fact, in March of 2021, our investigations in New York City led to one of the largest fair housing lawsuits since the enactment of the Fair Housing Act. This lawsuit was filed on behalf of Housing Rights Initiative by Legal Aid Society and Handley Farah & Anderson PLLC against 88 real estate companies for discriminating against Section 8 voucher holders.

In conducting our undercover investigation investigators like myself posed as CityFHEPS voucher holders and looked up apartments in the confines of the current voucher limits. While many brokers did accept CityFHEPS, many did not, outright refusing to rent to CityFHEPS voucher holders, as well as covertly discriminating, either through “ghosting” or setting exorbitant income requirements. Here is an example recording from one of our investigators. Our watchdog group found rampant discrimination at the hands of the New York City real estate industry, which illustrates the failures of our government to enforce its fair housing laws.

City Limits reporting last summer highlighted how New York City voucher enforcement cannot keep up with the constant reports of voucher discrimination occurring, and the agencies are understaffed in handling such a large influx. The report called voucher enforcement “hollowed out.”

The city’s voucher enforcement is conducted by two agencies. The Department of Social Services (DSS) has a Fair Housing Litigation unit through the Human Resources Administration, which handles cases of housing discrimination ranging from race, disability, or source of income. Additionally, the New York City Commission on Human Rights (CCHR) has a Source of Income unit, which handles cases specifically pertaining solely to source of income. CCHR’s Source of Income unit went from three staffers in 2021 to zero employees as of April 1, City Limits reported.

CityFHEPS vouchers are a benefit to those who live in shelters or those who are about to lose their homes — and they benefit the entire city. The vouchers are in high demand, and already difficult to obtain. Those who are able to obtain one shouldn’t have another roadblock to finding a home.

Vouchers are one of the most powerful tools in combating homelessness. According to the Center on Policy and Budget Priority, vouchers cut homelessness by three quarters. Additionally, vouchers help with housing stability, reducing how many times a family moves in a five-year period by over one-third, and reducing overcrowding by half. They can be the difference between someone having a home or being homeless.

Yet, the city has chosen not to enforce its own laws and protect voucher holders as they search for apartments. According to a joint report published by Unlock NYC, Neighbors Together, the Anti-Eviction Mapping Project, and the Housing Data Coalition, 20% of CityFHEPS voucher holders were able to exit the shelter system and find a home in 2019, and the average stay for those in the system was roughly around 450 days. In short, one out of five CityFHEPS voucher holders was able to effectively use their voucher. This is an embarrassment.

Our organization will be making an announcement on the fair housing front in the next few weeks, and will continue to push our government to properly fund its source of income discrimination units and address our broken voucher enforcement system. As Neighbors Together and Unlock NYC recommended in their report, it is vital that we get at least $1 million funded to CCHR for voucher enforcement. People need these vouchers. People need homes.

***

Nick Peters is the Policy Associate for Housing Rights Initiative, a housing watchdog non-profit. On Twitter @HousingRightsUS.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.