Investing in 5G is Crucial for Ensuring High Quality Education for New York Students

technology in schools (photo: Ed Reed/Mayor's Office)

21st century education requires 21st century innovation. If we want students to think critically and creatively to learn to solve problems and succeed in today’s modern world they also need and must have access to modern technology.

A decade ago, laptops, tablets, desktop computers, and internet access were just beginning to be introduced into schools and classrooms. Today, these tools are commonplace across New York and the nation, integrated into lesson plans and required for homework completion. And although cellphones can sometimes be distracting to students in school, more curriculum and education resources are being developed for mobile devices than ever before.

However, the classrooms of tomorrow will feature technology that today seems like science fiction: Virtual reality that lets teachers instruct students remotely in real time; augmented reality that students can use to conduct complex experiments; robots that interact with students and help monitor their learning progress; super high-speed connectivity that allows for massive amounts of information to be downloaded in just a few seconds.

Students now in the K-12 system, members of so-called Generation Z, are tech natives; screens, social media and surfing the ‘net are as natural to them as breathing, and this has forced teachers and administrators to upend traditional instructional models.

But it’s the incoming crop of students, dubbed Generation Alpha, who will force the true revolution of education. Born beginning in 2010 – the same year Apple debuted the iPad – these kids will be fully tech-integrated, having never known anything other than the modern digital age.

If the education community fails to adapt to meet the needs and expectations of this new crop of students, we risk losing them altogether.

A 2013 Gallup poll of 500,000 students in grades five through 12 found that nearly eight in ten elementary students were “engaged” with school, but by high school, that number had dropped to four in ten. Once they got into their teenage years, students reported that school left them feeling “bored” and “stressed” instead of excited and engaged.

This phenomenon will only worsen if we don’t rise to the challenge of educating the next generation. To do so, New York must make investments now in high-speed connectivity, ensuring that every child across the state has access to the most up-to-date technology that will be necessary for success.

5G, the next evolution of wireless connectivity, is not only essential to this success but also to ensuring that New York leads the nation in creating a modern education system that truly matches needs of the modern world.

Governor Andrew Cuomo is right for recognizing that the development of the small cell technology is necessary for making 5G a reality across New York. The governor made clear in his executive budget proposal that streamlining the process for establishing a statewide small cell network is crucial for making sure all New Yorkers have access to high-speed broadband service.

Access to high-speed networks is also important in higher education, enabling students and faculty around the state, the nation, and even the world to communicate and collaborate, which is the bedrock of the academic experience as well as the foundation for our economic well-being.

Improvements in connectivity will only further enhance the ability of the higher ed community to work together and share information, facilitating research breakthroughs that help build our economy and keep us on the cutting edge.

Better connectivity will also improve distance learning, an increasingly popular way to provide access to college classes for a wide variety of “nontraditional” students, like military personnel, single mothers, or mid-career professionals.

These students cannot, for reasons of transportation, childcare, or other challenges, attend regularly scheduled classes in person. Enhancing distance learning opportunities will help them further their education and get better jobs, improving the quality of life for them and their families while also helping to boost the state’s economy.

New York has long recognized the benefit of technology in education. In 2014, state voters approved the Smart Schools Bond Act, authorizing the issuance of $2 billion worth of bonds to pay for upgrades and advancements – including in broadband or wireless connectivity for schools and their communities.

But if investment is not made to improve the statewide network, these local improvements will be for naught and that money will be wasted.

New York is clearly moving in the right direction when it comes to making sure school-age kids are getting the sound, basic education to which they are constitutionally entitled.

The state Education Department recently released the latest data on graduation rates and found they’ve risen by 7.3 percent for students who entered high school in 2015 compared to those who did so in 2006. In addition, the achievement gap between students of color and their white peers has diminished between 1.5 and 6.8 percent.

New York must keep this progress going by taking the lead in building the broadband infrastructure that gives all New Yorkers access to modern technology and connectivity they need to succeed and thrive.

***

Andrew Rasiej is the founder and CEO of Civic Hall. On Twitter @Rasiej.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

The Fundamental Right to Art and Culture for All

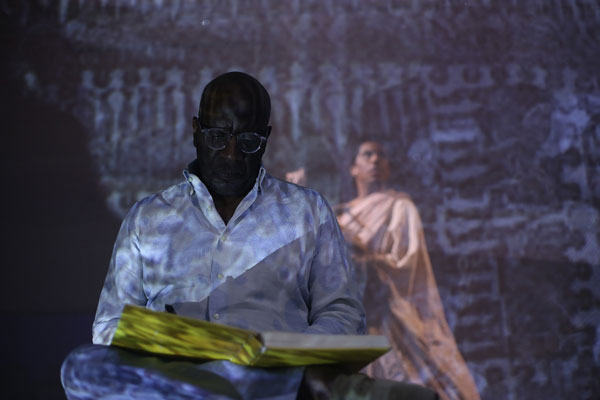

A Walk Through Slavery at The Billie Holiday Theatre

Many New Yorkers were stunned when the news hit in 2019 that Weeksville Heritage Center, the preservation site of one of America's first free black communities during the 19th century, would need to close its doors within months without an immediate influx of cash. Given the current funding realities in institutions serving communities of color, those of us leading African, Latinx, Asian, Arab, and Native American-focused (ALAANA) arts and cultural institutions were markedly less surprised.

A 2017 Helicon Collaborative study analyzed funding trends across the country and found that out of 41,000 cultural groups, just 2 percent received 58 percent of all contributed revenue. The organizations that received the majority of funding focus primarily on Western European arts, and serve upper-income, predominantly white audiences.

Having spent 16 years leading major initiatives in mainstream, predominantly white, non-profit institutions, before leading an institution of color, I have a foot in each world, and a hard-to-reconcile perspective on sustainability across institutions. There are many institutions like The Billie Holiday Theatre that understand the tenuous place that many of us find ourselves. These institutions have created great art for decades and were forged in cultural movements of resistance in a nation that has not always upheld its promise of “liberty and justice for all.”

These institutions are important to communities of color not just because of their contributions to creating art, but their contributions to bridging the racial wealth gap and to community development. According to a 2017 study by Mark Stern and Susan Seifert, cultural organizations encourage revitalization because they firm up social capital and get individuals involved in their communities.

Despite the overabundance of data that demonstrates how arts contribute to the economic development of neighborhoods, there have been inadequate investments in arts and cultural institutions in low-to-moderate income communities. Persistent disinvestment and marginalization have left arts organizations of color fragile. In fact, by the mid-nineties, 87% of the black theaters founded in the 1960s and 1970s went out of business and no great shifts or strategies have materialized to disrupt this trend.

Using arts in Bed-Stuy within the conversation of reparations, which is now a national one, it might look something like the following. According to The Brooklyn Community Foundation 2012 Neighborhood Report, the median New York City and State arts funding was $6.26 per resident compared to $2.44 in Bed-Stuy. Over more than half of a century, this disparity results in $30 million of underinvestment or $588,280 annually based on median population numbers.

How do we reverse this underinvestment and begin our journey towards true arts equity? It starts with engaging donors, private funders, government funders, boards, artists, and community members. If nothing else, this new journey requires, in the words of Toni Morrison from the Bluest Eye, “seeing in the new pattern of an old idea the Revelation and the Word.”

There are glimmers of hope. The City of New York's Create NYC cultural plan is changing the landscape of taxpayer funding, combined with investments from organizations like the Ford Foundation that have contributed to social justice and human dignity worldwide. In 2017, The New York Community Trust and the Doris Duke Charitable Foundation co-commissioned a report from Yancey Consulting to understand the health and viability of ALAANA arts groups in NYC; in 2018, the Mosaic Network and Fund was established. Together, city government and those foundations, as well as others, are engineering a paradigm shift in the growing movement towards greater arts equity.

But more can be done: we must ensure the fundamental right to art for all people, especially the most vulnerable people in our society, and now is the time to fill those voids of historic disinvestment, bridge the racial wealth gap, and build true equity for all in the arts.

To do this, ALAANA institutions must be willing to open new windows and consider the world anew, while philanthropic and government partners should throw out the 20th century playbook and collectively work together with ALAANA leaders, artists, and communities to shape a new path forward together.

In the words of Audre Lorde, let’s “define and seek a world in which we can all flourish.”

***

Dr. Indira Etwaroo is Executive Director of The Billie Holiday Theatre at Bedford Stuyvesant Restoration Corporation.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Investing in New York City’s Future

Saving for college (photo: Michael Appleton/Mayoral Photography Office)

Across every borough, neighborhood, and community in New York City, families are united behind one wish: that their children will have the access and opportunity to fulfill their dreams. Making this wish a reality, however, is more complicated.

Increasingly, current household income determines a child’s future. Nationally, fewer than 10% of children from low-income households graduate from college, compared to nearly 80% from high-income households.

While programs like free college and student loan debt forgiveness are being debated nationally, statewide efforts like the Excelsior Scholarship have made college more affordable for some New York students, and CUNY provides affordable tuition options for many students, we need to provide support that can cover both tuition and non-tuition costs that pose barriers to higher education for many families.

To bridge the gap of what’s possible for New York City’s youth, we need meaningful collaboration among government, the private sector, philanthropy, and local communities to provide actual funding and support to increase college and career-training access. We need a universal college savings system for every New York City student.

For many New York families, post-secondary education is not even a possibility due to the astronomical costs. For those that do go, nearly 60 percent end up with debt averaging more than $31,000. There is also a stark socioeconomic disparity in savings: among New York City’s lowest-income neighborhoods, just one out of every 91 kindergarten students had a NY 529 savings account, while one in four kindergartners in the highest-income neighborhoods had a NY 529 account.

Having savings set aside for college and career training, from an early age, can have a profound impact on a child’s ability to attend, graduate, and obtain higher paying jobs. A child in a low-income household with modest savings - between $1 and $500 - has been shown to be three times more likely to go to college and four times more likely to graduate from college than a child without an account. This clearly demonstrates the power of early investment in student potential to succeed in the long term.

Here in Western Queens, students entering kindergarten in a public school in District 30 have been part of a ground-breaking pilot program that provides them with college savings accounts. Through the NYC Kids RISE Save for College Program, every kindergartener over the past three years has automatically received an NYC Scholarship Account with a $100 initial deposit. This has been made possible by The Gray Foundation.

While similar programs have been piloted in other cities and states, this program is unique in its community-driven, neighborhood-based approach that allows any person, company, community organization, or philanthropy to provide funding to participating students’ accounts. Some examples include the “Concert for College,” a “Donate the Change” campaign sponsored by Seamless, a $15,000 contribution by Brooklyn parents to participating students at P.S. 92 in Corona and the recent “Funding Long Island City’s Future” campaign. These community scholarships have added an additional $400,000 into student college savings accounts.

In addition, the Save for College Program works by partnering with all 39 elementary schools in District 30, the Department of Education, and community-based organizations. All partners work together to provide financial education and college-and-career resources, meeting parents and students locally to provide wrap-around support and information.

Beyond the monetary value, these investments and resources communicate an important message to our children that the community is supporting their future. This month, the third cohort of kindergartners and new first- and second-graders in District 30 were enrolled in this program. With the new cohort, the total number of students with college savings accounts through this program is more than 10,000.

We believe that every New York City community would benefit from this program. That’s why we are working together to bring universal college savings accounts citywide, to all 83,000 kindergarteners who enter the New York City public school each year. We will work with our colleagues in the City Council, the Mayor’s Office, our partners at NYC Kids RISE, and other philanthropic and nonprofit partners to support the expansion of this program to new communities and boroughs.

This universal college savings and community wealth building initiative will not only reduce the cost burden of higher education but also bring our communities together to invest in our city’s future. Please join us in showing our children that their communities have their backs.

***

City Council Members Danny Dromm, Costa Constantinides, Francisco Moya, and Jimmy Van Bramer represent different parts of Queens.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Letter to the Editor: Raising Revenue for Medicaid and More

(photo: Governor's Office)

To The Editor,

I read with interest Gerald Benjamin's op-ed, Minding the Medicaid Gap, published on January 24, 2020. It's an excellent deep dive into the funding and administration of Medicaid at the state and local level.

I disagree, however, that raising taxes is necessarily unpalatable. Experts have identified ways to raise $40 billion in revenue, per year, by taxing New York's wealthiest individuals and corporations. Here's what we can tax, all without hurting Medicaid recipients, low- and middle-income families, and local governments:

-Second homes worth over $5 million

-Vacant luxury homes and commercial properties

-Annual Income over $5 million with additional tax brackets

-Carried interests (so hedge fund managers can't duck income taxes)

-Stock transactions

-Stock buybacks

-Companies that overcompensate CEOs

-Foreign companies that benefit from Trump tax breaks

Unlike a regressive sales tax, these revenue-raisers would only tax big corporations and the ultra-wealthy. This is how we can meet our state's needs for healthcare, housing, education, transportation, and climate justice. All we need is political courage on the part of Governor Cuomo and the New York State Legislature.

For readers who would like to learn more, nybudgetjustice.com, strongeconomyforall.org, and fiscalpolicy.org all offer information about these revenue-raising options.

Sincerely,

Carolyn Kelly

Manhattan

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

The Mayor’s Savings Mirage

Mayor de Blasio presents a budget (photo: Ed Reed/Mayor's Office)

On January 20, Mayor de Blasio presented his $95.3 billion preliminary budget for the 2021 fiscal year that begins on July 1 as well as updated data on the budget for the current fiscal year. He noted that the Office of Management and Budget (OMB) and city agencies had found enough cost savings to completely offset the “new needs” spending included in the preliminary plan. The mayor praised this as an especially significant accomplishment since so much work has gone into finding savings in the administration’s prior budgets and the low-hanging fruit had already been picked.

Really? To channel former President Clinton, whether you think the savings plan is a success depends on what the meaning of “savings” is.

There is no question that Budget Director Melanie Hartzog and her staff take the effort to find efficiencies and improve government operations seriously. OMB’s city-wide savings unit provided a detailed description of the planned savings by agency. But even a casual review of the report reveals that most of the claimed $713 million “savings” over two years is in fact lower than projected interest on city debt and increases in revenue, not lasting cost savings achieved by cutting agency expenses.

Debt service reductions are the largest “savings” in the current fiscal year ($129 million) and were also the largest element in the savings plan totaling $474 million that was presented this past November. It is good news that the cost of borrowing continues to be lower than anticipated, but that is mostly a product of economic and market conditions, rather than an accomplishment of city administration. It would be more appropriate to apply savings in interest costs to paying down the city’s heavy outstanding debt than to use it to increase operating spending.

Another large category of claimed savings is actually new revenue. Most if it comes from collecting more reimbursements from the state and federal governments – called “reimbursement re-estimates.” This is money that is supposed to have paid for services already being delivered and should be used to offset those costs, not fund new programs. The plan also includes millions of dollars in higher fees and collections such as ambulance charges, elevator inspection fees, summons collections, as well as revenue from litigation settlements. If more money can be obtained by better enforcement of fines, fees, and penalties, that’s great (not everyone would agree), but that is not savings. Nor is moving costs from the expense to the capital budget, which is also included in the savings plan.

Some initiatives in the savings plan can truly be characterized as improvements in agency operations that optimize efficiency. But the number of these efficiencies to be achieved and their total dollar value are very small relative to the total value of the overall plan. Many of the initiatives are in the Department of Education, where reductions in the costly absent teacher reserve will save $39 million in unnecessary salaries, and there will be cost reductions in food service contracting and professional development.

Other promising efforts include trying to save on city phone service (to be overseen by DoITT), merging two divisions of the Department of Health & Mental Hygiene, and installing new upgraded software at CUNY. But the largest efficiency measure in the plan, $55 million in recurring procurement savings, is likely a placeholder to build up the savings total, not a real expectation of savings, since specifics of the reforms and how they will be implemented is not explained.

There is nothing wrong with saving city dollars through lower debt service, collecting more fines and fees, and getting the federal and state governments to provide more reimbursements. All of these things should be done; indeed they should be regular, ongoing efforts of city government that reduce the costs of current services.

The problem is in treating them as offsets to more spending, when most cannot be expected to recur, while the new spending will continue into the future and be incorporated into future years’ budgets. Meanwhile, the City Council will surely want to add more “new needs” to the budget for next year -- the mayor may also have some of his own -- and it appears that additional expenses due to cost-shifts from the state may well have to be absorbed. More real, significant, and sustained savings in city government are needed.

***

Carol Kellermann was president of Citizens Budget Commission from 2008 through 2018.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

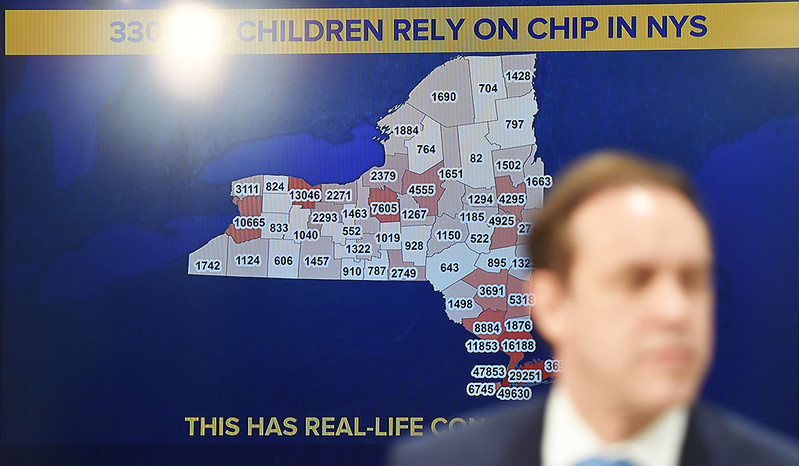

The Medicaid Solution No One Is Talking About

Another way of thinking about the state's Medicaid mess (photo by Kevin Coughlin/Governor's Office)

With Medicaid being blamed for the roughly $6 billion deficit our state is facing, most politicians see only two possible solutions: raise taxes or cut services.

Yet a far better third option exists: get rid of the for-profit insurers getting rich off our tax dollars, and recoup those funds for actual patient services.

Payments to private insurers are the silent bloat in New York's Medicaid budget, driving up our cost more than any other state in the nation.

Medicaid is a federal program that provides health insurance to people who can’t afford it. In New York, that’s one-third of us -- one out of every three neighbors, children, workers, seniors, and taxpayers.

Federal funds from taxpayers pay half and in most places across the country, the state pays the other half. But here in New York, Albany sends part of the bill to county taxpayers, to raise through regressive property taxes.

The feds let each state decide how to deliver Medicaid. And while there’s a big debate over single-payer universal healthcare (which I support), ignored in that debate is that Medicaid itself is not single-payer in New York.

Instead, we send our tax dollars to for-profit “Managed Care Organizations” (MCOs), like United Healthcare and WellCare.

Huge chunks of New York’s whopping $70 billion Medicaid budget flow to Big Insurance MCOs. The sicker people are, the more Big Insurance can bill.

The point of being in business is to make a profit, but the purpose of a taxpayer-funded program like Medicaid is supposed to be health care. Instead of blaming corporations for making a profit, I blame a government system that hands it over without question.

To top it off, these payments aren’t efficient. New York spends more per enrollee than 42 other states. When we hear that, some might think that means patients in New York get more out of Medicaid than patients in other states. But that’s not true.

Of the 38 states that use MCOs for Medicaid, New York is among the most expensive. In other words, not only is New York paying for-profit corporations with Medicaid funds, we are paying those corporations more than most states. New York State Comptroller Tom DiNapoli’s audit of our Medicaid budget just found almost $800 million in fat that can be trimmed off tax dollars funneled through Medicaid to Big Insurance and Big Pharma. With a projected 2020 state budget deficit of around $6 billion, that’s a good start - but as long as profit is the motive, costs will always go up.

The current system is bolstered by the steady stream of campaign contributions by those same private insurers to Albany politicians. In 2018, UnitedHealthcare PAC donated $40,000 to Democratic Governor Andrew Cuomo and $44,000 to the Republican Senate Campaign Committee. That’s just the tip of the iceberg.

Usually, politicians in Albany keep us bickering among ourselves about whether to raise taxes or cut services, while they soak up these campaign contributions from Big Insurance.

This time, let’s demand Albany doesn’t raise our taxes to pad corporate profits and doesn’t cut services to New Yorkers’ needed health care. Let’s cut costs by axing corporate profit off Medicaid. Let’s make Medicaid single-payer, and get rid of Medicaid for Profit.

***

Leslie Danks Burke is a 2020 Democratic candidate for State Senate in New York's five-county Southern Tier and Finger Lakes 58th Senate District. On Twitter @LDanksBurke.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

No Matter Trump’s Agenda, Refugees Remain Welcome in New York City

(photo: Ed Reed/Mayoral Photography Office)

Our nation has long been a beacon of hope for those fleeing their home country due to violence and persecution based on their race, nationality, religion, political beliefs, or membership in a social group. With resettlement as a refugee’s last option for safety, we have welcomed them and supported their successful integration in the United States for nearly 40 years with the establishment of the Refugee Resettlement Program.

Under the Trump administration, however, this country’s proud tradition of welcoming refugees and recognizing the contributions and impact of hardworking immigrants is under threat.

On September 26, 2019, President Trump signed Executive Order 13888—an unprecedented move to allow states and localities to block refugees from being resettled in their communities. His administration also capped total refugee admissions to a historic low of 18,000 at a time when the number of refugees and displaced people worldwide is at the highest point since World War II.

And as we’ve just honored Holocaust Remembrance Day this week, we must not forget the dark times out of which these policies and programs were created. Our nation turned a blind eye as millions of Jews were murdered during the Holocaust, including the hundreds of thousands that applied to immigrate to our country but were turned away due to the strict immigration laws and quotas that were in place at that time.

It was out of this humanitarian crisis that our country vowed not only to never forget, but never go back. Congress passed the first piece of refugee legislation in 1948, which would eventually become the Refugee Resettlement Program as we know it today. A profound moment of moral leadership and recognition that to sit idly by while the “victims of war and oppression” look to us for refuge is to hold “their fate in…our hands.”

Despite the best efforts of the Trump administration to dismantle the refugee program and take us back to those dark times, states and localities – many who share the deeply personal, profound, and real stories of refugees in their communities – have responded with an outpouring of support.

From Phoenix, Arizona, to Burleigh County, North Dakota, to Worthington, Minnesota, jurisdictions from across the nation have affirmed their commitment to resettle refugees in their communities and have recognized that true leadership considers the moral responsibility we hold to care for our fellow human beings who seek refuge from persecution.

New York City not only proudly issued consent to resettle refugees, but the city went a step further and joined a multi-city amicus brief in support of the litigation challenging the president’s order. Mayor de Blasio also joined with leaders across the nation urging the Trump administration to rescind the executive order and return this year’s refugee admissions cap to previous levels. And on January 15 a federal judge blocked the executive order from going into effect for the time being.

The message is loud and clear: refugees are not only welcome, but they are invaluable assets to every community they make home. With refugee workforce participation at 81.8 percent, far more than the 63 percent national average, and with refugees quickly surpassing United States median household income and owning more businesses than any other group—immigrant or otherwise—refugees contribute meaningfully to our economy as earners, taxpayers, and job creators. They enrich our neighborhoods and communities through their cultural contributions, civic participation, and engagement.

It is shameful that the Trump administration continues to turn its back on refugee and immigrant communities. Just this week, the Supreme Court made the deeply troubling decision to allow the Trump administration’s xenophobic Public Charge Rule to go into effect—targeting working immigrant families. While the merits of the case are still being fought in court, millions of families, children, and the elderly are at risk.

May our history guide us in the recognition that from a place of darkness and depravity our country grew small and stained and from there we had no choice but to embrace the light and commit to a better and more just way.

At a time when there are so many efforts to divide us, communities in New York and across the country continue to say, we will never go back to closing doors on those in need, and we will not allow the Trump administration to scare us into silence.

***

Bitta Mostofi is Commissioner of the Mayor’s Office of Immigrant Affairs. On Twitter @bittamostofi of @NYCImmigrants.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

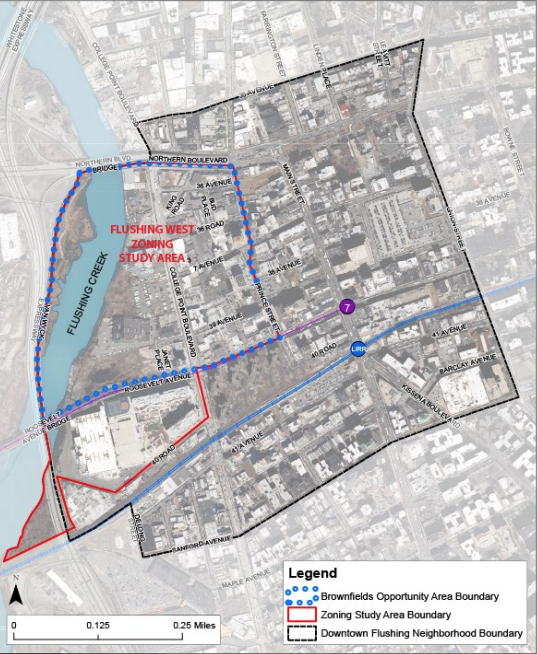

Special Flushing Waterfront District: A Massive Giveaway?

Flushing Special Waterfront District protestors

Most Flushing community stakeholders, including at least one Community Board 7 member, learned from a December YIMBY article that a massive waterfront rezoning and special district application had been certified by the City Planning Commission, initiating the seven-month Uniform Land Use Review Procedure that could make it a reality.

Eager to learn the details of the proposed rezoning and new development, the January 7 CB 7 land use committee meeting was attended by so many unfamiliar faces such that the committee chair asked everyone for a brief self-introduction.

While Flushing resident and activist Bobby Nathan was among a handful of attendees who expressed their opposition to the Special Flushing Waterfront District rezoning that evening, many others in subsequent meetings joined him. Initially protestors were dismissed for being “rude and inconsiderate,” then five NYPD officers were called to the January 21 meeting due to a group of protesters holding signs stating sentiments such as “We don’t want your -ty luxury condos.”

The Special Flushing Waterfront District proposal would add nine buildings for a total of 13 towers (four buildings provide a base for two towers each) in a 29-acre site bounded by 36th Avenue to the north, College Point Blvd to the east, 40th Road to the south, and the Flushing Creek to the west. All the proposed towers except for two will exceed the FAA height restrictions in the primary approach path to LaGuardia Airport, which is less than two miles away.

These towers would add 3 million square feet in luxury hotels, residential condos, retail, and office space. The addition of 1,725 luxury residential condos represents more than half of the total volume of luxury condos added to the Flushing market in the past decade. To facilitate pedestrian and vehicular circulation, a network of “publicly accessible” private streets and private extensions of existing mapped streets will connect the cluster of mixed-use towers.

The development team’s presentations emphasize the introduction of an urban scale and improvements in the public realm as primary community benefits. However, the architectural renderings underscore the utility of the open space, which largely serves to provide relief from the massive building bases lined with ground-level retail storefronts rather than accommodate passive or active recreational use.

The public realm includes a pedestrian path that will connect the new blocks along the Flushing Creek (which remains polluted by combined sewage and stormwater overflows). The other community benefit is a miniscule 61 units of affordable housing at 80% of Area Median Income (AMI) equal to $85,360 for a family of four, while the median household income in downtown Flushing is closer to $41,000.

Despite the massive scale, complicated and layered environmental matters including the remediation of brownfields and the Flushing Creek, construction in a coastal flood hazard area and hurricane evacuation high-risk zone, and outstanding public safety concerns due to the proposed building heights that potentially obstruct airplane navigation, the Department of City Planning issued a negative declaration on the Environmental Assessment Statement, meaning that the agency found “no significant effect on the quality of the environment.”

The negative declaration eliminates two pre-ULURP opportunities for public review and comment on the socioeconomic, environmental, and neighborhood impacts of this complicated and transformative special district and rezoning application. Because of the negative declaration, Flushing stakeholders were denied an opportunity for a public scoping hearing to comment on topics that should be part of an Environmental Impact Statement, and another opportunity to review and comment on a comprehensive Draft Environmental Impact Statement.

The Department of City Planning explained the negative declaration is merited because the development area is a commercial (C4-2) zone and the proposed new density and uses are as-of-right. Only a small portion of the development site will be rezoned from a manufacturing (M3-1) zone to a mixed manufacturing-residential (M1-2/R7-1) zone.

Department of City Planning’s explanation, however, is deceptively simplistic. Since the development site is comprised of numerous lots, several that are large (in the range of 100,000 square feet) and deep (as they are bounded by College Point Blvd and the waterfront, reaching 582 feet in depth) and varied in topography and grade (downward slope to the Flushing Creek), the as-of-right zoning is “fairly restrictive.” Moreover, the 1998 Waterfront Access Plan applies to the site and requires provision of “a shared public walkway, upland connections to the public walkway, and visual corridors.” Given these significant site constraints, a special district designation is essential for the developer-owners to maximize the commercial (C4-2) zoning bulk and density parameters.

To resolve these challenges, the three property owners formed FRWA LLC to work with the Department of City Planning and a small army of master planners, architects, engineers, and lawyers to divide the 29-acre area into buildable sites that facilitate visual corridors connected by privately owned and managed streets.

In order to maximize the commercial (C4-2) as-of-right buildable floor area, the special district requires a waiver to permit 11 towers to exceed the FAA’s strict height restrictions. Moreover, the special district lowers the parking to a commercial (C4-4) zoning that requires one parking space per 1,000 sq. ft. rather than per 300 sq. ft. in a C4-2.

In contrast to City Planning’s position that the proposed density is as-of-right, a Special Flushing Waterfront District to waive FAA restrictions, modify WAP zoning controls, and stipulate additional state and federal environmental approvals is necessary for FRWA LLC to maximize their C4-2 development rights. In order words, the proposed waterfront district is not truly as-of-right because the development scheme is dependent on numerous waivers and modifications of land use rules.

The planning for the Special Flushing Waterfront District dates back to 2010, when former Queens Borough President Claire Shulman’s Flushing Willets Point Corona Local Development Corporation (FWC LDC) secured a $1.5 million New York State Brownfields Opportunity Areas (BOA) planning grant.

FWC LDC hired ARKF to conduct baseline land use, zoning, and environmental studies of a larger 60-acre study area. In 2014, FWC LDC transferred the remaining $800,000 of the BOA grant to the Department of City Planning to complete these studies and prepare a zoning proposal. During this stage of planning, City Planning dubbed an 11-block portion of the waterfront area (approximately 47 acres) Flushing West, and expanded the scope of the zoning study to include new affordable housing production as part of Mayor de Blasio’s Housing New York plan. Crain’s New York Business reported on this highly unusual arrangement:

“The role of the (FWC LDC) in the planning process and the money it will be paying the department raise questions about who is actually running the show in this part of Queens and how much real estate interests who support the initiative— including members of the development corporation's board—stand to gain.”

Described as “under the radar,” Flushing West joined Brooklyn’s East New York and Jerome Avenue in the Bronx as the first neighborhood rezonings eyed for implementing the mayor’s mandatory inclusionary housing policy.

The Flushing Rezoning Community Alliance led by the MinKwon Center for Community Action, Faith in New York, and St. George's Church was formed in July 2015 to advocate for an inclusive planning process and deeper housing affordability. It prepared a report highlighting substandard neighborhood conditions and detailing recommendations for an equitable rezoning. Less than a year later on May 27, 2016, City Council Member Peter Koo wrote a letter to then City Planning Commission Chair Carl Weisbrod detailing outstanding infrastructure constraints and pressed the point that the Flushing West rezoning would be equivalent to "stuffing 10 pounds of potatoes into a five pound bag." The city ceded to Koo’s request and ended the Flushing West Neighborhood Planning Study.

While Flushing West ceased to be a city-led rezoning, the Department of City Planning continued to work with FWC LDC on a smaller area comprised of the lots owned by the three major developers that formed FRWA LLC. They are F and T Group, United Construction & Development Group, and Young Nian Group LLC, a Chinese transnational development group that purchased the former Korean supermarket Assi Plaza, after several speculative flip sales, for $115 million. In consultation with Community Board 7’s executive committee, this public-private collaboration completed the Flushing waterfront special district and rezoning application.

Department of City Planning served an integral role in preparing a Special Flushing Waterfront District plan that maximizes private development rights and profits. In response to the 2015 Crain’s article that questioned DCP’s consultant role to the FWC LDC, Queens Department of City Planning Director John Young wrote, “In short, the LDC has no veto power over our work. Rather, the public does - via the city's transparent and multilayered public land-use review procedure.”

However, the Department of City Planning’s negative declaration on the EAS has eliminated pre-ULURP opportunities for public review and comment on a complex special district and rezoning application. In response to my request for clarification on the EAS, the Queens City Planning office suggested I contact an associate at Stroock, the law firm that represents FRWA LLC.

ULURP ends with the New York City Council, and Council Member Koo’s vote will determine the fate of the Special Flushing Waterfront District. In addition to detailing the challenges due to overdevelopment and the outstanding need for affordable housing, Koo’s May 2016 letter noted that developers informed him the Flushing West rezoning represented a downzoning and since "the numbers didn't add up," “it is actually more financially feasible for them to have an empty lot.”

Apparently, City Planning, FWC LDC, and the FRWA LLC’s army of experts figured out how to make the numbers work to move ahead with the waterfront district plan. The question now is, will Council Member Koo maintain a principled position and reject a rezoning that augments environmental risks and socioeconomic burdens, and supercharges the gentrification of Flushing?

***

Tarry Hum is Professor and Chair of the Urban Studies Department, Queens College, City University of New York. On Twitter @TarryHum.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

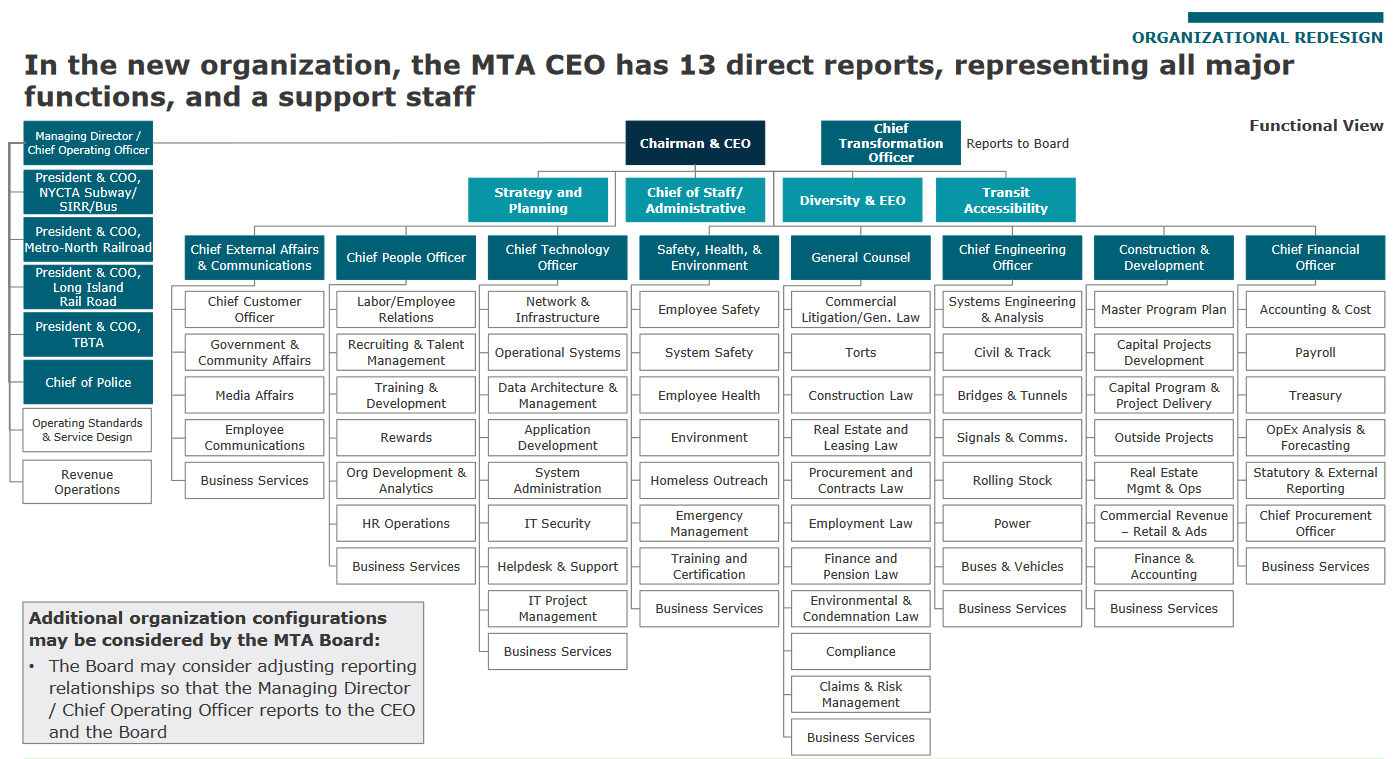

Byford’s Gone and So's His Job; What's Next?

(photo: Marc A. Hermann / MTA New York City Transit)

There will never be another MTA New York City Transit President with the power Andy Byford had when he took the job two years ago. Under Governor Cuomo’s MTA reorganization plan, all future NYCT “Presidents” have been stripped of the power to manage capital projects like replacing signals and switches or buying new rail cars and buses. The next boss of Transit also lost control of a large number of engineering experts and legions of Transit Authority workers who are reimbursed for their time on capital projects.

Going forward, Transit’s capital planning, purchasing, and project management will be done by a centralized, newly-renamed MTA Capital Construction & Development agency. This massive agency is run by MTA Chief Development Officer Janno Lieber, who has immense powers and approves everything from which kind of new bus to buy to who gets to rent the candy stand in the 103rd Street subway stop.

Byford’s departure got so much attention in part because the MTA is going through a wrenching reorganization ordered by the governor that includes eliminating 800 operations workers and 1,900 administrative staff. Amidst this turmoil, Byford was highly respected by rank-and-file workers and riders for hugely reducing subway delays with a mix of hard-headed pragmatism, sincerity, and optimism.

MTA “Reorganization” Pushed Out Byford

It was Governor Cuomo’s reorganization plan, approved in July 2019, just three months after it was mandated by the state budget, that led inevitably to Byford’s resignation.

In his resignation letter, Byford wrote that the “transformation plan...called for the centralization of projects and an expanded HQ, leaving Agency presidents to focus solely on the day-to-day running of service. I have built an excellent team...who could perform this important, but reduced, service delivery role.”

The central tensions in Byford’s relationship was the governor’s inability to share credit with a talented subordinate, penchant for secrecy, and his preference for surprise “man on horseback riding to the rescue” announcements instead of conventional, fact- and expert-based planning.

Byford’s “I’m a global transit expert” worldview came into a head-on collision with the governor’s insistence that the MTA and Byford could use Ultra Wide Band (UWB) radio technology to vastly speed up resignaling the subway system. New signals are a top priority and the core of Byford’s Fast Forward plan, because signal problems are the main cause of subway delays.

The problem is that UWB has not been widely deployed by any leading subway system and is viewed as a promising, but not mature, technology. Signal modernization is also at the fault line of authority over who will fix the subways: NYC Transit or MTA Capital Construction & Development. Since the departure of Byford and then his top signals deputy, Pete Tomlin, control over signal modernization -- and the decision about which lines get new signals first -- appears to be in MTA Capital Construction & Development’s hands.

Byford and Cuomo also famously clashed over the L train tunnel and subway speeds initiatives, when the public saw the governor reaching over the MTA board and MTA CEO to make direct decisions about MTA project management.

Reorganization or Disorganization?

Reinvent Albany and transit advocates have repeatedly warned that the reorganization plan could result in the fragmentation of expertise, and the derailment of Byford’s Fast Forward Plan (both before the passage of the state budget that mandated the change and after, when the MTA’s consultant, AlixPartners, was developing the recommendations).

We were concerned that shifting NYC Transit’s talent, like Byford’s signals expert Tomlin, to MTA Capital Construction would result in fragmentation, where the engineering and capital planning staff were separated from operations, creating new silos. One could argue the transformation plan created more than 13 new silos, with many new chief officers -- of operations, engineering, technology, communications, etc. -- all reporting to the CEO/Chair. See the “chief” heavy org chart below.

Splitting NYCT into Subway and Bus Operations?

A June 2019 “draft” version of the transformation plan that was scrubbed before final release proposed separating subways from buses, with all MTA buses merged together under one head. That seems more likely now with Byford’s departure, though not without challenges given the separate collective bargaining agreements for bus operators, as express buses are under the MTA Bus Company, while NYC Transit runs local and select buses.

Buses are too often relegated to second-tier status below subways in terms of public officials’ focus, but not under Byford. Byford made a point to own buses equally with subways, as seen through his work on the 14th Street busway and borough-based bus redesigns, which have been long overdue.

Transit advocates at the Bus Turnaround Coalition are working hard to maintain the momentum that Byford helped start, but his departure and the overall reorganization at the MTA leave it unclear who will restore the bus system. Thanks to Bus Rapid Transit, buses have undergone a global renaissance over the last 25 years that has skipped over New York City. With Byford leaving, all eyes will be on Governor Cuomo to ensure that needed improvements are made to both subways and buses.

#CuomosMTA

We hope our concerns are misplaced, and that the governor’s massive reorganization of the MTA will result in big benefits for riders and those who work for the Authority. We hope the governor’s repeated, direct interference in the MTA’s operations will lead to greater organizational focus and effectiveness. We hope that the reported exodus of experienced MTA managers -- some of whom left before Byford -- will allow for new talent and new ideas to rise. We hope the governor lets Janno Lieber do his job, and that Lieber knows what to do with the massive power he’s accumulated with the new MTA Capital Construction & Development agency.

Yes, we hope for a lot of things, so while we’re at it, let’s hope that the governor will take responsibility for the failures, not just the successes of his efforts at the MTA.

***

Rachael Fauss and John Kaehny are, respectively, senior research analyst and executive director of Reinvent Albany. On Twitter @ReinventAlbany.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

As Cuomo Proposes Excelsior Scholarship Expansion, 6 Things to Know About the Program

(photo: Kevin P. Coughlin/Office of Governor Andrew M. Cuomo)

In January 2017, Governor Andrew Cuomo unveiled the Excelsior Scholarship, New York State’s “free college” initiative. About 20,000 students were awarded Excelsior in the inaugural 2017-18 year. In 2018-19, the number of scholarship recipients rose to 24,000, and for 2019-20, the Legislature projects an increase to 30,000, which will equal no more than 5% of the state’s public college enrollment.

The 5% figure is small compared to the massive hype that surrounded the program’s rollout. Yet 30,000 beneficiaries is still a large number, exceeding the total undergraduate enrollment at the State University of New York (SUNY) campuses at Albany and Stony Brook, or the combined enrollments at the City University of New York (CUNY) Brooklyn College and City College campuses.

In his January 8 State of the State address, Governor Cuomo proposed to expand eligibility for Excelsior to students from families with incomes of up to $150,000, which is an increase from the current income limit of $125,000. The governor’s executive budget proposal includes a two-year phase-in, with the cap increasing to $135,000 for the 2020-21 academic year and then to $150,000 in 2021-22. For 2020-21, the total budget for Excelsior would be $146 million, up from an expense of $66.4 million in 2017-18.

When Cuomo first introduced Excelsior, it was with two purposes—first, to provide relief to families in the middle-class college affordability squeeze, neither eligible for much existing financial aid nor easily able to pay rising public tuition, and, second, to advance educational opportunity and equity to all New Yorkers. “With this program, every child will have the opportunity that education provides,” he proclaimed.

As a result of Excelsior, the amount of state financial aid distributed to middle-income families has markedly increased. At the same time, aid to the lowest-income students via the state’s Tuition Assistance Program (TAP) and TAP credit program has grown only incrementally with step-ups to keep pace with tuition increases.

With Excelsior, the goal of middle-class college affordability has advanced, yet as it has a wider chasm has opened between the resources available to low-income and middle-income students. Excelsior has never offered that much to low-income students and opening up Excelsior to higher-earning families won’t change that.

Now that the governor is proposing to expand Excelsior, below are six important things to know about the program, including that as it is now constituted, it offers relatively little to low-income students, community college students, and CUNY students.

1. Excelsior does not help low-income students.

The lowest income students in New York State receive enough financial aid from federal Pell grants and the TAP program to cover the full costs of CUNY tuition or SUNY tuition. As “last dollar” awards, Excelsior scholarships only go to students who have tuition balances remaining after exhausting all other aid.

The lowest income students, already going to public colleges tuition-free as a result of Pell and TAP, typically gain nothing financially from Excelsior. Thus, a “free college” initiative that might seem like a financial windfall for the lowest income students does not actually reward them additional aid.

This is a shame, as much research, often coming from the Hope Center for College, Community, and Justice, documents that low-income college students’ financial challenges compromise their abilities to stay in college and to progress toward graduation.

2. Excelsior benefits students from families that are “upper” low-income and middle-income.

If the lowest-income students don’t benefit from Excelsior, who does? The answer is middle-class students and near middle-class students with tuition balances remaining after accounting for Pell and TAP. My prior reporting profiled grateful middle-class students at Brooklyn College and SUNY Albany for whom Excelsior has been a difference-making lifeline.

Students from families with taxable incomes of between $80,000 and $125,000 are in the sweetest spot. At $80,000+ in taxable income, families generally phase out of eligibility for Pell or TAP. For these students, Excelsior flips the script from a full tuition bill to none.

As the income cap has increased to $125,000 from the initial cap of $100,000 in 2017-18, the program has become even more of a middle-class tuition relief program than it was during its inaugural year.

The proposal to increase the upper income limit to $150,000 would extend the program towards upper middle-class territory. According to the Pew Research Center, a household of three with an income of $50,697-$152,092 is middle-class, with that defined as having an income of between two-thirds and double the national median income adjusted for household size, with the figures modified to $60,49-$181,496 for household sizes of four.

Data from the NYS Higher Education Services Corporation (HESC), which administers Excelsior, is presented in the scattergram below and shows that the program, during its inaugural year, provided more substantial benefits to students at colleges serving predominantly middle-income and near-middle-income students than colleges serving predominantly low-income students. This is as would be expected given the design of Excelsior, but the magnitude of the program’s bias in favor of middle-income students is especially stark when visualized.

In the scattergram, each of the state’s public CUNY and SUNY colleges is represented by a point on the coordinate plane. The horizontal axis captures the percentage of students at each institution receiving Excelsior while the vertical axis captures the percentage of students receiving Pell grants. The Pell grant percentage at a college is a strong proxy for the percentage of low-income students at the institution.

In the scattergram, the lower the Pell grant receipt rate (and by proxy, the more middle-class the student body), the higher the percentage of students who received Excelsior. (The methodology section at the end of the article describes the data sources and their limitations.)

The lower quadrants of the scattergram are an area worthy of special attention. In 2017, 12 of the state’s public colleges had less than 40% of their freshmen receiving Pell grants. These colleges had the most middle-class student bodies among the state’s public colleges and included schools such as SUNY Geneseo and SUNY Binghamton. At these 12 campuses, 6.3% of students received Excelsior in 2017-18, nearly double the 3.2% statewide rate for the same year—and this was as a number of these campuses enrolled significant numbers of out-of-state students not eligible for Excelsior.

Meanwhile, as an example from a campus with a high-percentage of low-income students, at CUNY LaGuardia Community College, whose data point is in the upper left corner of the scattergram and where 73% of freshmen received Pell grants in fall 2017, only 0.3% of the student body received Excelsior, far below the 3.2% statewide rate.

The entire scattergram illustrates an inverse relationship between Pell grant receipt rates and Excelsior award rates.

3. Excelsior hardly benefits community college students.

Excelsior recipients are especially scarce at the community colleges, where 1.7% of students were awarded Excelsior in 2017-18, compared to 4.6% of students at the four-year colleges.

Excelsior is relatively unique among “free college” initiatives in extending benefits beyond community colleges, and this actually reinforces the historic under-funding of community colleges compared to four-year colleges. Of all 2017-18 Excelsior award recipients,75.7% were students at four-year colleges and 24.3% students at community colleges, even though community college students are about half of the state’s public college enrollment.

The vast differential in award rates between community college students and their four-year college counterparts is driven by two factors. First, community college students are more likely to benefit from fully-covered tuition via combined Pell and TAP awards than are four-year students. This is in part because the lower tuition amounts at the community colleges generate fewer cases where tuition gap-filling Excelsior awards are needed. Second, Excelsior rules that require full-time attendance, continuous enrollment, and earning a heavy 30 credits each year eliminate from eligibility many community college students.

In dollar amounts, $12.2 million in Excelsior funds, representing 18.3% of the total Excelsior budget, went to community college students in 2017-18, with the balance of $54.2 million, or 81.6%, going to four-year college students.

4. Excelsior hardly benefits CUNY students.

Excelsior also does not register much of a presence at the CUNY colleges. In 2017-18, the 18 CUNY colleges enrolled a 16.3% share of Excelsior scholarship recipients, with the balance of 83.7% of recipients attending SUNY colleges, even though CUNY students comprise 38.8% of the state’s public student enrollment. The number of recipients is small at SUNY but minuscule at CUNY.

Excelsior recipients are virtually non-existent at some community colleges. CUNY Hostos Community College had just 12 awardees, and CUNY Kingsborough Community College had only 42.

The key driving force for the differential is that CUNY students are more likely than SUNY students to have lower family incomes for which Excelsior offers no additional financial benefits. CUNY students also are more likely than SUNY students to be ineligible by attending part-time or by not earning 30 credits annually.

As depicted in the chart below, 0.4% of CUNY community college students received Excelsior in 2017-18, compared to 2.0% of CUNY senior college students, 2.3% of SUNY community college students, and 6.7% of students at SUNY four-year institutions. SUNY four-year college students also received financially larger awards, on average, though this is likely the result of these students receiving awards for two semesters at particularly high rates rather than just awards for single semesters.

In dollar amounts, $9.9 million in Excelsior aid went to CUNY students compared to $56.4 million to SUNY students. The discrepancy between the amounts to CUNY and SUNY students is steep.

The bar chart below is another telling visualization, presenting the imbalanced Excelsior awards for all of the state’s public colleges. The schools with the highest percentages of students receiving Excelsior awards tend to be mostly SUNY four-years. The schools with the lowest award rates are mostly CUNY two-years.

In theory, “free college” seems like a neutral idea—free to all!—yet in reality, Excelsior’s rewards are targeted. The by-product of Excelsior’s income and academic eligibility criteria is a funding imbalance between CUNY and SUNY constituencies.

Today, the imbalanced distribution of Excelsior awards is almost certainly more biased in favor of SUNY four-year schools than it was in 2017-18. The SUNY four-years likely have the highest percentage of students enrolled from families with incomes of between $100,000 and $125,000, an income range presently covered by Excelsior that was not during the program’s inaugural year. If Governor Cuomo is successful in expanding the income range another $25,000 to $150,000, then the imbalance in the distribution of funds between CUNY and SUNY would likely deepen further.

Data from the completed 2018-19 academic year, when the income cap was raised by $10,000 to $110,000, could shed light on the impact of marginally increasing the income cap but so far HESC has yet to release that information to the public.

5. The Excelsior program is not incentivizing more students to enroll in college.

One redeeming value for Excelsior could be that its simple message of “free college,” broadcast widely by Governor Cuomo and in the news media, may be incentivizing more New Yorkers, especially of limited means, to enroll in college and to achieve college degrees.

Research from Hieu Nguyen, a researcher in the Department of Economics at the University of Tennessee, suggests that, at least in its first year, Excelsior did not catalyze an enrollment boom. According to Nguyen’s 2019 article in Education Economics, which compares enrollment patterns in New York State with enrollment patterns in other states using a quasi-experimental statistical design, Excelsior had a “negligible effect” on boosting higher education enrollment in the state.

It should not come as a surprise that Excelsior didn’t jumpstart college enrollment given that it has such restrictive eligibility criteria and offers no financial benefits to most low-income students.

The research, however, is not definitive, as Nguyen’s research explored just Excelsior’s first year. There may have been an Excelsior-related bump in college enrollment in the program’s second or third years, once there were longer periods of time for the message of “free college” to influence high school students’ developing attitudes towards college-going.

6. Excelsior may have positive effects on student retention and on-time graduation.

Another positive feature for Excelsior could be that it contributes to increased retention and graduation rates.

Yet there is no conclusive research on Excelsior’s impacts on retention and graduation. In September 2019, the governor’s office announced that the two-year graduation rate for Excelsior students at SUNY community colleges was 30% compared to a non-Excelsior graduation rate of 11%. For CUNY community college students, the two-year graduation rate was also 30%, compared to 12% for non-Excelsior students. This is a positive sign, yet Excelsior and non-Excelsior students differ in substantive ways, most notably by income level, and more rigorous research is required, which is only possible if more Excelsior data is released.

In his State of the State address, Governor Cuomo declared, “The national progressive dream of free college tuition is a New York reality.” Yet for New York State’s “free college” program to be a strong model to other states and cities, there must be reforms to the entire New York State financial aid system such that it distributes more aid to low-income students, rather than introducing a costly subsidy to families in the $125,000-$150,000 income range.

*****

Methodological Notes:

The HESC data on the Excelsior Scholarship awards from 2017-18 is posted on the Open NY website. The figures for SUNY Tompkins County Community College (TCCC) are “pending final eligibility determination,” according to HESC (email correspondence), and have been excluded.

For each campus’ total number of undergraduate students, the fall 2017 NCES IPEDS enrollment figure was used. The number of Excelsior recipients at each college was divided into that college’s fall 2017 IPEDS enrollment figure to calculate the percentage of students at each campus receiving Excelsior.

This is an imperfect approach, as the Excelsior scholarship headcount figures in the HESC dataset are described as being for both semesters of the 2017-2018 award year rather than just for the fall semester. An alternative method would be to rely on the IPEDS unduplicated annual headcount as the denominator for calculating the award rate percentages. This alternative approach would have generated lower award rates and an even more pronounced gap in award rates between community college and four-year college students.

This alternative approach was not employed because the unduplicated annual headcount figure is a noisy variable skewed by summer session enrollments, non-degree enrollments, and other factors. In some cases, unduplicated annual headcount figures are twice the fall 2017 headcount.

As a consequence, the percentages of students receiving Excelsior cited in this article are not precise but are approximate ones employed to show relative differences.

***

Are you a student, parent, school official or other person who has an experience with the Excelsior Scholarship that you’d like to share? If so, contact This email address is being protected from spambots. You need JavaScript enabled to view it..

***

Eric Neutuch is a freelance journalist and former CUNY administrator, 2009-2017.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.