The 400-point drop in the Dow Jones average on February 27 was the biggest Wall Street decline in nearly four years. It capped a day of international stock market jitters that began with steep declines in Hong Kong and Shanghai and then traveled around the world. With New York's economy so dependent on finance, many city residents understandably fear any signs of weakness on Wall Street.

So is there reason to be concerned? If Wall Street sneezes, will New York catch pneumonia? Many parts of the economy continue to be robust, with jobs and wages growing, although they still remain below the peak levels of the 1990s. Such overall data and the trends for specific parts of the local economy suggest that New York City’s economy may slow but it won’t turn down unless Wall Street settles into a sustained slump.

READING THE SIGNS

â€Driving’ The EconomyMany economists use the concept of “drivers” to refer to sources of economic stimulus or to the sectors that heavily influence the economy’s course. For example, consumer spending is often referred to as the main factor influencing the magnitude of growth in the national economy. In New York City, Wall Street, tourism, professional services, information (media), and real estate/construction, are often considered the main “drivers” of the regional economy. With the exception of real estate/construction, these “drivers” are also “export” sectors that cater to a national or international market and serve to bring spending and incomes into local economy. The real estate/construction sector serves this purpose indirectly. |

Some experts see indications that the economy could stumble in the coming months. Former Federal Reserve chair Alan Greenspan believes there is a one-third chance of recession before the end of this year. Greenspan reasons that the economic expansion is starting to totter a bit in its old age and that a worsening slump in the real estate market could knock it off-kilter enough to trigger a recession.

The bursting of the housing "bubble" is widely acknowledged as the economy's biggest trouble spot. Housing prices and sales have fallen sharply in many areas, although not in New York City, and the low mortgage rates that fueled the housing frenzy are history. Home mortgage delinquencies and defaults have reached record levels. Many "subprime" lenders, the finance companies that specialize in granting mortgages to people with weak credit records, are in serious trouble. In a manner reminiscent of the savings-and-loan crisis of 20 years ago, we are beginning to pay the price for the financing practices that drove the current real estate boom.

Pessimists point to other signs of economic weakness, as well: slowing job growth, a declining manufacturing sector, weak business investment, record trade deficits and rising labor costs. Like Greenspan, they conclude that the U.S. economy is slowing further and could tip into recession. (While there is no single set of criteria defining a recession, it is often considered to be a period of two quarters of declining economic activity or output.)

But other economists point to different indicators and draw a happier conclusion. Citing low unemployment, rising wages, rising bank deposits, low inflation-adjusted interest rates, and a relatively strong global economy, these observers expect continued growth. The optimists do not believe sub-prime lending problems will spread, and they tend to see the manufacturing slump as an opportunity to shift capital and labor to sectors with brighter growth prospects.

Both pessimists and optimists will agree, though, that economic forecasting is tricky. A recent Wall Street Journal poll of 60 economic forecasters predicted, on average, a 25 percent chance of recession over the next 12 months. Testifying before Congress recently, current Federal Reserve Chairman Ben Bernanke said he expected a continuation of “moderate” growth, but emphasized that the Fed needed to be “flexible given the uncertainty we face.”

THE LOCAL PICTURE

How does any of this play out for the New York economy? Certainly, New York is touched by all of these forces to some extent. On balance, however, it appears that New York City is better positioned than much of the U.S. economy. Many "drivers" of the regional economy continue strong. [See box.]

Real Estate

Despite the slump in many parts of the country, the local real estate market remains robust. Housing prices generally have held up, easing slightly in some neighborhoods while continuing to rise in others. While most renters and prospective home buyers without millions to spend have a hard time affording a decent place to live, the luxury residential market continues to flourish, boosted most recently by record Wall Street bonuses.

Meanwhile, the market for office space in Manhattan is soaring. Stephen Ross, a major New York real estate developer and chair of the Real Estate Board of New York, recently claimed that the condition of the commercial real estate market here couldn't "get any better". The average rent in Manhattan hit $53 a square foot in the first three months of 2007, an all time high, according to the brokerage firm Cushman Wakefield.

However, mortgage foreclosures in New York City jumped 18 percent in the last half of 2006, and an alarming number of low- and moderate-income families are at risk of losing their homes. The Neighborhood Economic Development Advocacy Project estimates that 15,000 homeowners will face foreclosure this year, with the biggest impact coming in predominantly minority neighborhoods like South Jamaica and Cambria Heights in Queens, Bedford-Stuyvesant and East New York in Brooklyn, and Williamsbridge in the Bronx.

Construction

With several large public transportation projects and various publicly subsidized building projects starting to get underway, the outlook for New York City construction activity is brighter than it has been since the 1960s. For construction, the greater worry is the rising cost of materials and the possibility of capacity constraints.

Tourism

Record levels of tourists have kept most hotels fairly full for the past three years. New construction will add an estimated 5,000 hotel rooms to the city in 2007, largely offsetting the number lost to luxury condo conversions over the last three years. The white tablecloth restaurant industry has been amply fed by higher tourist spending, as well as by rapid high-income growth.

Finance

Although New York's financial sector still provides several thousand fewer jobs than it did at its peak in 2000, Wall Street profits have grown impressively in recent years (the top five firms had combined profits of over $30 billion last year) and compensation packages are as generous as ever. This winter's bonus season saw a record $24 billion paid out on Wall Street, according to estimates by the State Comptroller's office.

The city's economic horizon is not without a few clouds. The most worrisome is probably the vulnerability of certain Wall Street firms that lent heavily to sub-prime lenders. The Economist magazine recently warned that the profit growth of financial powerhouses linked to sub-prime lenders "looks set to fall."

THE JOB PICTURE

Wall Street may have a hugely disproportionate effect on the New York economy, but like the Yankees, it is not the only game in town.

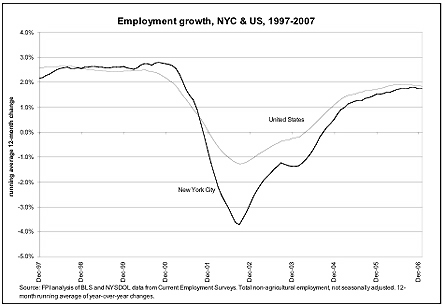

The number of private sector jobs in New York grew at a fairly strong 1.8 percent annual rate for the last three years. For the past several months, the city’s job growth has nearly matched that of the U.S. economy overall. Although this relatively robust job growth still leaves the city with about 50,000 fewer jobs than it had in December 2000, New York City’s job growth accounts for a disproportionate share of the state’s job growth during the recovery. The city’s solid job growth coupled with weak growth in most of the rest of the state means that jobs have been growing in the city at a pace three times that of the balance of New York State over the past three years.

Five industries each had employment growth of five percent or better in 2006. In order of most jobs gained, these were professional services, securities, home health care, construction, and banking. Together they accounted for much of the city’s total job gain. Within professional services, advertising and accounting employment grew by double digits.

With the exception of banking, these industries are also among the overall leaders in job growth since 2003. Other industries accounting for the city’s job growth during the recovery include (in order of most jobs added): retail trade, restaurants, social services, private educational services, civic and religious organizations, real estate, and doctor’s offices. For retail trade and real estate, job growth was fastest in 2004, the first full year of recovery, but has slowed since then.

Similarly, other sectors have their own dynamics and face broad trends that need to be understood in taking the economy’s pulse.

Take healthcare for example. Employment in home healthcare services has expanded by 40 percent since mid-2003, and jobs in doctors’ offices and outpatient care centers have increased by 10 percent. On the other hand, while hospitals and nursing homes together employ over 200,000 workers in New York City, there has not been any net gain in institutional employment over the past three-and-a-half years.

The broader leisure and hospitality sector, which encompasses hotels, restaurants and the arts, has been a steady contributor to recovery job gains. Both performing arts and restaurants have increased jobs by 13 percent since mid-2003. But the net employment level in hotels has risen by less than five percent because the conversion of hotels to condominiums. The recent boomlet in hotel construction should again boost the hotel workforce.

And not all parts of the economy have thrived. Manufacturing and telecommunications are the only major sectors to have lost jobs during the city’s recovery. Since mid-2003, both have lost about one-sixth of their employment bases, with manufacturing losing 20,700 jobs while a net of 4,100 telecommunications jobs have disappeared (the loss of jobs in wired telecom has far exceeded the growth in wireless telecom). Employment in both manufacturing and telecommunications is off by about 40 percent since 2000.

Telecommunications is part of the broader information sector that includes modestly sized, but high profile industries such as publishing, motion picture production, and broadcasting. These industries have seen only slight job growth, ranging from one to three percent, since mid-2003.

WHAT THE NUMBERS MAY MISS

Economists are beginning to note that the State Labor Department payroll jobs data may be missing an important part of the story: the rise in the self-employed. Indications are that the number of self-employed people and workers considered “independent contractors” are increasing at a faster rate than the number of people on a payroll. Many businesses are hiring people as free-lancers or consultants and not calling them “employees.” Businesses that treat workers as “independent contractors” do not make payments for payroll taxes or social insurance premiums. It is hard to pinpoint how much of New York City’s job growth is in the form of “self-employment” or “independent contractors,” but state-level data indicate that there was an increase of over 200,000 in this category between 2000 and 2004. During this same period, the net decline in payroll jobs was close to 200,000.

THE WAGE PICTURE

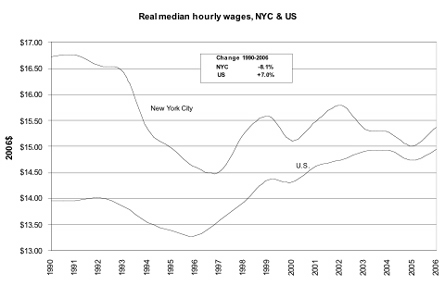

Last year saw the first real gain in wages in New York City since 2002. This is based on the median hourly wage derived from the monthly Census Bureau survey of households. If all wages are ranked from lowest to highest, the median is that wage at the mid-point in the distribution. To look at wage changes over time, economists usually adjust the survey data for inflation and look at the trend in “real” wages. In 2006, New York City saw a 2.4 percent increase in the real median hourly wage. Although the median wage had increased fairly steadily through the late 1990s to 2002, when adjusted for inflation, the real value of the median wage was still lower in 2006 than it was in the early 1990s.

A continued growth in the median wage could help sustain economic growth in New York City in the face of possible turbulence at the national level. Despite the good news on wages and in many parts of the economy, the biggest risk to the New York City economic health remains a downturn on Wall Street. For now, though, that is only a possibility and not a probability. And many other parts of the economy should continue to generate jobs and economic stimulus – even if the stock market gets the jitters.

James Parrott is deputy director and chief economist for the Fiscal Policy Institute.

Â