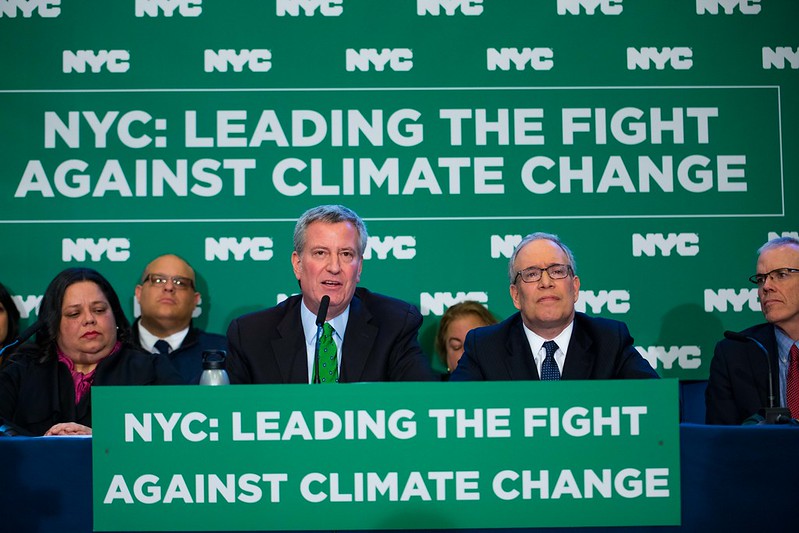

The current comptroller, Scott Stringer, with Mayor de Blasio (photo: Benjamin Kanter/Mayor's Office)

Perhaps the single most important thing the New York City Comptroller can do to combat climate change is to insist that companies in which we invest our $230 billion of pension money adopt the recommendations of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosure. This year, we will pick a new comptroller. We should insist that all candidates for the job pledge to call on companies to agree to the new reporting rules.

It is tough to imagine a topic with less political sex appeal than accounting standards, but anyone who understands the world of finance and the clout of the city’s pension investments will realize how important the Task Force’s recommendations are. They constitute a call for all companies to include in their annual financial reports an assessment of the risks to their businesses from climate change and their strategies for responding.

The impact of climate change is all-pervasive at this point. It has caused unimaginable floods here in New York City, untamable wild fires in California, and hurricanes on the Gulf Coast with alarming frequency. Europe has experienced record hot summers. The polar ice cap is melting. The resulting rise in sea levels threatens to submerge island nations and coastal communities from Bora Bora to Brooklyn with devastating consequences. President Biden has declared responding to climate change a top national security priority.

The Financial Stability Board, an arm of the Bank for International Settlements—the central bank for central banks—has a mandate to promote complete and accurate financial reporting by companies around the world. Reliable information is the only way investors know what they are investing in when they buy stocks and bonds. Climate change will affect how almost every industry operates with implications for profits and long-term viability. Yet, there is currently no standard for including the impact in financial reports. Investors are making decisions through smog-clouded vision.

Requiring companies to include a clear-eyed assessment of how climate change will affect their businesses will allow investors, like the five New York City pension funds responsible for the retirement future of 700,000 current and former city workers, to understand a fundamental risk associated with their investments. That will allow smarter decisions that will improve the long-term performance of the funds. Requiring transparency on the topic will cause corporations around the world to embrace measures to reduce climate-damaging pollution because a credible response to climate change will become essential to maintain the confidence of the capital markets they rely on to finance their operations.

Much attention has been focused on oil and gas companies, and three of the city’s five pension funds have divested from the sector. Divestment is a blunt tool. Once used, an investor loses influence over the companies shunned. And while carbon fuel companies are perhaps the most obvious contributors to greenhouse gas emissions, they are far from the only ones. The transportation industry; mining, materials, and building businesses; agriculture, food, and forestry sectors are all huge emitters of climate-damaging gases. All businesses are subject to the extreme weather risks climate change has created. We need all corporations to get with the program of saving the earth. Using New York City’s pension fund power to insist companies adopt the Task Force’s reporting requirements will help it to happen.

Climate change offers more than financial risk. The compelling need to transform the way we power modern life offers tremendous economic potential. The clean energy industry can provide thousands of good jobs right here in New York City. We have ample opportunity to make our region a renewable power hub, including through a repurposing of Rikers Island. With interest rates at all-time lows and unemployment painfully high, now is the time to invest in making our infrastructure more resilient, and our public and private sector buildings more energy efficient.

Yet, New York City, as big as it is, is responsible for just one quarter of one percent of the world’s greenhouse gases. The companies our pension funds invest in emit far more of the climate damaging pollution that threatens us all. It is time to deploy our financial power in defense of the environment we all rely on. Voters should insist that every candidate for New York City Comptroller pledge to do so.

***

Chris McNickle writes about New York government and politics. On Twitter @NYChrisMcNickle.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.