Let's Legalize Surrogacy In New York The Right Way

State Senator Liz Krueger, the author (photo: NY Senate)

Advances in assisted reproductive technology (ART), including intrauterine insemination (IUI), in vitro fertilization (IVF), egg and sperm donation, and surrogacy, have created remarkable new family-building options in the last several decades. As someone who is unable to have my own biological children, I support New Yorkers being able to use ART, including surrogacy, to build the families they want.

Yet these relatively new technologies bring with them complex issues that must be considered carefully. After many discussions with my colleagues who support existing proposals to legalize and regulate paid surrogacy in New York, as well as experts and advocates, I believe those proposals do not do enough to balance and protect the health, safety, interests, and rights of all parties involved.

At the same time, in spite of the fact that paid gestational and genetic surrogacy are currently illegal, the ART, gamete donation, and surrogacy industries are already operating in New York, with insufficient regulation and protections. That is why I have introduced an alternative bill, along with Assemblymembers Didi Barrett and Danny O’Donnell, to tighten regulations on gamete donation and to legalize surrogacy with appropriate safeguards.

Our bill goes further than existing proposals in creating consumer protections, ensuring that participants are fully informed of health risks and other relevant factors, preventing exploitation, power imbalances, and inequitable treatment, requiring the use of best medical practices to protect the health and wellbeing of all parties, and information-gathering to facilitate much-needed research and tracking.

Intended parents, people acting as surrogates, egg and sperm donors, and of course any children that are conceived by assisted reproduction or born through surrogacy, are all intimately invested in the process and outcomes of any gamete donation or surrogacy agreement. For intended parents who decide to use surrogacy, they spend a significant amount of money, take time to carefully choose a person who will bear their child, and place their hopes in the person acting as surrogate.

Surrogates take on significant risks to their health, and in some cases their lives. They place their trust in the intended parents to adhere to the surrogacy agreement, and to provide a good home for the children they have spent nine months growing and nurturing inside their own body.

Children born through surrogacy or using ART have a right to have their needs and interests considered throughout the process, and to access data and research that are sorely lacking today on the health impacts of using certain forms of ART.

Our bill strengthens the existing proposals through several new or tightened provisions, including:

Evaluating intended parents and people acting as surrogates to assess eligibility.

Minimizing health risks for surrogate by establishing age restrictions, requirements relating to prior pregnancies and births, and preclusions on preexisting medical and psychological conditions that would make the pregnancy high-risk.

In order to prevent human trafficking, requiring intended parents and surrogates to be U.S. citizens or permanent lawful residents, and New York State residents for at least 12 months prior to executing an agreement.

Explicitly requiring more comprehensive, longer-lasting health, life, and disability insurance be provided to the surrogate.

Recognizing and protecting the human agency of the surrogate by allowing them to terminate the agreement at any time during the pregnancy. If this happens, the surrogate must return any financial compensation already received other than payment for medical, legal, and pregnancy-related expenses.

Creating a window after the birth of a child during which, in rare and extreme circumstances, the person acting as surrogate could ask a court to step in and determine legal parentage.

I believe that these measures, and several others addressing not only surrogacy but an array of assisted reproduction technologies, are necessary to balance the needs and interests of all the people engaged in gamete donation or surrogacy agreements. I hope that my colleagues in the Legislature, and Governor Cuomo, will take the time – after the new state budget is passed – to thoroughly consider and discuss all of the options on the table. Fundamental issues of equity, family, health, and people’s lives are at stake.

***

State Senator Liz Krueger is a Democrat representing parts of Manhattan. On Twitter @LizKrueger.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Attorney General Disrupts Progress on Taxi Loan Crisis

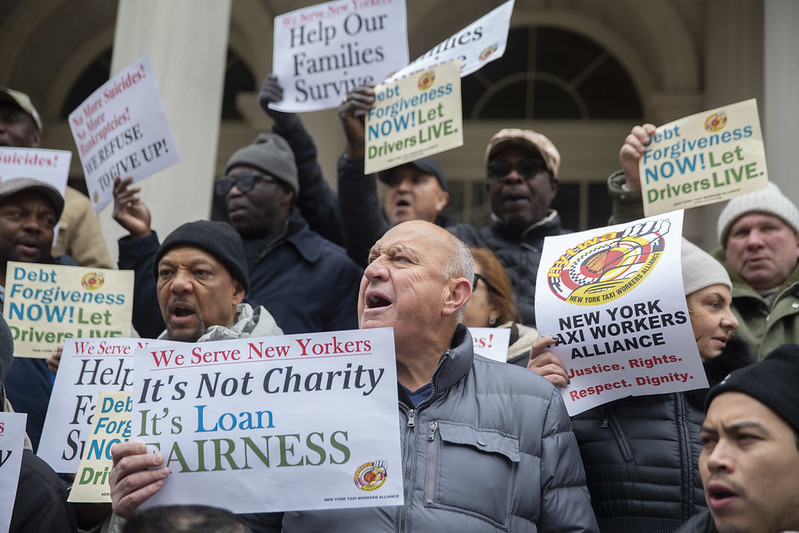

Taxi driver-owners protest at City Hall (photo: John McCarten/City Council)

Last May I wrote a column criticizing the practice of including taxi medallion sales revenue in the city’s operating budget and pointed out the perverse incentive it creates to encourage high sales prices. My comments were triggered by the publication of a compelling investigative series on the New York City taxi medallion market in the New York Times.

The series provoked outrage from elected officials, several of whom launched investigations and studies of their own. The City Council appointed a task force, which recently came up with thoughtful recommendations; but the state’s attorney general has thrown a wrench into efforts to responsibly help needy taxi medallion owners by threatening to sue the city to give all their money back to everyone who bought medallions during the ten-year period when prices rose and then fell so dramatically.

It is heartbreaking to hear the stories of taxi drivers, many of them immigrants, who thought that ownership of a taxi medallion was a ticket to the American dream, only to see their value plummet as an onslaught of ride-hailing vehicles flooded city streets. But the challenge is how to help these driver-owners in a way that is appropriate and fiscally responsible.

In the early 2000s when the city’s economy was doing well and the ceiling on the number of medallions made them a scarce resource, it made sense that they were extremely valuable. Yes, the New York City Taxi and Limousine Commission (and city’s budget office, which counted on medallion sales revenue to help balance the budget) encouraged -- or at best, did not try to mitigate – the rapid growth in medallion prices from 2004-2014, but market conditions were the primary cause.

In retrospect it looks crazy that prices rose as high as they did, but no one wanted to cast a skeptical eye (except Citizens Budget Commission and other fiscal monitors, of course) on a business that could empower hard-working people to prosper. No one anticipated the rapid and dramatic creation and growth of Uber, Lyft, and other ride-hailing services that have overwhelmed city streets with cars and left taxi drivers scrambling for passengers and income.

After the Times series the City Council created a Taxi Medallion Task Force that issued its report last month, recommending that the city form an entity to purchase outstanding medallion loans at discounted prices and work with borrowers to pay them back over time. The report recognizes that it is not feasible for the city itself to fully buy the loans, although it states that costly city-sponsored loan insurance might be necessary to make the fund viable. What is proposed is a kind of public-private partnership in which “mission-driven” entities such as socially responsible investors and philanthropies contribute to a pool of funds. While Mayor de Blasio has not endorsed this specific recommendation he has said this is the best solution he has heard to the problem so far.

However, before there has been any time for this approach to be refined and pursued, along comes New York Attorney General Letitia James with a plan that would be more straightforward and far more costly to execute: sue the city and make it pay back all the $800 million-plus it has collected for medallion sales since 2004. A notice has been filed with the City Comptroller giving the city 30 days to resolve the claim before a lawsuit is filed.

The threat of this litigation casts a pall over other attempts to help underwater taxi medallion owners by getting their lenders to accept discounted amounts. Why would anyone agree to take less money when there is now the prospect that the city will pay the full amount borrowed? Why would financial institutions and other lenders participate in the City Council’s plan to create a fund for this purpose if the need is obviated by the AG’s lawsuit?

While AG James is undoubtedly trying to help struggling individual driver-owners, it is primarily professional industry lenders and fleet owners who would benefit from her claim. And it would unfairly hold New York City government responsible for a problem that has multiple layers and causes.

Most important, the AG’s litigation would set an extremely dangerous and expensive precedent that taxpayer dollars can and should be used to bail out an entire line of business that has hit hard times. (It is unclear how the lawsuit would impact negotiations to reduce the amount due on several thousand medallion loans just purchased from the National Credit Union Administration by a hedge fund, Marblegate Capital.)

Can the city be expected to pay off the loans of restaurateurs who must close because of new minimum wage and other regulatory requirements? What about the mortgages of homeowners who may face more difficulty paying them off if and when property tax reforms are adopted? By the way, when the Attorney General was a City Council member she voted to approve the budgets that included the revenue from medallion sales; does that make her culpable too?

The city has no choice but to resist the AG’s attempt to be the taxi industry hero at everyone else’s expense and the City Council should join the mayor in denouncing the lawsuit.

Meanwhile, even if the city successfully facilitates a loan fund, still left unresolved is how to keep medallions financially viable over the long-term. What is needed is a coherent plan of reforms and new policies to make the system of taxis and for-hire vehicles in New York City functional going forward.

***

Carol Kellermann was president of Citizens Budget Commission from 2008 through 2018.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

With Marijuana Back on the Agenda, It's Time New York Lawmakers Get Serious About Social Equity

Rally to call for legalization of adult marijuana use (photo: @equityorg)

Governor Cuomo's rollout of a reworked Cannabis Regulation and Taxation Act means this may finally be the year New Yorkers get access to legal weed. And while a similar legalization push floundered in the statehouse last year, many are optimistic about its odds during the 2020 legislative session. Not only are the vast majority of New Yorkers in favor of adult-use sales, but legislators staring down the barrel of a $6 billion budget hole will be hard-pressed to turn down an estimated $300 million in annual tax revenue.

As for the New York lawmakers who haven't yet succumbed to the siren song of legal marijuana? Their colleagues may soon force their hand. Massachusetts currently allows for adult-use sales — and Connecticut, Rhode Island, and New Jersey are all aggressively eyeing legalization. Cuomo has even helped convene neighboring leaders to coordinate a regional approach to the effort. If the other states' proposals pass, New York will be forced to choose whether to follow their lead or risk watching those potential tax dollars pad the budgets of neighboring states — plenty of New Yorkers are already heading to Massachusetts to get legal cannabis.

Still, legalization is far from a done deal. Like last year, we're sure to see a showdown between Cuomo and the Legislature when it comes to the issue of 'social equity.' Many Democractic lawmakers want a guarantee that a percentage of New York's cannabis tax revenues will help fund programs and policies that serve the communities hit hardest by decades of marijuana arrests. Cuomo would prefer to put the money in the state's general fund, where he can distribute it as he sees fit.

As recent news reminds us, the past half-century of cannabis criminalization has had devastating consequences in low-income communities of color, in New York City and others around the state. And while legal marijuana may be minting a new class of cannabis industry millionaires, the spoils of the "Green Rush" are almost exclusively flowing to a small group of wealthy, well-connected, and disproportionately white players. This is unacceptable in any industry, but it's particularly infuriating given the fact the low-income, rural, and/or minority communities being shut out of the sector are the same people who've borne the brunt of our prohibitionist policies in the first place.

So yes, I agree with many of the Legislature's leaders — it's only right we use some of this revenue to repair the harms of the War on Drugs. That said, if the Legislature doesn't act more strategically, we'll end up wasting this unique opportunity to create a diverse, equitable, and sustainable new industry in New York State.

Social equity funding may be the biggest difference between the dueling marijuana legalization efforts, but that disagreement pales in comparison to the macro-problems found in both proposals. Our legislators would be smart to look into the issues that have plagued other states post-legalization.

Despite having an extensive cultivation network, a glut of pro-legalization politicians, and the country's largest population of cannabis consumers, California is seeing its legal marijuana market implode. Prohibitively high taxes and exceptionally burdensome regulations have driven prices so high that patients and consumers are left with no choice but to buy products from unlicensed sources. As a result, experts estimate 85-90% of California's cannabis sales are made in the unregulated market. This shift has bankrupted smaller marijunana outfits and forced larger cannabis companies to constrict and consolidate. If California's problems continue to go unaddressed, they could very well work to increase organized crime's influence in the industry.

It's difficult to shed a tear when you learn about the troubles of shady operators like MedMen. That said, both Cuomo's Cannabis Regulation and Taxation Act and the Legislature's Marijuana Regulation and Taxation Act create a taxation and regulatory structure that would make it nearly impossible for even the most well-capitalized cannabis corporation to survive, let alone a small, rural, and/or minority-owned business.

We can't forget that a non-functional legal sector means no money for social equity initiatives. If we want these programs to thrive, we'd be wise to look to the regulatory environment in cannabis markets like Colorado — a place where the state's $2 billion in annual cannabis tax revenue can actually help fund social services. To his credit, Cuomo recently announced he'll be heading to other legal states to learn more about what strategies have and haven't worked in their marijuana markets.

Another knock on New York's legalization bills? The lack of nuance. Even if the Legislature manages to secure social equity funding, what's its plan for steering that money into the communities it's meant to serve? Given state-run programs are floundering across the country, the how is an increasingly important — and often underlooked — question.

Why are so many social equity initiatives struggling? One reason is the fact they focus (almost exclusively) on creating licensing processes that prioritize businesses run by individuals that have been disproportionately impacted by cannabis prohibition. Facilitating entrepreneurship in rural and minority communities is a laudable goal, no doubt, but even if those programs help businesses navigate the byzantine patchwork of local and state regulations, they don't help them access the capital (a couple million dollars, at least) required to get a cannabis company up and running.

For argument's sake, let's just say New York's social equity-focused licensing program—as written—is successful (an outcome that's eluded other legal states). The bill mainly focuses on prioritized business licenses—a critical issue of course, but still an effort that would impact a relatively small number of people. While I recognize legislators are looking for their ribbon-cutting moment, wouldn't it also be smart to put as much effort into building wealth via workforce development programs? Or create a more concrete plan for reinvesting tax revenues directly into underserved communities?

Given the sordid history and devastating consequences of marijuna prohibition, it's clear New York has a once-in-a-lifetime opportunity—as well as a moral imperative—to create a diverse, equitable and sustainable legal cannabis industry. At the same time, as we evaluate social equity initiatives across the country, it's also quite apparent we need to come up with smarter, more impactful ways to start "righting the wrongs of the War on Drugs."

***

Natalie Papillion is the Founder and CEO of The Equity Organization, a nonprofit focused on creating a diverse and equitable legal cannabis industry. On Twitter @npapillion & @Equityorg.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.