When is a 'raise' not a raise? The CUNY Faculty Union Deal

photo: Murphy Institute

When is a “raise” not a raise? When the salary “increase,” adjusted for inflation, is below the base-year salary.

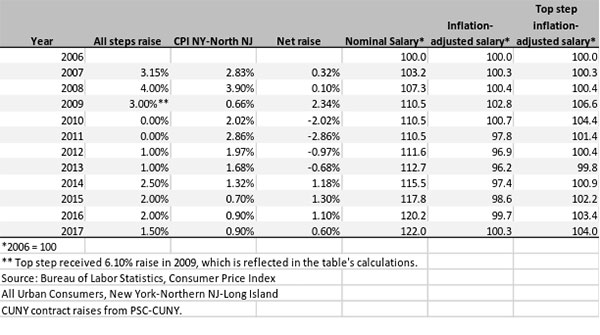

On June 17, after five years of working without a contract and six years without even a nominal raise, the Professional Staff Congress, the City University of New York’s faculty union, announced the main terms of a tentative contract with the CUNY Board of Trustees. Let’s examine how the salary increases in this agreement measure up against erosion from inflation.

In March I wrote a Gotham Gazette op-ed called “CUNY Faculty’s Lost Decade and the Risk Ahead,” pointing out that “In 2015, assistant and associate professors at the top salary step earned 92% in real terms of what they earned in 2006. Full professors at the top step did slightly better, taking home just under 96% of their 2006 salaries.”

These figures derived from my analysis of Bureau of Labor Statistics cost-of-living data and from information on contractual salary increases that PSC-CUNY provided.

The “raises” in the proposed new contract don’t really constitute a raise, even for those of us at the top full professor salary step, who received a special increment in 2009 under the old contract. Most CUNY faculty will again earn in real terms what they took home in 2007. We full professors at the top step will receive slightly less inflation-adjusted salary than we did in 2010 (see table below).

So will I vote to ratify the proposed deal? Yes, but only while holding my nose. I won’t delude myself that I’m getting a real raise, but I would rather be earning almost what I earned in 2010 than 96% of my 2006 salary.

The agreement also contains other extremely important provisions. Adjuncts, for example, the most exploited sector of CUNY’s faculty, will now have the right to multi-year appointments. CUNY management has agreed to negotiate a plan to reduce the onerous teaching load (seven courses per year for full-time faculty at senior colleges) by one course per year. Graduate Assistants who become Adjuncts will receive health insurance. These are all important gains and, in the current context of permanent austerity and bloodletting in public higher education, it would be foolish to vote against them.

The proposed seven-year contract covers a period that has already mostly elapsed. It expires in little more than a year, on November 30, 2017. Wouldn’t it be great if next time CUNY management and the PSC-CUNY could negotiate an actual “new” contract before that date, one which provides raises instead of “raises”? Then, instead of having to spend years lobbying in Albany for a new contract, walking picket lines and testifying before the CUNY Board of Trustees, we could devote ourselves to advancing knowledge and serving the hundreds of thousands of students who attend the largest public urban university in the United States.

CUNY Faculty Salaries and Inflation under Proposed New Contract, 2006-2017

***

NOTES: Three factors understate the salary erosion estimates in the table: (1) Future inflation is unknowable; the Bureau of Labor Statistics estimates 2016 annual inflation at 0.9% for the period through May; I use this figure for 2016 and 2017 even though inflation for key areas (housing, healthcare, food) and overall inflation in 2016-2017 could be higher (because of pending interest rate hikes by the Fed, rising energy prices, financial instability in the European Union and other reasons); (2) The raises in the new contract kick in on April 20 of the respective years; for simplicity I have them covering the whole calendar year; and (3) the lump sum retroactive pay and signing bonus will be taxed in one calendar year.

One assumption in the table overstates the salary erosion estimates. The table does not include the $1000 per full-time employee “signing bonus,” since this will be a different proportion of salary for employees at different ranks and on different salary steps. Taken together, these negative and positive factors are unlikely to alter the salary erosion estimates significantly.

***

Marc Edelman is professor of anthropology at Hunter College and the CUNY Graduate Center.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Another Legislative Session Ends with Thousands Still in Solitary

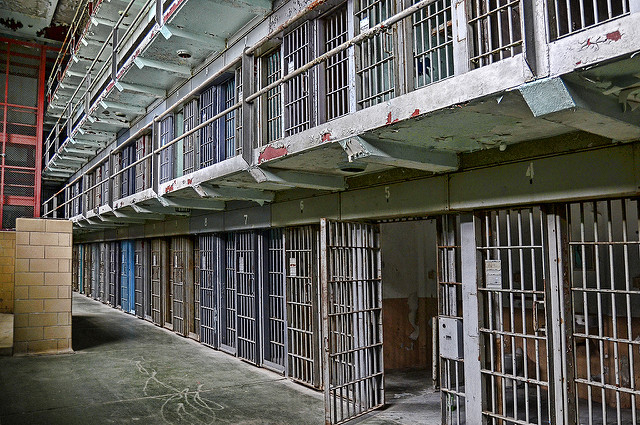

Earlier this month, I saw Mariposa & the Saint: From Solitary Confinement, A Play Through Letters. Actress and activist Julia Steele Allen plays Sara Foneseca, or Mariposa, as she is referred to in the play, and uses Mariposa’s own words to express her experiences in the Security Housing Unit (SHU) at a women’s prison in California. For the past ten years the two women have been corresponding through letters; the play is a collaboration that grew from this communication.

In one of the most disturbing parts of the play, Mariposa shares in a letter to Allen that a woman in the prison has committed suicide. Mariposa seems frantic and in shock at the calm response from the prison personnel. She exclaims there was no sense of urgency. It seems, she says, as if they were saying, “nothing to see here folks, just your average, run of the mill, scheduled suicide.” Mariposa tries to keep her spirits up although it is evident that she is slowly fading. At one point in the play she explains she refused to leave her cell -- even to shower -- for eight months.

The performance was followed by a workshop discussion on the issue of solitary confinement during which Regina, who was incarcerated in Albion Correctional Facility near Buffalo, New York, shared horror stories of her own experiences in “the box.” She noted that many of her peers were not even allowed to send or receive letters, practices considered privilege and meted out by the guards, despite being one of the only forms of human communication they had left.

There are 2.5 million people incarcerated today in the United States, and while it’s rare for the experiences of these people to be given a public viewing such as Mariposa provides, public demands to reform prison conditions and to end mass incarceration are growing. As are calls to end the torturous practice of solitary confinement.

Allen has brought “Mariposa & the Saint” on a national tour of eight states, including New York, which all have active campaigns and pending legislation to end or reform the conditions of solitary confinement. Humane Alternatives to Long Term (HALT) Solitary Confinement Act (A. 4401/S. 2659) is a piece of legislation that has yet to pass through the New York State Legislature, despite being introduced for years. This bill would create substantive alternatives to solitary confinement, place strict limitations on the use and permitted durations of confinement, and improve due process protections for people facing disciplinary infractions.

The Campaign for Alternatives to Isolated Confinement in New York (CAIC), a community group consisting of advocates, legal service providers, formerly incarcerated community members, and family members, has supported the HALT Solitary Confinement Act since 2014.

Last month, “Mariposa & the Saint” was performed for members of the state Legislature, hosted by the Women of Color Sub-Committee of the Black, Puerto Rican, Hispanic, & Asian Legislative caucus including Assemblymembers Maritza Davila and Latoya Joyner, along with Assemblymember Jeffrion L. Aubry, and state Senator Bill Perkins. Additionally, in early May, CAIC organized a lobby day which resulted in HALT now boasting more than 60 sponsors in the Assembly. Despite this support, the bill did not pass this year and remained in the Assembly’s Crime Victims, Crime and Correction committee until the end of the session. What was left out of the final Albany deals earlier this month was prison reform for thousands in solitary confinement, which has been denounced by Pope Francis, the United Nations Special Rapporteur, and President Obama.

The play was performed on Friday, June 10 at The New Settlement Community Campus in the Bronx, located in Assembly Speaker Carl Heastie’s home district in hopes of adding pressure to the Speaker so that he would use his authority to bring HALT to a vote before the session ended.

Solitary confinement is torture and can lead to devastating, lasting psychological consequences such as depression, alienation, suicide, and withdrawal. Solitary Watch estimates 80,000 to 100,000 incarcerated people are held in some form of isolated confinement at any time in the United States, most spending 23 or more hours a day in their cells. Dr. Terry Kupers told The New York Times, “many [formerly incarcerated individuals] still carried the psychological legacy of their confinement.”

New York State legislators did not act to reform the torture happening in their state prisons. Governor Cuomo, state legislators, and all New Yorkers must see and say that solitary is torture. It is time that we all demand reforms to end, or at least significantly limit, the use of solitary here in New York.

***

Jennie Encalada is a Brooklyn-based social worker and activist. On Twitter: @jenjeno07. Mariposa & the Saint completed it's 2015-2016 national tour this June, but has further plans. Learn more about the Campaign for Alternatives to Isolated Confinement (CAIC).

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Protecting the Soul of Flushing, and Beyond

132-40 Sanford Ave in Flushing, a Treetop Development-owned rent-stabilized building

After more than a year of intensive community engagement, Flushing’s "under the radar" rezoning study of an 11-block waterfront area dubbed Flushing West was suddenly withdrawn by the Department of City Planning (DCP). The decision was prompted by a letter from City Council Member Peter Koo, who outlined a comprehensive list of outstanding concerns including “that the numbers don’t add up” for developers who perceive that the rezoning amounts to a “downzoning.”

DCP’s decision to pause the study elicited mixed reactions, in part because the rezoning study did spotlight the heavy infrastructural strain of Flushing’s white hot real estate market and unified multiple community stakeholders to protect the neighborhood’s rapidly diminishing affordable housing and advocate for equitable community development.

Mayor Bill de Blasio recently penned a Huffington Post column proposing that in the current market climate of hyper-gentrification, the city’s existential identity is defined by residents of public housing and rent-stabilized apartments. As the mayor opines, “It’s in protecting these people that we protect the soul of our neighborhoods.” I dare say the soul of Flushing has been under attack and protecting its diverse, working-class residents is long overdue.

Like many neighborhoods of color, affordable housing in Flushing is threatened by predatory equity investment. Investors target “underperforming” and “undervalued” multi-family residential buildings in strategic markets (i.e., “up and coming” and gentrifying areas). They count on capturing unrealized market value through replacing current tenants with those that can afford to pay higher rents or reselling properties at huge profits after making nominal capital improvements. Treetop Development LLC, one of the largest real estate companies in the New York City area, has a business model based on these “multi-faceted” strategies, to the detriment of communities.

Treetop’s online profile notes, “We actively acquire and transform existing rental properties in the region by modernizing living spaces, common areas and building systems before returning them to market. We are well-known for creating cutting-edge projects in neighborhoods coming up as desirable new addresses.” Since its establishment in 2005, Treetop Development LLC has been one of the region’s most active investors in multi-family properties including federally subsidized, project-based Section 8 developments and rent-regulated buildings.

In the past few years, Treetop has acquired and flipped numerous rent-stabilized buildings, generating huge profits. In July 2013, Treetop purchased 17-27 West 125th Street, a 50-unit rent-stabilized building in Harlem for $13.6 million. According to Treetop’s website, “17-27 West 125th Street boasts large apartments, which will be renovated upon vacancy to include new wide plank hardwood flooring, modern and chic kitchens and bathrooms, and stainless steel appliances.” After spending only $1.5 million on “signature” capital improvements, Treetop sold the building to Thor Equities for a whopping $30.6 million in August 2015 (a $17 million gross profit after 25 months of ownership).

Similarly in 2014, Treetop acquired a portfolio of six rent-stabilized buildings with a total of 139 rental and seven retail units in Washington Heights for $23 million. These properties, referred to as the "Columbia Audubon" portfolio due to their proximity to Columbia University Hospital and Audubon Avenue, were sold a little over a year later, in December 2015, for $36 million to a group of private investors.

In describing Treetop’s strategy to purchase and flip a multi-family portfolio in Central Harlem, co-principal Adam Mermelstein explained, “This portfolio is the perfect example of how picking the neighborhoods, identifying underutilized properties, effective management and recognizing the right time to buy and sell can pay tremendous dividends.” The portfolio purchased by Treetop for $22 million in 2013 was comprised of 12 five-story walk-up apartments and included rent-stabilized buildings on St. Nicholas Ave and Frederick Douglass Blvd. Two years later, Treetop sold the portfolio to a newly formed investment firm for $35 million, generating a profit equal to 59% of Treetop’s original purchase price.

Treetop Development LLC was featured in Crain’s New York Business for its enormous $138.8 million acquisition of eight rent-stabilized buildings in Queens representing the county’s largest multi-family transaction in 2015. Seven of the rent-stabilized buildings (totaling 489 apartments) are clustered in a three-block area near downtown Flushing and one building is in Elmhurst. Treetop wasted no time in making cosmetic upgrades to common areas such as lobbies and hallways, and renovating vacated apartments. A recent visit and conversation with a long-time, rent-stabilized tenant in one of Treetop’s Flushing buildings indicated that the common areas had already undergone capital improvements which permitted the prior landlord to increase rents.

Since Treetop’s acquisition, tenants have reported construction-related disruption and dust, spotty heat and hot water, and a sudden increase in vacant apartments. City Council Member Koo’s office has submitted a list of complaints pertaining to these buildings to 311.

This past year has been very busy for Treetop as it expands its extensive portfolio of rent-stabilized buildings in Harlem and Flushing, sold “select holdings at high profit margins,” and refinanced some properties through mortgage consolidation, as in the case of four Brooklyn properties including 188 South 3rd St., a rent-stabilized building in Southside Williamsburg. Among its early acquisitions in New York City’s multi-family market, Treetop paid a little over $5 million in August 2006 for the 41-unit building, intending to convert the apartments into upscale rentals. A few months later, various publications including the Metropolitan Council for Housing’s newsletter detailed the reasons why Treetop’s Mermelstein was named the city’s “most abusive landlord” by a group of tenant advocacy organizations.

Treetop’s 188 South 3rd St. was in the news again in July 2013 when a three-alarm fire erupted between the ceiling of the top floor and the roof. Over one hundred firefighters responded to the early morning blaze that took approximately two hours to extinguish. Several tenants were interviewed noting long-standing electrical problems and non-professional repairs. Charlin Ramos said to Brooklyn News 12, “I knew this was going to happen, I predicted it was going to happen.” Jacqueline Jimenez claimed Treetop ignored numerous calls from tenants. Extensive damage required many tenants to vacate and according to the Department of Buildings, the current status of 188 South 3rd St. is that a partial vacate order remains in effect as well as civil penalties and an outstanding Class 1 violation defined as “immediately hazardous.”

The same weekend that Mayor de Blasio’s column was published by Huffington Post, the New York Times published an opinion piece titled, How to Force Out Rent-Controlled Tenants. The timing and message of these articles underscore the precarity of rent-regulated housing that has been affordable to working-class New Yorkers. Key forces destabilizing the city’s neighborhoods, especially its communities of color, are the tactics deployed by predatory equity investors such as Treetop Development LLC. While the Flushing West rezoning study provided an opportunity to highlight the outstanding need for affordable housing, the current state of the neighborhood’s rent-stabilized housing requires immediate action to protect long-time tenants, or as the mayor would describe them, the soul of Flushing.

In early May, the Flushing West Community Alliance (FRCA) released a comprehensive research report that includes anti-harassment and anti-displacement measures. Based on numerous discussions with rent-stabilized tenants, FRCA recommends that landlords with a history of tenant harassment should not be able to receive permits necessary for renovations that will enable them to increase rents. At minimum, the four bills introduced to the New York City Council earlier this year, including Brad Lander’s “Certificate of No Harassment,” should be acted on immediately. Although the Flushing West rezoning process is temporarily on hold, speculative real estate market conditions have not abated which means rent stabilized tenants need strengthened protections now.

***

Tarry Hum is a professor at the City University of New York and author of Making a Global Immigrant Neighborhood: Brooklyn's Sunset Park.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.