NYC Jobs: A History

Working in New York: A Timeline

BEGINNING TO 1843: TRADE

1625: Early Business

The Dutch West India Company’s trading post at the southern end of Manhattan is named New Amsterdam.

1670: Early Commerce

The royal governor of New York organizes the colony’s first merchants’ exchange where craftsmen, importers and merchants conduct business for an hour every week.

1691: Government Regulation

The city establishes rules governing the carting business, including fees, size of loads and who can own carts.

1768: Business Group

Twenty merchants organize the New York Chamber of Commerce in a meeting at Fraunces Tavern.

1792: Trading Shares

1792: Trading Shares

The New York Stock Exchange has its beginnings as 21 brokers sign an agreement under a buttonwood tree on Wall Street. In the pact, they agree to rules of conduct and set commissions.

1835: Great Fire

Fires in the Wall Street area level much of the city’s financial district, so that banks and insurance companies cannot make payments. The Common Council, a precursor of City Council, only authorizes $6 million in loans. In the ensuring financial chaos, banks and insurance companies fail and prices rise sharply.

1844 TO 1945: RETAIL AND MANUFACTURING

1877: Beginnings of the AFL

1877: Beginnings of the AFL

New York cigar maker Samuel Gompersreorganizes the Cigarmakers Union, setting up an international union and establishing dues to pay for strike funds and pensions. In 1886, Gompers will form the American Federation of Labor, which he will head for most of the following 40 years.

1899: Safer Factories

The New York State Legislature passes the Costello Anti-Sweatshop Act, which regulates work done in city tenements. It also passes measures to increase worker safety laws and limits working hours for women and children.

1900: The Union Label

The International Ladies’ Garment Workers Union, representing workers in Newark, Philadelphia and Baltimore as well as New York City, is founded on the Lower East Side.

1909: On the Picket Line

As 20,000 working women, members of Ladies Waist Makers Union Local 25, go out on strike, rich women’s suffragists join the young immigrant women to push for better pay and working conditions. The workers will return to their jobs after nine weeks, having won higher wages and a 52-hour work week.

1910: Help for the Hurt

The state legislature establishes a worker’s compensation system to insure workers who are injured on the jobs and to provide incentives for employers to improve job safety.

1911: Triangle Tragedy

A four-alarm fire sweeps through the Triangle Shirtwaist Factory on Washington Place, killing 146 people, most of them young women. There is no sprinkler system in the factory, fire department ladders are too short to reach the blaze, and the owners have locked all the exists to the factory to prevent theft, leading the workers to leap from the factory. The fire prompts new demands for safer conditions in factories, but the factory owners will be acquitted on al manslaughter charges related to the fire.

1911: Shorter Hours

The state legislature passes a law limiting the number of hours women can work per week in a factory to 54.

1913: Bank Regulation

President Woodrow Wilson signs a law establishing the Federal Reserve System to regulate U.S. banking and currency. It established 12 Federal Reserve Banks, including one in New York City.

1916: Child Workers

1916: Child Workers

In an effort to control child labor, Congress passes the Keating-Owen Act, which bans interstate transportation of products made in factories, shops, canneries or mines employing children. In 1918 the Supreme Court will rule the act unconstitutional.

1925: A New Union

A. Phillip Randolph, publisher of the “Messenger,” a New York monthly on black politics and culture, organizes the Brotherhood of Sleeping Car Porters in Harlem.

1933: New York Woman

President Franklin Roosevelt names Frances Perkinsof the Consumers League of New York as his labor secretary. The first woman Cabinet member ever, she will serve at a time when government involvement in labor issues increases dramatically. In the same year, Roosevelt established the National Labor Board to insure worker’s rights to collective bargaining. It will be chaired by New York Senator Robert F. Wagner.

President Franklin Roosevelt names Frances Perkinsof the Consumers League of New York as his labor secretary. The first woman Cabinet member ever, she will serve at a time when government involvement in labor issues increases dramatically. In the same year, Roosevelt established the National Labor Board to insure worker’s rights to collective bargaining. It will be chaired by New York Senator Robert F. Wagner.

1935: National Labor Law

Congress approves President Roosevelt’s plan to create a Social Security program to provide benefits to the retired and the unemployed. It would be financed by a payroll tax on current workers’ wages. Congress also passes the Wagner Act, introduced by Senator Robert Wagner of New York, guaranteeing workers the right to collective bargaining and establishing other rights for labor unions and their members.

1938: Regulating Work

Congress passes the Fair Labor Standards Act, putting limits on the length of the work week, requiring overtime pay and setting a minimum wage of 25 cents an hours for most workers. For the first time, federal law will set a minimum age for employment and limit the number of hours that children can work.

1945 TO TODAY: BUSINESS AND FINANCE

1958: Unions for City Workers

1958: Unions for City Workers

Mayor Robert Wagner, son of the pro labor senator, signs an executive order giving municipal employees the right to collective bargaining with the city.

1964: Equal Rights

Congress passes the Civil Rights Act, which prohibits discrimination in employment based on race, color, religion, sex or national origin.

1967: Staying on the Job

Following several strikes by public employees, including a transit strike the year before, New York State passes the Taylor Act, which allows government employees in the state to form unions and negotiate contracts but bars most public employees from going out on strike.

1968: City Projects

The state legislature creates the Urban Development Corporation, a public authority to initiate, finance, build and manage projects in the state. Although in its early years, it will concentrate largely on housing, it will turn increasingly to aiding economic development projects, such as the South Street Seaport and the Marriott-Marquis Hotel.

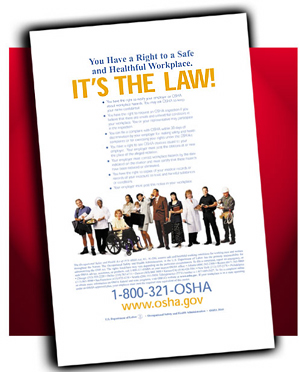

1970: Cleaning Up Factories

1970: Cleaning Up Factories

Congress passes the Occupational Safety and Health Act setting regulations for safety in the workplace and establishing an agency to enforce them.

1986: Special Districts

New York State establishes the Empire Zones program to attract companies to blighted areas throughout the state, including New York City, with lower taxes, worker-training programs and low-interest loans.

1993: Trade Agreement

Congress, with strong backing from President Bill Clinton, approves the North American Free Trade agreement, which establishes a free trade zone encompassing Mexico, Canada and the U.S. Proponents say it will create jobs and help consumers, while opponents say it will undercut wages for U.S. workers, encourage businesses to move jobs to Mexico and erode environmental and workplace safety protection.

1997: New York Sweatshops.

1997: New York Sweatshops.

In the first such survey ever taken by the federal government, investigators find that 59 percent of a randomly selected sample of New York garment factories violate overtime laws and pay employees less than the minimum wage. Some of these factories provide merchandise for chain stores, such as Wal-Mart, Kmart and Nordstrom.

1999: Town/Gown

The New York State legislature and Governor George Pataki create the NYSTAR program to encourage the state’s research universities and institutions to invest in technologies that will create jobs in cutting edge industries.

2002: Enough to Live On

City Council passes a living wage bill raising the pay of 50,000 home health care attendants to $8.10 an hour with benefits (about 60 cents above the current average), or $9.60 an hour without benefits.

2002: Economic Boost

Congress passes The Job Creation and Worker Assistance Act of 2002 that extends the amount of time workers can receive unemployment benefits from 26 to 39 weeks and provides tax breaks for businesses to encourage them to expand and create more jobs.

2004: Minimum Wage Dispute

Over Governor George Pataki’s objections, the state legislature agrees to increase the minimum wage in the state to $7.15 an hour by 2007 (the federal minimum wage is $5.15 an hour).Â

State Debt + Federal Debt = City Budget Trouble

Mayor Michael Bloomberg's preliminary budgetfor fiscal year 2006 should, as promised, translate into a balanced adopted budget in June with a minimum of fuss. The details of that election-year budget will likely change in several ways, but with the surplus for this year already at $1.4 billion - and likely to rise - there is plenty of room for last-minute adjustments to get the mayor and city council through their skirmishes over the mayor's annual cuts in health, social, cultural, youth, senior, and other human services.

What's not promised is longer-term budget balance. The mayor's proposed actions for 2006 - detailed in Gotham Gazette's recent report-- do next to nothing about future deficits. For instance, the city deficit for fiscal 2008, as of last June, was projected to be $3.7 billion; now it is projected to be $3.6 billion - not counting many risks, such as unrealistic labor-cost projections.

The biggest change likely to take place before June's budget adoption is a reduction in the mayor's wish list for $750 million in new federal and state aid. One reason why is illustrated in two new reports on federal and New York state budgeting. They show how federal deficit spending - borrowing money to pay current expenses - and state borrowing increase budget gaps and diminish prospects for new intergovernmental aid.

According to a January report from Citizens for Tax Justice (In PDF format), extraordinary levels of federal deficit spending will dramatically increase federal debt service payments and likely force cutbacks in discretionary spending. At the state level, State Comptroller Alan Hevesi's new report on state debtunderscores how Governor George Pataki's borrowings in the past four years have added billions of dollars of new state debt.

Federal Deficit Spending

Citizens for Tax Justice's report is entitled, "Bush's $10 Trillion Borrowing Binge: An Update." It is a blow to prospects for any new federal aid to New York in the near future. Using "frightening statistics" from the respected Congressional Budget Office's January report on the federal budget and economy, Citizens for Tax Justice shows how projected annual deficits under Bush policies "skyrocket" from $572 billion in 2005 to $1.164 trillion by 2015.

These new projections for 2015 are seven times what the president projects, because the current Bush numbers assume, among other things, that current tax cuts "sunset,' that Iraq and Afghanistan expenditures will suddenly end, and that federal appropriations will "plummet" as a share of the economy. The Congressional Budget Office report uses more realistic assumptions and suggests that by 2013, "the government is likely to be spending more on interest on the debt than on all domestic appropriations put together - from education, to the environment, to law enforcement, to science, to transportation, to veterans."

Under the Congressional Budget Office assumptions, the national debt, including what's owed to Social Security (excess Social Security revenues are lent to the federal budget), will triple by 2015, to $14.8 trillion, some $10 trillion more than the debt when President Bill Clinton left office.

State Debt, Public Authorities, and Budget Gaps

Governor George Pataki has his own method of avoiding structural budget balance. According to the Hevesi report, since 2000 the state has borrowed $7.7 billion to pay for state, city, and school district operating expenses. That includes $4.6 billion borrowed from a tobacco-settlement fund. Such debt generally is paid off over a 30-year period, at least doubling the total cost of the debt. In addition, the state authorized $2.8 billion in debt for legislators' program initiatives and local economic development for fiscal years from 1997 through 2005.

State-funded debt now is approximately $47 billion. That represents $2,420 per New Yorker statewide, more than two and one-half times the national average of $944. (New York City's own $50 billion debt, as noted in last month's Finance topic page article, is over $6,200 per city resident. So, total governmental debt burden for city residents now stands at more than $8,600 per person.)

Another problem with the state debt is that some 92 percent of the $47 billion was authorized through public authorities. Essentially controlled by the governor, these authority debt decisions bypass any democratic approval process. Hevesi calls this "backdoor borrowing." A Newsday articlesuggests that such off-budget techniques remain alive and well: the governor is now considering selling such state resources as the New York State Thruway and the Tappan Zee Bridge for cash to help balance the state budget.

Hevesi's report recounts the state's most outrageous example of shuffling state resources to fill an operating budget deficit at great long-term cost. In 1990 the state, under Governor Mario Cuomo, "sold" Attica prison to the state's Urban Development Corporation (now the Empire State Development Corporation).

The state, in other words, sold the prison to itself. That raised $200 million of cash to help one year's budget deficit, but since 1990 the state has paid $242 million in debt service on that deal. And because of refinancing the "appalling" debt, the state still owes $323 million in principal and interest. So the total cost for the $200 million one-shot revenue will be at least $565 million.

Hevesi notes the link between state debt and the state budget: "The State's practice of paying for recurring operating expenses with one-time funding sources exacerbates structural instability and feeds annual budget gaps along with the State's chronically poor credit rating."

Structural Balance Ignored Again

A common theme in these accounts is that president, governor and mayor all refuse to use their revenue powers to stabilize their financial plans. For both President Bush and Governor Pataki, tax cuts are long-term ideological positions. For Mayor Bloomberg, tax cuts are an election-year strategy, in spite of huge revenue losses: $250 million in property tax rebates and over $600 million in the phasing out of personal income taxes paid by the city's highest-income residents.

The mayor complains about his lack of discretion in budget decisions. Rapidly increasing Medicaid, pension, and debt service costs, indeed, are mostly beyond his control. But the mayor is disingenuous; he has huge discretion on the revenue side. (The mayor's most stabilizing budget move, after all, was his bold $3.7 billion tax-package back in 2002/2003).

The problem is that mayors like Bloomberg and his predecessor, Rudy Giuliani, have little or no interest in "structurally balanced budgets" - that is, budgets that at any moment are balanced over several years. They essentially say: Let's take it a year at a time. Trust us.

For more than a dozen years, fiscal monitors have set a goal of "structural balance" for the city. Every year they get the fiscal back of the hand. Most recently, the December 2004 Financial Control Board report on the mayor's October 2004 budget modification(In PDF format) says, "The budget gaps projected for FY 2006 and beyond are illustrations that the city's finances remain structurally unbalanced."

This year's adopted budget was mostly balanced by using the (one-shot) $1.9 billion surplus - a kind of sunny-day fund -- from the previous year's budget. With this year's surplus at $1.4 billion and counting, next year's adopted budget will apparently go the same route. That may work well enough for an election year, but it will leave next year's mayor with the same old problem, a structurally unbalanced financial plan at the mercy of the economy.

Glenn Pasanen, former associate director of City Project, teaches political science at Lehman College of the City University.

Facing Unemployment

In the months after September 11, thousands of New Yorkers lined up at job expos when the city's unemployment rate peaked at 8.3 percent. Today, the unemployment rate is down, however the total number of jobs and the size of the city's labor force have also decreased. Related in Community Gazettes: Saving Industrial Jobs in Bathgate |

Since she lost her job at CVS pharmacy in May 2003, Marlene Perez has interviewed for jobs at over a dozen other retail stores. She has spent months shuttling to and from the New York State Department of Labor, trying to collect unemployment insurance.

Perez has had no luck in getting either employment or unemployment benefits, which may be why she is not a big fan of Mayor Michael Bloomberg and his upbeat declarations about the city's economy.

"Every time he comes on that TV, I flip the channel," she said. "I don't want to hear it."

Perez, a 40-year old native New Yorker, is one of 230,000 unemployed New York City residents. She is not alone in questioning the official optimism about the unemployment problem. How effective, critics ask, are the city's job training programs? How fair are New York's policies on unemployment benefits? What will the plans and programs for "job creation" really create? But the debate begins with something even more basic: What is the real picture of unemployment in the city?

NEW YORK CITY'S UNEMPLOYMENT PICTURE

"We've come back strong - and we're creating jobs and opportunity in all five boroughs," Mayor Bloomberg proclaimed in his state of the city address last month. "Today the unemployment rate is down to 5.4 percent. For the first time in 16 years, New York City's unemployment rate is as low as the entire nation's."

New York City Councilmember Charles Barron, who is a candidate for mayor, was not the only person to react skeptically, but his response was among the more succinct: "He painted a rosy picture," he said, "of a city that I'm trying to find."

The skepticism begins with the unemployment rate itself. There is no question that the city's unemployment rate has declined recently, from a spike after 9/11 that reached a peak of 8.3 percent. But those who monitor the city's economy put little faith in this monthly statistic issued by the U.S. Department of Labor. "It's a meaningful measure of several things," Daniel Okrent wrote recently in the New York Times, "but not of what you and I mean by unemployment.'"

That is because the official unemployment rate does not include those people who have given up looking for work. In fact, in recent months, the total number of jobs in the city has actually declined, and the size of the city's labor force - those people either employed or looking for work - decreased between 2000 and 2003 by 11,000 people.

The official unemployment rate also does not take into account people who are "underemployed" - those who work only part-time or whose jobs do not provide them with adequate pay, security or benefits. Over the past year, the number of New Yorkers working as temps has increased, the temp agency industry having grown by more than eight percent.

Worse, say some critics, is the inequality of opportunity. New Yorkers are more likely to be jobless if they are male than if female, if they are in blue-collar occupations than white-collar, and if they are black or Hispanic than if they are white. Young people in New York City are less likely than those the rest of the country to have a job.

In an oft-quoted study, the Community Service Society found that barely one-half of African American males worked in 2003, as opposed to 75 percent of while males (report in pdf format). This disparity is due in part to a lack of credentials and experience among black men, says the study's author, Mark Levitan, and in part to discrimination.

Optimists argue that, in keeping with the usual up and down pattern of the business cycle, the unemployment picture in the city will improve as the economy improves. But others point to signs that something this time is different: For more than two years now, over 20 percent of the workforce has been unemployed for at least six months, which is the longest such streak since records started being kept in the 1960s.

Nationwide, millions of the unemployed are exhausting their unemployment benefits, the government-funded cushion intended to aid them while they look for work. In New York, unemployment benefits range up to $405 a week and last for 26 weeks. In recessionary times, the federal government can provide the funds to extend this, though it did not do so the last time it could have.

But many people are getting no benefits in the first place, a problem that is particularly widespread in New York.

UNEMPLOYMENT BENEFITS

Only 42 percent of unemployed residents of New York State collected unemployment insurance in 2003, a far smaller percentage than other states in the region, according to the National Unemployment Law Project.

Low-income residents of New York City collect at even lower rates. A 2002 study by the Brennan Center found that New York City residents who lost jobs paying over $22.46 an hour were more than twice as likely to receive benefits than those whose previous jobs had paid less than $8 hourly, regardless of education (in pdf format). It attributed the discrepancy to low-wage workers not believing that they were eligible for benefits.

Andrew Elmore, a Legal Aid attorney adds that low-wage workers — especially those who aren't completely comfortable with English –are less likely to be able to navigate the state's bureaucracy. He believes this problem will get worse as the state does more and more of its business over the phone and the Internet, as opposed to in person.

"For upper income and middle income English speakers, this is probably a good thing, because you don't have to physically wait online to apply and claim for benefits," he said. "The problem is really for low income workers, especially those who are low English proficient."

Elmore spends much of his time trying to prevent employers from blocking their former workers from collecting benefits, in hearings at the state's Department of Labor. He represented Perez when CVS challenged her unemployment claim. The company said that Perez had been fired for violating a store policy. Perez says that this is what she was told when she was let go by a new manager, but that she had simply been following the rules as taught to her by her previous boss. After a hearing in which two managers testified against her and a co-worker and a supervisor testified on her behalf, Perez's claim was rejected. She appealed, a process that lasted six months but ultimately ended in the same result.

"I don't know why they are trying to fight me," said Perez, whose failure to get employment benefits convinced her husband not even to file for them when he lost his job.

The reason they fight is that employers' tax rates are based on how many former employees qualify for unemployment. This has been part of the unemployment insurance system since its inception in 1930s. It was intended to discourage companies from laying off workers, but it also creates an incentive for employers to challenge claims.

"Unemployment insurance is not a welfare system," said David Raff, a labor law attorney. "You have to be unemployed through no fault of your own, and no fault of your own is an elastic concept."

If some see an inherent injustice in a process that pits well-prepared companies against overmatched individuals, critics have long labeled New York's system as especially unfair. Raff monitors the state's performance, a responsibility he took on after his firm successfully sued the state for the system's lack of due process.

The procedural violations continue, Raff says, including a lack of translation services, and a failure to allow the presentation of evidence and the cross-examination of witnesses. Much of this, he says, is the result of insufficient funding, which limits many cases to hearings of a half hour or less.

JOB TRAINING

Philip Botwinick lost his job working on computers for financial firms shortly after September 11. Since then he has worked as a driver for a car service, for WBAI radio, helping friends on remodeling projects, and during November's presidential election as a poll worker near his home in Queens. None of these jobs have offered steady, full-time work.

Botwinick also received benefits for workers displaced by 9/11. His benefits included a stipend to take classes in newer computer languages.

"I wasn't happy with the courses I got," he said. He said the classes didn't teach him much, and wondered if they were practical. "I don't even know if technology is worth going into. From what I'm reading, all of the jobs are in the service industry or restaurants."

For as long as the city has run job-training programs, the lack of connection to the real-life working world has been a common complaint. The more effective programs have been offered by private employers or by unions, whose apprenticeship programs have long been considered one of the best ways to get workers who do not have high levels of education into steady, well-paying jobs.

City College of New York has also become increasingly effective in providing job training, according to a report by the Center for an Urban Future (report in pdf format). In total, a quarter of a million people are involved in some sort of practical job training, the report found; 25,000 were in programs where the university had partnered directly with private employers to provide training.

Conceding that the city's operations needed to be more responsive to the current job market, the Bloomberg administration folded the Department of Employment into the Department of Small Business Services in the summer of 2003 and the following April opened job-training centers called Workforce 1 Career Centers across the city.

"The big strategic imperative was how do you make sure that when you're training people, it's connected to real work at the end of the day," said David Margalit, deputy commissioner of workforce development for the department.

Pablo Acosta, a Dominican-born resident of Gun Hill in the Bronx, had been unemployed for about a month when he started attending bank teller classes at one of the centers. After a three-week training period, Acosta quickly found a job with HSBC.

"It might have been the lowest position at the time. But it was a great opportunity to learn from the bottom and work yourself up," said the 25-year old Acosta, who had previously worked in retail, a job he found too taxing. "They had connection with the banks … and put you into new and different ones until you found one."

While comprehensive statistics are not yet available on the program's success, some who have been skeptical of the city's job training in the past say they are modestly encouraged. But, they say, it is not enough.

"I believe in training, but we get stuck in training," said Councilmember Barron. "It has to be coupled with serious job placement -- and serious job creation."

JOB CREATION

When the members of the City Council heard of the report on unemployed black men, they allocated $10 million to create new jobs. But how to do it? Should they subsidize wages, or create business incentives, or directly help local entrepreneurs? All these ideas have been discussed. The money so far remains unspent.

Nobody is against job creation, but public officials seem unsure how to do it. Steve Malanga of the Manhattan Institute thinks that the government should concentrate on making the city attractive to businesses, "with reasonable tax rates, effective schools, and low crime rates." The Bloomberg administration's pitch for its ambitious development projects includes an argument that it will create many new jobs. Bloomberg contends that the Hudson Yards development alone will create 280,000 new jobs, largely in the tourism industry. Critics counter that, even if this number is for real, it might not make sense to focus on a low-wage industry that has traditionally hired few minority men. They believe there should be targeted encouragement of specific industries that have potential to create sustainable jobs for the populations that need them most.

Last month the administration announced several new steps to support manufacturing and keep manufacturing jobs in the city. The mayor’s plan (in pdf format) would create 14 Industrial Business Zones. These areas could not be rezoned for residential use, which are often more profitable. Tax credits would be available to businesses that moved to the zones, and the city would also help provide job training and improve sanitation in the area. The new Office of Industrial and Manufacturing Businesses, will oversee the Industrial Business Zones. (See related story.)

Public officials and economic observers generally agree that the construction industry holds the greatest promise in the near future, for several reasons. First, with the number of housing permits up 20 percent since 2000 and increased commercial development anticipated at Ground Zero and on Manhattan's Far West Side, there will be plenty of construction work to do. Second, the jobs are well-paying union positions. Third, the impending retirement of baby boomers, the last generation to move into skilled trades, is expected to create many openings in the coming years.

Fourth, those jobs might finally be opened to women and people of color. Bloomberg recently announced that his administration will focus on the construction industry, promising programs (with names like "Building Jobs Through Building New York") that would encourage the hiring of minorities, especially through minority-owned and women-owned businesses. This might have been a pre-emptive strike against a City Council report published soon afterward that found the city is failing to contract with such businesses now. (in pdf format) But the promise leaves some observers feeling hopeful. "I think that the good will is genuine on the part of the people from the employer side and from the union side" said David Fischer from Center for an Urban Future. "That is really all you need to make what the mayor was talking about work."

In the meantime, Marlene Perez looks for work without help from the city – partly because of her unhappy experience trying to get benefits and partly because she wants to be independent. Her husband David's military pension and his job at the Columbia Presbyterian Hospital pay the bills; her 20-year-old son David, who works as an electrician, helps her buy things for his 16-year-old brother, Christian, when he can be convinced not to spend the money on his girlfriend instead.

Perez has thought about switching from retail - maybe to work with children - but she is hesitant to leave a profession she feels comfortable with. Her most recent interview with Rite-Aid pharmacy went well, she thinks. She's still waiting to hear back.

FROM GOTHAM GAZETTE

• The Mayor's State of the City Address

• Mayor's Rivals Respond to the State of the City

• What is the State of the City?

• In Big Projects, Where do the Jobs Go?

• The Lie of Prosperity

• Creating Jobs, and Filling Them

NEW YORK'S UNEMPLOYMENT PICTURE

• National Employment Situation Summary (by the Bureau of Labor Statistics)

• New York City Unemployment for December, 2004 (by the City Comptroller)

• Companies Increasingly Relying on Temp Agency Workers (by the National Employment Law Project)

• A Crisis of Black Male Employment: Unemployment and Joblessness in New York City (in pdf format by the Community Service Society)

• Black Male Unemployment in NYC, 2004 (by the Center for an Urban Future)

• New York City's Disconnected Youth (in pdf format by the Community Service Society

• Why are New Yorkers' Incomes Staying Steady When So Many Are Unemployed (by City Limits)

• Women and Minorities not Getting Their Fair Share of City Contracts (in pdf format by the New York City Council)

UNEMPLOYMENT INSURANCE

• Unemployment Compensation (by the Almanac of Policy Issues)

• What is Unemployment Insurance (by the New York State Department of Labor)

• Unemployment Insurance (a series of articles by the Center of Budget and Policy Priorities)

• Improving NewYork State's Unemployment Insurance System (by the National Employment Law Project)

• State by State Comparison of Unemployment Benefits (by the US Department of Labor)

JOB TRAINING AND CREATION

• CUNY on the Job (by Center for an Urban Future)

• Workforce One Career Centers (by New York City Department of Small Business Services)

• New York City's Unemployment Crisis and the Need for an Emergency Job Creation Program (by James Parrott of the Fiscal Policy Institute)