Great House Party in New York City (But You're Not Invited)

There's a fabulous house party going on in town — but it's doubtful you're on the guest list. The rich and famous are celebrating the Big Apple housing market. What a boom!

"There's a lot of euphoria" according to Noah Rosenblatt of the Manhattan real estate web site UrbanDigs. New York City real estate news site The Real Deal labeled the luxury market "manic" and reported vacant land in Manhattan selling for up to $800 per buildable square foot, about equal to the square foot price of finished luxury condos just a few years ago. One expert said raw land at $800 a square foot would require apartment prices of $2,500 a square foot. To extrapolate, that's $2.5 million for a not-so-special 1,000 square foot apartment.

Brisk sales and rising prices have fueled residential real estate in the city's outer boroughs. Many Brooklyn neighborhoods are just as hot as Manhattan. A townhouse in Queens is under contract for $3 million, a record price in that borough. The Real Estate Board of New York says home sales outside Manhattan rose 13.4% year-over-year in the second quarter.

Across America, Standard & Poor's Case-Schiller index of residential sales reports, prices are up over 12 percent in the last year, and 2.5 percent just in April, the last month numbers are available for.

It's largely driven by supply and demand, the one economic concept we all understand. Available inventory is down — that's supply. Realtor Douglas Elliman, who issues quarterly reports, says supply in Manhattan was down 31.3 percent in 2013's second quarter compared to the same period last year.

Meanwhile, demand is rising.

No lesser authority than Frederick Eklund, star of Bravo's reality show "Million Dollar Listing", says, "You have a $15 million buyer in New York and can't find anything. It's chaotic out there." His co-star Ryan Serhart claims, "In Manhattan there's bidding wars everywhere."

{pullquote}The rich and famous are celebrating the Big Apple housing market. What a boom!{/pullquote}

The New York Times ran an article ("In a Seller's Market, Every Minute Counts") reporting it's a seller's market in New York City where "open houses are packed to capacity, bidding wars and all-cash offers have almost become the norm, and some listing prices actually rise, not drop, after a home is listed."

The Times quotes a broker saying "it's the kind of insanity you live for in this business" while relating the story of a two-bedroom, two-bath condo "aggressively" listed for $1.89 million earlier this year. Within 24 hours he had a flurry of requests to see the listing, so he raised the price to $1.99 million and scheduled an open house. In no time there were multiple offers. The sale finally closed, all cash, for $2.16 million.

The Times offered advice. Move fast. Don't wait for the open house. Forget about getting a deal. Be the first to make an offer. Make a bigger down payment (30 or 35 percent is the new 20 percent). Think about waiving contingencies.

So the law of supply and demand dictates prices rise. Party on!

Last month, Harvard's Research Center published a study with a cautionary title: "A Housing Recovery, But Not for All Americans." Steeped in the kind of detail and methodology you'd expect from Harvard research, the report essentially gave notice to most Americans and certainly most New Yorkers that if you're not already at that party you might not be on the guest list. It's not just that your invite went missing in the mail.

The report says there are 12.1 million extremely low-income renter households in America, but only 6.8 million housing units affordable to them. That's a game of musical chairs where most low-income families come up short.

About 37 percent of American households, 42.3 million of them, spend more than 30 percent of pre-tax income on housing — that's the federal government definition of "unaffordable" housing. Over 20.6 million households spend over 50 percent on housing, the definition of "severely burdened" unaffordable housing. In New York state, 22 percent of households fall in the "severely burdened" category.

The Harvard study documents "severely housing cost burdened" families spend 1/3 less on food, 50 percent less on clothing and 80 percent less on health care than an average family. To be clear, most of these households are working families. Seven of 10 households earning full-time minimum wage are in the "severely burdened" category.

More disheartening, it's getting worse. The law of supply and demand is working against poorer families. Renter households increased by 1.1 million in 2012, roughly equal to the entire growth of all American households, but the number of affordable apartments isn't close to keeping pace. April 2013 was the 34th consecutive month of rent increases averaging 2.5 percent annually. Meanwhile, the number of rental vacancies fell for a third year in a row.

If you don't believe Harvard, you can read the same story in the just published "State of New York City's Housing and Neighborhoods, 2012," from NYU's Furman Center for Real Estate and Urban Policy. Their annual housing report documents city rents are high and growing. Real estate prices in New York City fell 20 percent during the recession while rents increased by 8.5 percent in constant dollars. New York City's market rate rent in 2011 averaged $1,540.

Furman reports that from 2005 to 2011 median gross city rent increased 10 percent while median household income actually decreased. The average New Yorker's rent burden — the percentage of before tax income going to housing costs — rose from 29.9 percent to 32.5 percent, meaning average New Yorkers were renting unaffordable apartments by federal standards. An astounding 31 percent of New Yorkers spend more than half their income on housing making them severely cost burdened. In New York City, 78 percent of all low-income renters are officially "rent burdened".

Every Sunday many New Yorkers turn to the real estate section to read about "The Big Ticket", the most expensive sale of the week in Gotham. Invariably it's a 6,000 square foot, $28 million, sky-high penthouse with views and terraces. Or it's an historic home on a storied street with its own name at $35 million. There, and in a hundred glass enclosed condo buildings and blocks of brownstones in New York City, the grandiloquent house party is going on.

Most of us can read about it, but we're not really invited. Far more important than an open door, though, would be a commitment to more affordable housing. That would let more people throw a house party of their own.

Jeff Foreman is Policy Director for New York City's Care for the Homeless. Follow him on twitter @JeffForeman2

Op-Ed: Preservation Can Contribute To Affordability

In July, the Real Estate Board of New York went on a media blitz, touting their latest report blasting landmark preservation in New York City. This is part of REBNY’s ongoing campaign to paint our landmark preservation system, which covers a little over 3 percent of our city’s building stock, as “out of control” and “broken.”

In this latest attack, using Greenwich Village as an example, REBNY claims that landmarking makes New York unaffordable, and pushes the working and middle class out of our neighborhoods.

REBNY should tell that to the residents of Westbeth and 505 LaGuardia Place, Greenwich Village’s two largest affordable housing complexes.

Westbeth is the former Bell Telephone Laboratories, converted to subsidized housing for artists by Richard Meier in 1970. 505 LaGuardia Place, an affordable co-op designed by I.M. Pei in 1964, is part of a pinwheel-shaped trio of towers surrounding a giant Picasso sculpture.

Residents of both complexes are very committed to preserving the affordability of their homes, and both fought long and hard alongside the Greenwich Village Society for Historic Preservation to secure landmark status for them.

In both cases, residents felt landmarking would protect the character of their surroundings and provide a bulwark against schemes to demolish their homes and replace them with something less affordable.

While they recognized that some obligations came with landmark designation, they saw that on the whole landmarking helped protect what they valued about where they lived (it should be noted that as a co-op, the residents of 505 LaGuardia Place are also the owners, who directly bear the responsibilities that come with landmark designation, while the owners of Westbeth, the non-profit board which runs the complex, also supported landmark designation).

REBNY should also run their argument by the residents of First Houses in the East Village. Built in 1936 as the very first public housing development in New York City, First Houses was landmarked in 1974. As in many New York City Housing Authority developments, residents often struggle to get needed repairs and maintenance.

But GVSHP worked with the tenants association to use the complex’s landmark designation to apply additional pressure for long-overdue repairs.

If REBNY was truly interested in examining Greenwich Village’s struggle with affordability, they would have also talked to residents of the far western part of our neighborhood. That part of our neighborhood, which until relatively recently mostly lacked landmark protections, also saw the swiftest rise in housing prices over the last two decades, and the most dramatic transformation from a mixed-use, mixed income community to home of the super-rich.

Quite contrary to REBNY’s assertions that landmark designation undercuts the affordability of our neighborhoods and stifles economic development, that un-landmarked area saw working factories and warehouses employing scores of people torn down and replaced by luxury high-rises that now largely serve as trophy homes for jet-setters who spend little time in New York.

Rather than increasing affordability, as REBNY would have you believe, the lack of landmark protections in this part of our neighborhood helped lead to a wave of ultra-high-end development the likes of which few parts of New York have ever seen.

Of course it might be easy to dismiss any claim by REBNY to champion the cause of affordable housing, since, in addition to dismantling landmark protections, the group has also sought to undermine the rent regulations that guarantee affordable housing for millions of New Yorkers.

And I have to admit, I take some personal umbrage with REBNY’s claim. In addition to serving as executive director of the Greenwich Village Society for Historic Preservation, I am also an affordable housing advocate, having sat on the board of several of our city and state’s largest affordable housing groups. I grew up in an affordable housing development in the Bronx, and spent most of my adult life in exactly the kind of affordable, rent-regulated housing as well.

In spite of this, I am glad that REBNY is shining a light on the relationship between landmarking and affordability, especially in an election year. I believe that a true examination of this relationship actually shows that landmark designation tends to help, not hinder, the cause of keeping our neighborhoods affordable.

But a true examination does not seem to be REBNY’s goal. In addition to alleging that landmarking causes unaffordability simply because neighborhoods like Greenwich Village are now both landmarked and expensive, REBNY also seeks to play upon the fear that landmarking adds prohibitive expenses to basic property maintenance.

While undoubtedly the extra layer of bureaucracy involved in landmarks regulation can add time and expense, REBNY’s approach is to throw the baby out with the bathwater. Rather than joining landmarks advocates in calling for increased funding for the Landmarks Preservation Commission (the smallest of all New York City’s public agencies) to streamline this regulatory process, REBNY has instead sought to create a climate that would starve the agency and dismantle its portfolio.

In spite of this fear-mongering, the reality is that almost all repair and restoration work to landmarked properties merely requires a staff-level approval from the Commission, which can typically be secured in less than 30 days. And while there are cases where the Commission may require slightly more expensive materials for renovation work, these are often investments which pay off in the long term, with more durability that helps protect buildings from deterioration.

{sidebar id=14}

What landmark designation also sometimes does, however, is create hurdles to developers trying to force long-term tenants in less expensive apartments out of their homes — which may be why groups like REBNY are so opposed to landmark designation.

For example, the East Village has seen a spate of “rooftop additions” where new owners seek to build additional floors on top of buildings while residents are still living there. Tenants frequently claim that the construction is aimed at making life intolerable and forcing them out, and it often succeeds in doing just that. But in landmarked districts, such additions are harder to build, and much less likely to be approved.

Similarly, developers sometimes use the “demolition clause” to get around the rent regulations that allow long-term residents to stay in their homes at relatively affordable rents. One of the few ways in which a developer can remove a rent-regulated tenant from their home is to demolish the entire building. But in landmark districts, such demolitions are rarely allowed.

Listening to REBNY, you would think that developers are regularly thwarted from constructing new affordable housing in places like the Village due to landmark regulations. In fact, quite the opposite is true.

An enormous percentage of our neighborhood’s remaining affordable housing stock is located within its landmark districts, which helps protect it from some of these more unscrupulous practices. And, in my 20 years of working on both landmark and affordable housing issues, I have yet to encounter a single example of an affordable housing development that could not be built due to landmark regulations.

By contrast, I know of many cases of affordable housing conserved or developed within preserved buildings, often using tax breaks and financial assistance available specifically for the re-use of historic buildings. Even without these incentives, re-use of existing buildings is often cheaper and more efficient than new construction, to say nothing of more environmentally responsible.

So while landmark designation may not be the answer to our city’s affordability crisis, it is certainly not the cause of it, as REBNY would have you believe.

Landmark designation provides a means to preserve the character of historic neighborhoods in all five boroughs, many of which currently face tremendous pressure, and in all demographic and socio-economic strata. Landmark designation does not directly regulate affordability, and its application can certainly have different impacts in different circumstances. But more often than not, I believe, landmark designation can help the cause of affordability.

Because it’s not just in the Village that landmarked buildings shelter a diverse range of people and businesses, including long-term residents who have put down roots and aspire to stay permanently in their communities. Landmark designation, in helping to preserve the buildings these residents and businesses call home, give them a fighting chance to stay as well, and can help ward off some of the more pernicious means by which they can be forced out.

Without landmark protections, these buildings are rarely if ever demolished to make way for more affordable housing or cheaper retail space. Instead, they are almost always lost to new luxury housing, usually with retail space for chain or big box stores, not small mom-and-pops.

This is one of the reasons we are seeing neighborhoods clamor for landmark protections throughout the city, from Bedford-Stuyvesant to Bay Ridge, Ridgewood to Richmond Hill, the South Bronx to Staten Island.

They are not doing so because they want to make their neighborhoods unaffordable. They are doing so because they want to preserve and perpetuate what they love best about the communities they call home.

Figuring out how to maintain the affordability and protect the character of our neighborhoods is among the most pressing issues facing our city this election year. Scare tactics and false equivalencies but forward by REBNY that mask hidden agendas are not the way to find solutions to these serious challenges.

A thoughtful examination of the facts is. And I believe the facts show landmarking and affordability are not only compatible, but more often than not, go hand in hand.

Andrew Berman is executive Director of the Greenwich Village Society for Historic Preservation.

Creating A City For All Ages: A Roadmap For Mayoral Candidates

The next mayor will be responsible for 1.4 million people over the age of 60 — a population larger than most United States cities. New Yorkers are living longer. Seniors vote. What should be on the minds of candidates?

For the first time in its history, the city will see a 45 percent increase of older adults by 2030.

Baby boomers began turning 65 in 2011 and will begin turning 70 in 2016 — during the term of the next mayor. The over 85 is the fastest growing segment of the city’s population. Older New Yorkers reflect the diversity of the city’s population as over 50 percent come from minority groups. Many seniors financially struggle with one one out of there living in poverty. There are also endless opportunities for using their life experience in positive ways.

{sidebar id=11 align=right}

The next mayor needs to navigate this population tsunami with careful citywide planning. Older New Yorkers must be included as major stakeholders and not excluded as they often are. As a city, we must raise the bar on addressing ageism.

How does the next mayor take the helm and what are the issues?

Council of Senior Centers and Services has developed an extensive candidates questionnaire designed to address issues impacting the lives of older adults. Responses can be found at www.cscs-ny.org.

On July 11, over 400 seniors and others packed the first mayoral forum focusing on older adults. They came from over 80 neighborhood programs across the city. Five candidates attended: Democrats Sal Albanese, Bill de Blasio, John Liu and Anthony Weiner; as well as Republican John Catsimitidis.

It was a great opportunity for those who came to answer an array of questions. It was a lost opportunity for those who did not come.

The audience was engaged and serious — clapping, cheering and even booing at one point. They will talk about this with their friends at senior centers and other places, their families, and neighbors.

CSCS’ alert and the video of the forum let thousands of New Yorkers know what happened.

A broad array of issues was covered:

• Department for the Aging funding for community based services

• Elder abuse

• Retaining and building affordable housing with services for older adults, rent regulation and SCRIE

• Hunger and food insecurity and the under enrollment of older adults in the SNAP/food stamps program

• Public transportation – user friendly mass transit system and improving Access-A-Ride

• Emergency preparedness and disaster response for older adults

• Cultural sensitivity to elderly immigrants and LGBT seniors

Time did not allow for questions regarding supports for family caregivers, mental health services, and the increase of those with Alzheimer’s. These areas are covered in our questionnaire.

The next mayor needs to provide a variety of means to ensure the economic security of older adults. The platform presented in our questionnaire and at the forum is a roadmap to making the city a good place to grow old. Aging with dignity is what we want for ourselves, our loved ones and all New Yorkers.

Bobbie Sackman, director of public policy at the Council of Senior Centers and Services, can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.. CSCS’ mission is to champion the rights of older adults to make NYC a better place to live.

A Public Policy to Put Homeless Kids on the Streets

Suppose there were 3,800 children living on their own or without homes in New York City, but only 250 shelter beds for them. According to the nonprofit providers of the city's shelter beds, some of those kids — sometimes hundreds and hundreds of them — are turned away each night because there's not enough space for them.

How would we address that?

One answer would be to cut the number of beds and turn even more homeless kids back to the street.

And that's exactly what had been proposed for the 2014 city budget by cutting $12.6 million to $7.2 million and reducing beds to an estimated 90.

Let me quickly reassure you that no cut was actually adopted. But that issue brought me to a rally last month on the steps of City Hall to talk about helping runaway and homeless kids.

It was an unforgettable rally. What moved me weren't the well-reasoned arguments and statistics of advocates like Jennifer March-Joly and Caroline Nagy of the Citizens Committee for Children of New York. Not even the heart-wrenching providers' stories of turning kids away each day as they ran out of beds — and can you imagine how that feels for the people who devote their lives to serving kids in need.

It was the kids.

The kids, all under 18, spoke about life on hard streets and having a safe place to lay their heads. But mostly they talked about the other kids, the ones on the streets who hadn't found a bed, "the turned away kids."

One young woman [girl] struggled to ask that those other kids get a safe place, too, questioning aloud if she was greedy to be asking. Another boldly said everyone should be able to get a bed and at least one meal a day. One. That teenager concluded, "I hope I'm not asking too much." Of course, he was asking for far, far too little.

{sidebar id=14 align=right}

They're just kids. Most of them either escaped from sexual or physical abuse or got thrown out after "coming out" about a sexual orientation their parents wouldn't accept. They seemed scared and bewildered. Mostly they're hurt.

A recent Covenant House and Fordham University study of these runaway and thrown-away kids in New York City found 25 percent had either been "trafficked" in the illegal sex industry or involved in "survival sex" — trading their bodies for a place to stay or a meal. On the streets they're at constant risk of mental and physical health problems, especially violence or sexually transmitted diseases like HIV.

Jane Bigelsen, director of the Anti-Human Trafficking Initiative for Covenant House, told how pimps approach the turned-away street kids. He said they say, "The shelters are full. Where are you going to go? Why don't you come with me?"

Councilman Lew Fidler, the longtime, staunchest supporter of runaway and unaccompanied kids who will be term-limited off Council in January, asked, "For crying out loud, can't we find a shelter bed for every young person who needs one?" Fidler, too, said the kids who can't find beds are "forced in one way or another to sell their body, their soul, their dignity."

Providing beds for unaccompanied minors isn't without controversy. There are critics opposed to providing "opportunities" for kids to runaway, or who would place them in more restrictive institutions or other forms of government care.

Current providers do frequently reunite runaways with their families and they offer high-quality and varied human services and counseling. Many of the kids, who now self-report to these shelters they trust say they would avoid more restrictive programs. Surely this debate can't be between theoretical government care programs and non-existent shelter beds, while thousands of kids remain prey on the streets.

There is a more fundamental point. American public policy hasn't been kind to our children.

The poorest age group in America is children under 18. The Census Bureau reports 22 percent of children, over 16 million of them, lived in poverty in 2011. Kids make up 24 percent of the U.S. population but 34 percent of those living in poverty.

Over seven million children live in "extreme poverty," defined as living in a household with income less than half of the poverty level. That's currently below $11,511 annually for a family of four.

One in four (25.1 percent) of American children under 5 years of age live in poverty. It's one in three for black or Hispanic kids.

UNICEF recently published an alarming study of child poverty in the world. In one chart, they ranked developed countries on a measure of poverty they devised tracking the percentage of kids in families living below the national median income. Of 35 countries the U.S. came in 34th, beating out Romania. Finland ranked highest, but we also lost out to Latvia, Lithuania, Slovakia, Estonia, Slovenia and the Czech Republic, among others.

The statistics in our city are grimmer. The city Health Department reports 20 percent of kids between 6 and 12 — about 145,000 city kids — struggle with mental health issues. Half of third graders read below grade level. One in every dozen babies born in New York City is underweight.

As sequestration cuts spending, and an austerity policy gnaws at the American safety net and our social compact to give all kids a chance, the programs being hurt the most are disproportionately programs for kids.

Sequestration has brutalized head start programs, cut childhood immunizations and federally funded child care. Cuts to the federal Maternal and Child Health programs will stop millions of families in need from getting access to that service over the next decade. The proposed SNAP food stamps cuts being debated in Washington would literally take food out of the mouths of babies.

We need a national movement to raise all children out of poverty. But let's start with an effort to make sure all the kids have a safe place to rest their heads at night. And maybe we can splurge for two meals a day.

Jeff Foreman is Policy Director for Care for the Homeless. Follow him on @JeffForeman2

Op-Ed: A Tale of Two New Yorks

It is the best of times; it is the worst of times. New York has always been a city of both wealth and poverty, but never more so than now. It’s easy to spot the wealth – getting a clear view of the poverty is a bit more complicated.

A recent WealthInsight study sets the number of millionaires in Manhattan at 389,100, defining millionaire as someone with net assets over $1 million excluding their primary residence. America's second city for millionaires is Los Angeles, with a mere 126,000. More breathtaking, Manhattan boast 70 billionaires — more than any other city in the world (Moscow is second with 64; L.A. has just 19). Why not in a city led by the world's wealthiest mayor, reportedly worth $27 billion?

The Center for Economic Opportunity, a city project initiated by Mayor Michael Bloomberg, recently issued its "Poverty Measures Annual Report" for the city with statistics through 2011. It's an interesting read because the CEO uses a poverty measure different than the official federal poverty rate.

The official rate produces a national poverty level without regional adjustment. The CEO measure adjusts for variations in area housing costs and it's based on National Academy of Science criteria reflecting what families actually spend on necessities, but also includes the value of noncash benefits like SNAP payments (food stamps), free or reduced rate school meals, Home Energy Assistance, housing assistance and so on, as income.

The official 2011 federal poverty rate in New York City was 19.3 percent , though it's now 21 percent . The 2011 CEO figure was 21.3 percent , a full 2 points higher. It was worse for hard-hit subcategories like non-citizens (28.9 percent ), kids under 18(24.7 percent ), single parent homes (30.9 percent ) and the Bronx (26 percent ). The poverty rate for kids in single parent homes was 34.7 percent . Asians CEO poverty rate was 26.5 percent and the rate for Hispanics was 25.3 percent .

Now in the throes of sequestration and a public policy of austerity, assistance resources for poor people have generally gone from few to really meager. There is Temporary Aid for Needy Families, but only for families with children and limited to an aggregate five years over a person's lifetime with the requirement that family adults work for the benefit. New York has a Safety Net Assistance program for those who have exhausted their lifetime federal benefits, but that generally has a two year limit for regular cash benefits.

New York City's safety net for homeless families in shelters used to include a priority for public housing or Section 8 vouchers, but that generally stopped after 2004, replaced by a transitional rent subsidy program which was also eliminated in April of 2012. Now the only generally available program for moving most homeless families to permanent housing is a job. That's if you can find one and if it pays a living wage.

New York's Institute for Children, Poverty & Homelessness estimates unemployment among homeless families at 57 percent. In fact, ICPH's 2011 survey of homeless parents found 68.5 percent unemployed.

Sequestration has foreclosed on some of New York City's tools. It visited Section 8 housing cuts on the three agencies issuing vouchers in New York City, meaning 5,000 planned housing vouchers won't be issued. New York City's Housing Preservation and Development Department lost $36 million and plans to cut 1,000 vouchers. "The real problem is," HPD Commissioner Matthew Wambua says, "these are our neediest tenants, the ones who cannot even afford the units in our developments."

{sidebar id=14 align=right}

He notes 32 percent of HPD's vouchers go to elderly renters and 44 percent to disabled people. Still, to avoid eliminating even more vouchers Wambua plans to reduce subsidies for many current Section 8 recipients, with reductions to subsidies as high as $400 a month.

New York City's Housing Authority and the state Department of Homes and Community Renewal both issue Section 8 vouchers in the city and have suffered sequestration cuts. They too won't issue a large number of planned vouchers.

The recently passed city budget does add some NYCHA resources, but not enough to overcome the public housing repair backlog, and certainly not resources to make up for sequestration cuts.

Even having a job isn't necessarily a get-out-of homelessness free card.

Most homeless people who find employment work in low wage jobs in fast food, child care and personal services, security work or retail sales. Fast food and security jobs often start near minimum wage. Even work in the healthcare-childcare and personal services fields pay an annual median income of $22,980 for homeless heads of household in New York City, according to the ICPH survey.

The federal poverty level for a family of four is $22,811, though the CEO sets New York City's poverty level at $30,945. Among the 22 percent of homeless families with a fulltime worker, most remain in poverty. Even among all New York families with two fulltime workers, 4.9 percent are in poverty.

A better way to understand poverty in New York City is to consider income inequality. Since 1967, the U.S. Census Bureau has used a measure, the Gini coefficient, sometimes referred to as the index of income correlation, as a measure of income inequality. It's a ratio of income dispersion comparing the median income of the highest quartile (20 percent ) to the lowest quartile median income. The higher the coefficient is, the greater the income inequality. If all families had the same income, the coefficient would be 0. If one family had all the income and the rest had none, it would be 1.0. In 1967, the first year the Census Bureau used it, the national Gini coefficient was .34. But in 1969, 1970 and again in 1974 it was as low as .326

The Census Bureau's 2011 national Gini coefficient was .477. But for Manhattan it was an extraordinary .601, the second highest number for any county in America. If Manhattan were a country, its Gini coefficient would be among the highest in the world — meaning the greatest income inequality — including most sub-Saharan nations, Middle Eastern emirates and third world countries. Manhattan's median income for the top 20 percent of earners was $391,022, compared to a $9,681 median for the lowest 20 percent. Top earners made better than 40 times what the bottom fifth did.

New York really is a tale of two cities: a rich gloriously city and a desperately poor one. The two cities cover the same geography but offer very different views. The ICPH study has a dire warning: "If changes are not made to the current system, family homelessness will only continue to grow" from its already historic highs.

All of the 21 percent living in poverty in America's richest city — nearly 1.75 million people — are at risk of homelessness if something isn't done about it.

Jeff Foreman is policy director at Care for the Homeless. Follow him on twitter @JeffForeman2.

Op-Ed: Stop-And-Frisk From A Mother's Perspective

I often wonder if I have what it takes to raise my black son in New York City.

While concerns about navigating public school application processes and scheduling play dates are common topics among parents, what often goes unspoken is something far more important: the unique challenges that come with parenting a young boy of color in New York City.

With nothing promised for young blacks and Latinos other than low expectations, street violence, negative peer influences and persistent police suspicion, how do we make sure that that our sons grow up safe and thriving? One step is putting an end to stop-and-frisk.

The New York City Police Department’s stop-and-frisk policy and all of its implications on crime and race are now at the forefront of political and social conversation.

With a decision pending in Floyd v. New York City, a high profile federal case challenging these practices, along with relentless community activism and a hotly contested mayoral campaign, now is the time to push for leadership that acknowledges the crisis in policing and proposes criminal justice policies and social reforms that will actually keep our young people safe without criminalizing them.

{sidebar id=14 align=right}

In a recent mayoral debate, Bill Thompson, the only candidate to address this issue from the perspective of parenting a black son, said “I’m the one who has to worry about my son getting shot on the streets of New York … And at the same point, I don't have to sacrifice his constitutional rights to make sure he is safe … I can have them both."

As a parent, I worry about my son’s safety. As a lawyer, I worry about his rights. Stop-and-frisk promotes neither.

In this climate of heated discussion, the mayoral candidates must acknowledge that stop-and-frisk has proven so damaging and polarizing a practice that it has become New York City’s civil rights issue of the day. Those vying for New York City’s top office must articulate proposals for credible alternatives to stop-and-frisk policing that go beyond weak promises to train police in cultural sensitivity and professionalism.

New York’s next mayor can learn from the successes of other cities that have developed anti-gang initiatives, gun control programs and community collaborations.

Ironically, proponents of stop-and-frisk often cite parental desire for increased youth safety as one of the most compelling reasons for continuing this policy. Like all mothers and fathers, parents of young men of color want their children safe from drugs, violence, and many of the other harmful influences of New York City’s streets.

Yet, draping stop-and-frisk in emotional appeals to safety overshadows its damaging reality. Moreover, those arguments overlook evidence showing that the decline in serious crime in New York City cannot be directly attributed to stop-and-frisk.

While violent crimes fell 29 percent in New York City from 2001 to 2010, other large cities that do not rely on an aggressive stop-and-frisk policy — such as Los Angeles, Baltimore and New Orleans — experienced larger declines in violent crime. In terms of illegal gun recovery, according to the New York Civil Liberties Union, from 2003 to 2012, the NYPD increased stops by 372,060, but recovered only 96 more guns, amounting to an additional recovery rate of 0.02 percent.

In fact, in 2011, the NYPD recovered illegal guns four times more often through methods not involving street stops.

Young black and Latino men are indisputably the targets of stop-and-frisk. Male youth of color between the ages of 14 and 24 comprise less than 5 percent of this city’s population, yet they accounted for 41 percent of stops in 2012.

Appallingly, more than 90 percent of black and Latino youth stopped by the police were innocent of any wrongdoing.

These unwarranted stops are not without consequence.

Most critiques of stop-and-frisk focus on damaged police-community relationships and the fraying of youths’ willingness to assist police investigations. While these are significant costs, parents should also consider the emerging evidence of the emotional and psychological harm caused by these often disrespectful, humiliating, and threatening interactions.

Nicholas Peart, a young black man named as one of the plaintiffs in the Floyd suit, gave a first person account of the toll of being stopped and frisked: “Essentially, I incorporated into my daily life the sense that I might find myself up against a wall or on the ground with an officer’s gun at my head. For a black man in his 20s like me, it’s just a fact of life in New York.”

There are many facts of life that I am prepared to teach my young son. This should not be one of them.

Nicole Smith Futrell is a clinical law professor in the Criminal Defense Clinic of Main Street Legal Services at the City University of New York School of Law.

Shining A Bright Light On Government Spending

Some say the West Coast has the best beaches, the Midwest has the friendliest people, and that you can't beat the cheesesteaks in Philly.

But financial transparency? Fugghedaboudit. New York City’s got everyone beaten by a mile.

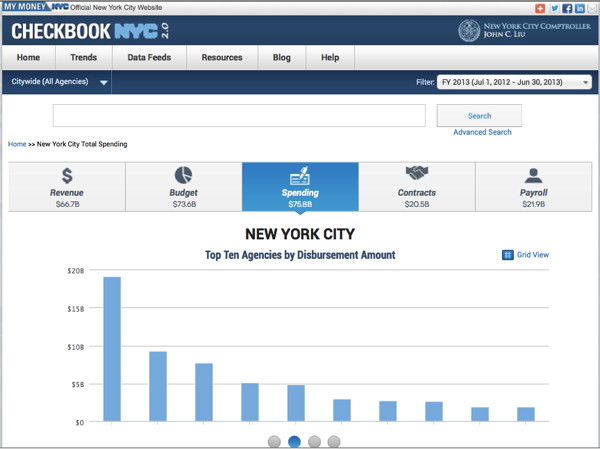

That’s not just our opinion. That’s the view of the United States Public Interest Research Group, which in January named New York City the most transparent municipal government in the nation on the strength of Checkbook NYC, a website created by my office that allows users to view City spending.

Recently, however, we took steps to share the honor: we made the source code for CheckbookNYC.com freely available to every government that wants it.

This “open source” release means that cities and states across the country can leverage our investment in Checkbook NYC to create similar websites of their own.

We hope other places will like New York-style transparency, and we think they will.

On CheckbookNYC.com, you can find comprehensive, up-to-date information about the money that flows into or out of the City’s accounts. Details about spending, contracts, payroll, budget, revenue — it’s all there.

And the site is accessible to techies and luddites alike. Search functionality, graphic visualizations, and an intuitive interface make it easy for anyone to become a fiscal watchdog.

We built it for a simple reason: shining a bright light on government spending helps root out waste and ensure that tax dollars are spent wisely.

When governments know that their spending decisions can be easily scrutinized, they are more likely to use their resources prudently.

The site has the potential to save taxpayers big bucks. Imagine: If Checkbook NYC encourages the City’s decision-makers to rethink just one-tenth of one percent of our annual $70 billion budget, that’s a $70 million savings.

{sidebar id=14 align=right}

And that’s just for starters. The site can further drive costs down by encouraging competition among vendors and serving as an early warning system for projects that start to go over budget.

We aren’t giving the code away just out of the goodness of our hearts — we’re nice, but not that nice. We also want to mobilize the collective talents of local governments and technology engineers to improve upon what we’ve created so far.

It’s a civic experiment that we can all benefit from. Say Los Angeles starts using Checkbook, and then develops a new way to map where tax dollars are spent; every government that uses the platform will be able to benefit from Los Angeles’ innovation.

Following this theory, the more rapidly and widely Checkbook is adopted by other states and cities, the better it will become.

To encourage widespread adoption, two of the leading providers of government accounting systems, Oracle and CGI, are building Checkbook “adapters.” Their clients — hundreds of governments across the country — will be able to feed their financial data into the Checkbook system with the flip of a switch. And the company we worked with to build the site, REI Systems, is lending their technical expertise to help get open-sourcing off the ground as well.

The code for Checkbook NYC is available on GitHub.com. Local governments and techies should take a look, and get involved.

No one’s ever going to stop debating about where to find the nicest places, friendliest people, or tastiest grub. But when it comes to financial transparency, we can work together and all become the best.

John C. Liu is the New York City Comptroller.

Gov. Cuomo’s Tax-Free New York Initiative Makes Economic Sense

Upstate New York was once the economic envy of the nation. We were truly the Empire State.

Triggered initially by the public-private partnership that built the Erie Canal and later maintained by the construction of the New York State Thruway, companies such as Kodak, IBM, Carrier, General Electric, Syracuse China, General Motors, and Chrysler built major plants employing thousands of workers. Today, most of those manufacturing plants are closed and the jobs are gone.

Over the past several decades, we have seen economic development proposals ranging from casinos to hydraulic fracturing. Nothing has worked, and upstate New York remains stuck in the financial mud.

A new approach is needed if New York State is to grow again.

Increasingly, most of the world’s economic growth can be found in what we call the brain based economy — a marriage of education, high tech, and the design (not the manufacture) of consumer products.

Silicon Valley in Northern California and the Route 128 corridor around Greater Boston are perhaps the best known and most successful examples of economic growth fueled by combining the research and education capacity of first-rate universities, the entrepreneurial spirit of their graduates, and tax incentives provided by state and local governments.

Other states and localities took notice and have successfully copied the model— so successfully that Forbes magazine's recent ranking of best cities for high tech jobs placed Silicon Valley at number seven behind Seattle, the Washington D.C., metropolitan area, San Diego, Salt Lake City, Baltimore and Jacksonville, Fla. All these cities have used lower taxes, education, and available land adjacent to higher education research centers as the formula for economic growth.

{sidebar id=14 align=right}

New York State and New York City have begun to move in this direction. Last month, the New York City Council approved the construction of a $2 billion Cornell University Technology campus and office complex on Roosevelt Island made possible by a grant of free land and up to $100 million in improvements from the city. In Harlem, the city’s Economic Development Corp. is developing space to rent to new biotech firms. Our own university is constructing a new Mind, Brain and Behavior research complex on its new campus in West Harlem, and companies like Google and Yahoo are flocking to New York City.

Upstate, in Albany, the SUNY and the State have partnered to create the now world-renown College of Nanoscale Science and Engineering, where students, faculty and private firms work together and separately to conduct education, pure research and cutting-edge commercial nano-industry products.

CSNE is now bringing this model to projects in Utica, Rochester and Buffalo. In Syracuse, the State and local governments are assisting Upstate Medical University to work with a private developer to create a mixed-use, medical and high tech research, housing and retail complex called Loguen’s Crossing on the site of an abandoned public housing project.

In May, the governor announced “Tax-Free NY,” offering new businesses an opportunity to operate completely free of New York state taxes for 10 years if they locate and partner at any of the SUNY campuses outside of New York City (some commercial space at private universities and 20 underutilized state assets are also eligible for the program). Those taxes that would be suspended include sales, property, and business/corporate taxes, and the employees are exempt from the state income tax for the same ten-year period.

The program already has the public support of the leaders of the state Senate and Assembly, the State Conference of Mayors, and Association of Counties, the Business Council of NYS, the Partnership for New York City, the chancellor of SUNY, and senior executives from GE, IBM, JP Morgan, and Goldman Sachs among others.

But the program is not without its critics and doubters. CSEA, the state’s largest public employee union, sees the program as a give-away to business and unfairly beneficial to the employees of the participating companies. Others say that New York City should be included — the governor responds that it is upstate that is in most need of new jobs. The Conservative Party opposes the program because government will choose who gets the benefits and instead suggests reducing taxes on all businesses.

Academic research on the long-term benefits of tax incentives is inconclusive— time lags need to be considered to accurately assess the full impact of the incentives and firm-level data are seldom available.

Our view is that the economic situation upstate is desperate and we need to experiment with a variety of programs to see what works.

In the words of Franklin Roosevelt, another New York governor during tough times: “It is common sense to take a method and try it. If it fails, admit it frankly and try another. But above all, try something.”

Gov. Cuomo has it right: we need to try things. We need action, not words.

We know that the communities having success in growing their tech and biotech industries have used strategies very similar to Tax-Free NY —leveraging their higher education system, location-based tax incentives, and public-private partnerships.

Particularly given the success of the College of Nanoscale Science and Engineering in Albany, New York should enact the governor’s program.

Eimicke is the founding executive director at the Picker Center for Executive Education at Columbia University. Cohen is the executive director of the Earth Institute at Columbia University. Both are professors in Columbia’s School of International and Public Affairs.

Op-Ed: Turning The Tide On Rent Law Enforcement

New York’s rent regulation system is defined by two competing forces: we are a city of renters, with a proportion of tenants to home owners (two-to-one) almost the exact inverse of the national balance; we are also one the most lucrative real estate markets in the country, if not the world.

As a result, we have some of the strongest protections in the country, but our rent laws and regulations are persistently undermined by loopholes and lax enforcement.

These gaps in the rent laws are created and maintained through policy interventions. Every few years, New York’s rent laws sunset. When the legislature votes on their renewal, they attach amendments, which can either weaken or strengthen their regulatory powers. Paralleling this legislative process is a series of administrative actions, which change the way the state housing agency — New York State Homes and Community Renewal — interprets and enforces the state’s rent regulations.

For many years, New York’s rent protections were on the decline. A string of weakening amendments was added to the rent laws, making it easier for landlords to raise rents and bring apartments out of the rent regulation system. In 2000, the Pataki administration initiated a major revision of the Rent Stabilization Code, the document that guides interpretation of the rent laws, and sets policies for enforcement. In a set of changes over 150 pages long, HCR pushed through changes that were described by tenant advocates at the time as “an attempt to deregulate apartments on a wholesale basis.” Those revisions drastically reduced the agency’s ability to protect tenants and preserve affordability.

Recently, the tide has begun to turn back towards tenants. In 2011, for the first time in nearly two decades, the rent laws were renewed in Albany with strengthening rather than weakening amendments. One of the most important victories that year was a promise, written into law, that HCR would issue new regulations on rent law enforcement.

Following that announcement, tenants took action to make sure that promise was kept. They met with agency staff, testified at public hearings, and protested in front of Governor Cuomo’s office, calling for swift and definitive action.

Finally, on April 24, HCR issued their proposed regulations: a set of new guidelines touching on some of the most important issues facing tenants, from resetting fraudulent rents to stopping landlord harassment. The proposed regulations are far from comprehensive, but they are a definitive turn away from the agency’s prior orientation and an important shift towards tenant protection. They will create more tools to fight fraud and prevent rent theft.

Take the case of a renter who is currently organizing a tenants association in Washington Heights. Glenda (not her real name) moved into her apartment in 2011. She was told to sign a rider saying the apartment had left rent stabilization because the rent rose above $2,500.

After doing some research, she found that her apartment never should have been deregulated, and that the last legal rent for the apartment was just under $1,500.

Why had the apartment been deregulated? Had any significant work been done in the apartment between tenancies that could have justified that rent hike?

Glenda is currently fighting an overcharge case through HCR, which will likely take months if not years to settle.

{sidebar id=14 align=right}

Under the new proposed regulations, however, the landlord would have been forced to provide documents explaining how and why the apartment became deregulated, and proved that rent increases were justified by real, documentable costs. This change would help maintain the affordability of rent stabilized apartments and prevent illegal deregulations.

There is, of course, much more the agency can do with these regulations. HCR could strengthen the succession rights of tenants, who are routinely denied the right to take over an apartment from their loved one because of minor technicalities of no fault to the tenant. They could also take the opportunity to roll back the rents of apartments that were illegally deregulated while landlords received tax breaks. HCR’s proposed regulations are an important step forward, but they alone are not enough to fully correct the giant leap backward the agency took in previous years.

On Monday June 10, HCR will hold hearings on their proposed regulations in Manhattan, Westchester and Nassau counties. The agency needs to hear from members of the public that in the current climate of rising rents and stagnant incomes, tenants need new rules for stronger enforcement.

Samuel Stein is the Rent Regulation Campaign Coordinator at Tenants & Neighbors, a grassroots organization that helps tenants build and effectively wield their power to preserve at-risk affordable housing and strengthen tenants’ rights.

Op-Ed: Poor People Can't Bank on Banking Services

NEW YORK — There's a joke about banking: That it's only for people who don't need it.

If you really need a loan you won't qualify, but if you don't it'll always be available at a low interest rate and with a smile. Like most humor, there's truth in it.

New York City's Association for Neighborhood and Housing Development studies how the federal government's attempt under the Community Reinvestment Act to make banks serve the communities they operate in actually affects low-income neighborhoods in the city. The findings aren't very good.

Banks are bringing in record earnings but ANHD finds their investment insufficient "to truly help meet the credit needs of low- and moderate-income New Yorkers." They report the city's 23 largest banks have deposits in the city exceeding $590 billion but lend or invest only 1.35 percent of it in a way that benefits low- and moderate-income residents.

That's an amount they say is insufficient "to satisfy their obligations under the CRA."

{sidebar id=14 align=right}

More is less. Deposits are up and so is lending. Again, it's just that little of it goes to low-income neighborhoods. ANHD found lending for multifamily properties is "steeply" down in low- and moderate-income neighborhoods and of course low- and moderate-income people live in multifamily rental units.

CRA-qualified lending doubled in 2010 as the economy recovered but investments and lending to nonprofits in New York City decreased 30 percent.

Even given that so much "community reinvestment" bypasses moderate- and low-income people, the ANHD study asked how much reinvestment is enough.

Even with average re-investment of 1.35 percent, the study found several banks — Bank of America, JPMorgan Chase, Sovereign, Apple Bank, Astoria, Emigrant, Ridgewood, Morgan Stanley, Deutshe and Bank of NY Mellon — each reinvested less than 1 percent of their New York City deposits in New York City.

JPMorgan reinvested just .36 percent of its more than $256 billion in city deposits and Duetsche Bank just .35 percent. Two smaller banks, Emigrant and Astoria Savings Banks, reinvested .18 percent and .15 percent respectively.

ANHD says 5 percent is a fair minimum for re-investment. That minimum would pump another $12 billion into the city's economy from JPMorgan alone.

That kind of financial investment in underserved communities is absolutely vital to those neighborhoods and residents, but it might not be the most critical thing banks fail to provide.

In the era of megabanks, too large to fail, merging and buying out smaller institutions, there's immense competition for wealth management services and private banking for multi-millionaires but diminishing interest in vital banking services for low-income and poor people.

The four biggest American megabanks — JPMorgan Chase, Citibank, Bank of America and Wells Fargo — have over 61 percent of all New York City deposits according to ANHD. They also have about half of all city government deposits in their banks amounting to over $230 million. But they're not looking for low-income city resident depositors.

According to the FDIC, 8 percent of American households are "unbanked," meaning they have neither a checking nor savings account. The number is as high as one in four in poor neighborhoods. It may be higher in New York City where both the poverty rate and the cost of living are higher.

Last month I submitted public comments to the Office of the Controller, the FDIC and the Federal Reserve, America's three big bank regulators, about the Community Reinvestment Act, along with Dr. Al Arterburn. Arteburn formerly worked as an economist for the federal government. We wanted to make the case that banks should provide basic services to poor and low-income Americans at affordable costs. But, of course, they usually don't.

Poor and very-low income consumers desperately need basic services like checking and savings accounts. They need them far more than high income consumers do but bank imposed minimum balances, service fees, check charges and punitive penalty fees often make it unreasonable for low-income people to establish or maintain accounts.

"The ability to open and maintain checking accounts is important to those underserved consumers because an inability to have those services requires them to utilize very expensive and sometimes predatory check cashing services, to incur expensive money order or similar charges, to endure the inconvenience and expense often involved in these services and exposes them to often unregulated and sometimes unreliable operations," we wrote.

Of course, it also makes it more difficult to pay bills on time and impossible to save.

These aren't theoretical concerns. Our letter was sent on behalf of and at the request of Care for the Homeless clients in New York City, based on their first hand experiences.

They know that without an account they can't have direct deposit forcing them to pay up to $7 to cash a check and incentivizing them to carry cash. They know not having checking means payments for necessities requires buying a money order. They know without a savings account their difficult struggle to save $5 a paycheck is likely to fail.

They've lived the unpleasant and dangerous inconveniences the inability to use direct deposit, automatic savings or on-line payments force on them.

"Pay day" loans are illegal in New York, so check cashing services in New York aren't allowed to offer them, or any loan above the state's 16 percent usury limit. "Loan-sharking" has always been illegal, yet in the cash and costly world of check cashing apparently pay day-type loans are sometimes available.

The CRA is perhaps the best tools bank regulators have to incentivize financial institutions' involvement and investment in their communities. It operates through bank regulator evaluations of individual banks performed about every 2-to-4 years.

The CRA has been used to push banks to reinvest and has helped reign in "redlining" of poor communities, the long-time practice of not offering mortgages in "bad" neighborhoods.

Though the Federal Reserve website invites comments because they and the other regulators are "currently considering what can be done to make CRA a more effective regulatory incentive going forward to address an unprecedented set of community needs," the CRA has never even rated the availability of basic banking services for underserved consumers.

Enter New York City and the "Responsible Banking Act." Enacted by City Council in 2012 by a 44 to 4 vote over the Mayor's veto, the Responsible Banking Act sets up a Community Investment Advisory Board to review how well financial institutions serve low-income neighborhoods and requires an annual report that the city Banking Commission must consider in determining which banks are eligible to get city government deposits.

Currently 25 institutions are eligible, including JP Morgan Chase and Bank of America.

There's been a glitch, though. When the New York City Banking Commission approved the current eligible depositories on May 13, 2013, it didn't take the annual review into consideration. Actually, there has been no review and no annual report.

More precisely, the Advisory Board required by statute hasn't been fully implemented and awaits appointments by city officials, including by Mayor Michael Bloomberg's administration.

Crain's New York Business reported last week that City Council Speaker Christine Quinn sent a letter to the Bloomberg administration urging them to select a candidate soon.

In fairness, the city has recognized the problem of lack of access to banking, too.

A 2008 city neighborhood financial services study concluded "for many low-income households, banking has become costly, unpredictable, and out of step with their actual needs" so "hundreds of thousands of New York families living on low incomes choose to remain 'unbanked' and "rely on 'fringe' financial service providers such as check cashers and pawnshops."

With 13 percent of New Yorkers unbanked, almost double the national average, Manhattan Borough President Scott Stringer launched the "Bank on Manhattan" program to identify better services for poor families.

The Mayor's Office of Financial Empowerment encouraged the unbanked to open accounts through their NYC Safe Start program.

But the numbers of unbanked moving to banking really hasn't moved.

This is hardly a theoretical problem. Surveys show poor "unbanked" people spend hundreds of dollars annually on check cashing and hundreds more on money orders. And what's the value of automatic savings to struggling very-low income people? Think of it as priceless.

Jeff Foreman is policy director at Care for the Homeless. Follow him on twitter at @JeffForeman2.