Tax Reform In Bloomberg's Second Term?

When Mayor Michael Bloomberg said in his victory speech that he believed his re-election sent a message “that you can make the tough decisions and be re-elected, as long as they are the right decisions," it seems clear what tough/right decisions he was talking about. At the top of the list has to be his tax hikes.

The boldest move of his first term was proposing and selling a $3 billion tax package, the key to resolving a $6 billion budget deficit. The package was a burden for most New Yorkers, but the public seems to have accepted his argument that this is an expensive city, and taxes are basic to essential services.

That is why there is hope among fiscal experts of both liberal and conservative perspectives that Bloomberg will devote his second term to reforming the city’s tax system, particularly its incomprehensible property tax, its roller-coaster personal income tax rates, and its mostly hidden corporate tax breaks.

In New York’s think-tank world, the conservative Manhattan Institute’s E. J. McMahon’s new study, “Pricing the â€Luxury Product’: NYC Taxes Under Mayor Bloomberg,” urges restraint on city personal income tax rates and calls for a city/state commission to reform the city’s property tax system.

The progressive Fiscal Policy Institute’s James Parrott, in a new study, “Hudson Yards Tax Breaks, Unwarranted and Fiscally Irresponsible,” analyzes an acceleration of corporate tax abatement and argues against long-term tax breaks for West Side developers. (Juan Gonzalez provided a short review of the study in the Daily News.)

The Property Tax

E. J. McMahon believes reform should begin with, if not end with, the city’ s property tax system, which produces nearly 40 percent of all city tax revenues. At a Baruch College School of Public Affairs seminar on the property tax held October 31, Independent Budget Office Deputy Director George Sweeting released new data that underscore the inequities and what McMahon calls the “Byzantine” complexities of the current system.

The current problems began with 1981 state legislation that set up the current system, which essentially protects city homeowners. But one kind of owner (1-, 2- and 3-family house owners) has a lower burden than most coop and condo owners. Commercial owners have a much higher burden, and renters, who pay a substantial share of their landlords’ property tax in their rent, have almost as high a burden as commercial owners.

So, for example, according to the new data from the Independent Budget Office, on a piece of property worth $300,000 – if the property is a one-family house, the typical 2005 property taxes would be $1,602; if it’s a co-op, the typical property taxes would be $2,772; but if it's a rental property, even though it's worth exactly the same amount as the private home or the coop, the typical property taxes would be nearly eight or five times higher, $13,050.

These inequities are, in large part, created by a bizarre assessment process. In most localities, a property assessment is based on a property’s market value, and the tax bill is determined by simply multiplying that assessment by the current tax rate. Not in New York City.

Here assessments are only a fraction of market value. Assessments of houses, for instance, are targeted at six percent of market value. Thus a $300,000 house would be assessed at $18,000. Assessments of commercial and rental apartment buildings, on the other hand, are set at 45 percent of market value. A building with a $10 million market value would have an assessment of $4.5 million. Co-ops and condos are assessed as if they were rental apartment buildings, creating even more confusion.

To further protect homeowners, there are caps on annual assessments -- no more than six percent for house owners in one year, or 20 percent over five years. There are slightly higher caps for co-op and condo owners.

Recent data from the city’s finance department show the effects. A house with a market value of $350,000 saw its market value rise by 76 percent from fiscal year 2001 to 2006, but the assessed value rose by only 20 percent. The effect of the residential caps is that much of the increase in market value in owner-units is never “captured” in the assessment, thus reducing owner tax bills over the long run as well as short run.

The McMahon report says, “While all cities have real property taxes, few if any could rival the complexity, inequity, and opacity of New York’s system.”

Absent the overall reform that McMahon urges, attempts to fix property tax inequities have only created new problems. For instance, in order to lower the burdens of coop and condo owners, the mayor and city council in 1997 introduced a property tax abatement for them (since extended to 2008). The abatement ranges from 17.5 to 25 percent of the property tax bill.

The new Independent Budget Office data show that because of the convoluted assessment practices, over 78,000 co-op and condo units actually had lower tax burdens than the typical house owner before the abatement. And the abatement has moved several thousand more units into this privileged house owner tax status. In dollar terms, it means that nearly $100 million of the annual abatement is a “waste,” because it goes beyond the original equalizing goal.

Personal Income Tax

The second most important city tax – now representing about 22 percent of city tax revenues – is the personal income tax.

Looking to Bloomberg’s second term, McMahon and the Manhattan Institute fear an extension of the city’s temporary top personal income tax rates for the city’s highest earners (over $150,000), which under current law expire December 31, 2005. They fear many of the city’s millionaires will flee the city to avoid the 4.45 percent top tax rate – which if extended beyond the end of this year would bring in approximately $500 million.

But a similar top 4.45 percent personal income tax rate was in effect through most of the 1990s, after being introduced by former Mayor David Dinkins and Council Speaker Peter Vallone during a recession and fiscal crisis in 1990. The fear of high-end earners flight seems exaggerated, since that rate apparently had no negative impact on the booming city economy of the late 1990s, and in fact, helped create huge Rudy Giuliani budget surpluses.

A city tax commission could take a look at the roller-coaster changes in personal income tax rates over the last 15 years and test McMahon’s dubious claim that the early 1990s tax increases triggered the loss of 300,000 jobs in the city. As McMahon suggests, personal income tax revenues can be volatile because of economic ups and downs, but that does not mean the rates can’t be set efficiently and progressively.

Commercial Tax Breaks

James Parrott’s study of commercial tax breaks – which mayoral administrations sell as “economic development” -- is revealing: In the four years after 2000, these increased over 72 percent, from $334 million to over $575 million. Parrott argues for a review of the rationales for these breaks, many of which were arguably unnecessary, especially in Manhattan; the developments would have gone ahead without deep city subsidies.

Parrott also pulls the curtain on what’s happening in Manhattan’s West Side (Hudson Yards) development area. The city’s financing of the infrastructure that will support this development – the extension of the #7 subway line is the biggest piece – is not yet completely clear. The mayor and the city council agreed last winter to use city funds for the start-up of the financing, but long-term financing is based on using new property tax revenues generated from the development area.

The problem is that the mayor wants to use a pre-determined PILOT – a payment-in-lieu-of-taxes – for the whole development period. A PILOT is usually determined by a negotiation on a specific property between the city and a developer that sets a less-than-full-property tax payment. (The Port Authority, for instance, paid the city a PILOT for the World Trade Center that was about 25 percent of what it would have been had the property been fully taxed.)

But here, the city proposes, through its obscure Industrial Development Agency, to establish what is called a Hudson Yards Uniform Tax Exemption Policy that Parrott says “will likely permanently institutionalize the granting of across-the-board tax breaks for any commercial development in New York City.” The immediate Hudson Yards effect would be to grant a “uniform” break for all Yards developers through at least the year 2040.

Public economic development investments provide incentives for private development. Why assume decades in advance that further incentives will be needed at all, let alone at some arbitrary and uniform tax-cut level set in 2005? Parrott argues that what “gets locked in with this ill-advised economic policy are the inequities that result when large companies receive sizable property and other tax breaks that shift the city’s tax burden to smaller businesses and other taxpayers.”

The Industrial Development Agency will, according to Good Jobs New York (a joint venture of the Fiscal Policy Institute and Good Jobs First which monitors the secretive processes of New York’s public authorities), in the near future hold a hearing to determine just what this important uniform exemption will be. Will it be a 50 percent discount? A 20 percent discount? The long-term costs – through lost property tax revenues – could be in the hundreds of millions of dollars.

Another obscure public authority – the Hudson Yards Infrastructure Corporation – is the financing mechanism that controls the borrowing that will pay for the Hudson Yards infrastructure. It has a mayoral-dominated six-member board: the city comptroller, the speaker of the city council, three mayoral appointees, and one independent member, appointed by the mayor. They will have to approve any financial plan.

A City Tax Commission?

Before the city goes ahead with this dubious financing mechanism, there ought to be a serious public review of its long-term economic, revenue, and equity consequences. A city tax commission would be the perfect vehicle.

A city tax commission could take the long, comprehensive view. It could examine the overall impact of all revenue policies and recommend changes that would -- among other goals -- make the property tax fairer, simpler, and more efficient; stabilize and make more progressive the personal income tax; and analyze the revenue as well as economic impact of current economic development policy.

Glenn Pasanen, who teaches political science at Lehman College, has been in charge of Gotham Gazette's finance topic page since 2001.

Â

Mayor's Management Report for 2005: Thinner, Less Useful

Michael Bloomberg released his mayor’s management report for fiscal year 2005 on September 12, one day before the Democratic primary election, a preemptive strike against his political opponents. Fair enough: The report is required by the city charter in order to give voters a useful measure of mayoral accountability.

In this latest report, the mayor says that his administration has achieved “high levels of service delivery [and] in some cases, historic progress.”

But much like last year’s report, this one gives voters little help. It includes too many insignificant indicators, lacks any overview or sense of priorities, and says little or nothing about such major (and problematic) policies as the reorganization of city schools, big changes in homeless services, the costs of school construction, and high levels of overtime among the city’s uniformed services.

And a number of recent surveys and independent management studies challenge the mayor’s rosy assessment, identifying some real problems and providing an alternative view of mayoral accountability.

SMALLER, BUT BETTER?

The printed version of the 2005 Mayor’s Management Report is much smaller than the ones put out during the administration of former Mayor Rudolph Giuliani (276 pages in 2005, compared to 1,162 pages in 2001). Many observers admire this change, including most participants at an expert panel sponsored by the mayor’s charter revision commission on April 4. But one dissenter on that panel, deputy city comptroller Greg Brooks, pointed out that smaller is not necessarily better.

Brooks noted a net reduction of 1,087 indicators (from 2,606 in 2002 to 1,519 in 2004), a 42 percent cut. He also noted that 16 percent of the 1,519 remaining indicators are related to 311, creating what he characterized as a “soft indicator of the quality of city services [that] could in fact skew results.”

The good news is that the mayor’s management report does have a number of useful statistics, if not many performance indicators. It provides glimpses of current city demographics and some social conditions. The basic problem is that the report does not connect the dots between those facts and city policy.

Some of the more glaring examples include:

- Graduation Rates

- Between 2001 and 2004, the percentage of students graduating from high school within four years increased, from 51.0 to 54.3 percent.

- But in the same period, the percentage of students graduating from high school within seven years declined, from 69.5 percent to 68.0 percent.

Issue to connect the dots: What improves/impedes graduation rates?

- Special Education

- From 2001 to 2005, NYC student enrollment has decreased by nearly 30,000, to 1,075,300.

- But in the same period, the number of special education students has increased by 5.5 percent, from 167,800 to 177,100.

Issue to connect the dots: Is a higher percentage of students in special education good or bad?

- Homeless Families

- Between 2001 and 2005, the average number of homeless families in shelters per day has increased by 55 percent, to 8,623 (including 14,849 children).

- In the same period, in spite of a focus on “prevention,” there’s been a 46 percent increase in families entering the shelter system for the first time (6,618 in 2005).

Issue to connect the dots: What’s the actual impact of prevention work?

- Crime

- Since 2001, major felony crimes have decreased by 21 percent (murders by 15 percent, rapes by 11 percent), from 172,646 to 136,491.

- But the number of uniformed officers has decreased in the past four years by 3,141, or eight percent.

- And in the same period, police overtime has increased by 20 percent, from $338 million to $406 million.

- And over four years civilian complaints against police officers increased by 46 percent, to 6,358 in 2005.

Issue to connect the dots: Are officer levels, overtime, crime statistics, and civilian complaints related?

THE VIEW OUTSIDE CITY HALL

What The Customers/Constituents Say On Education

One performance indicator that would improve the mayor’s management report in many agencies is the constituent/customer survey. In June the city council’s education committee published an education oversight report card, based on a survey of 689 parents and 30 teachers. Using a state-based grading system (1=Not Proficient, 2=Basic, 3=Proficient, 4=Advanced):

- Three of 14 categories – class size, teacher and principal morale, special education, and operations -- got the lowest score of 1.

- High school admissions got a 3, and competition and choice a 4.

- All other categories (including instruction, communication, and parent involvement) received 2’s.

The Quinnipiac University September 22 poll of 1,504 NYC registered voters reported mixed public judgments of school performance: Some 66 percent of voters are dissatisfied with the public schools (an improvement from earlier polls over the past three years that showed dissatisfaction ranging as high as 78 percent). But the mayor got a 52 /33 percent approval/disapproval rating for his public education role, and chancellor Joel Klein a 40/33 percent rating.

Overall, 12 percent of voters were “very satisfied” with the ways things are going in the city, with 51 percent “somewhat satisfied,” 22 percent “somewhat dissatisfied,” and 13 percent “very dissatisfied.”

What The Independent Monitors Say

The city comptroller’s office and the NYC Independent Budget Office, like the the city council, serve as alternative governmental sources of accountability measures, particularly in data and technology areas. For instance, the comptroller’s May 2 audit of "the paperless office system" of the Human Resources Administration showed that a system that has cost $47 million and was (according to the 1996 Mayor’s Management Report) to be completed by April 1998, has yet to be finished.

Furthermore, HRA did not provide complete documentation of the many contracts associated with this project, and gave “the false impression” that the paperless office system “was progressing smoothly.”

The Independent Budget Office’s September fiscal brief, "Follow the Money: Were School Construction Dollars Spent as Planned?” (in pdf format) identified major problems with reporting systems: “Determining how successful the education department was in implementing its $6.9 billion 2000-2004 capital plan was a difficult task, plagued by inconsistent and missing data….The lack of detail linking the spending to individual projects limits the comparison between plan and actual.” (This is just what the mayor’s management reports are supposed to do, but don’t.)

In spite of the data restrictions, the IBO doggedly pursued a projected vs. actual cost study of a small part of the total capital plan -- 14 new elementary and four new high schools. The study found that actual spending was 22.0 percent and 38.1 percent higher per square foot in the elementary and high schools, respectively, than projected in the original plan. (The study suggests those percentages may be understated.)

SPECIAL EXAMPLE: SPECIAL EDUCATION

For decades 110 Livingston Street, the city Board of Education’s central office in Brooklyn, was a notorious symbol of the modern bureaucracy – distant, unresponsive, ineffective. Mayor Bloomberg, newly in charge of public education and sensitive to the symbol, moved central headquarters to the Giuliani-renovated Tweed building, next door to City Hall (although the $100 million cost of its renovations and the building’s association with the city’s most famous crook raised some eyebrows).

But has the mayor simply created a different monster? A new management study of Bloomberg ’s reorganization of special education describes an eerily familiar structure -– “a bureaucratically-driven” agency that has continued bad old policies and created a new set of dubious policies and procedures. Written in a polite and technical academic style, the study lays out an astonishing range of management problems, from complex and confusing infrastructure and ineffective data systems to a central-office reliance on an old “medical model of treatment” that the researchers say contradicts current best practices.

“Comprehensive Management Review and Evaluation of Special Education” was written by a team of seven researchers, headed by Thomas Hehir, a lecturer at the Harvard Graduate School of Education. Contracted by the city’s department of education, its purpose was “to critically assess the recent reorganization of…special education evaluation and placement processes and special education oversight in light of the Jose P. litigation.”

The study is independent of both the department and the plaintiffs in that litigation, which has been in place since 1979, when the city was found in violation of the federal Education for All Handicapped Children Act (now the Individuals with Disabilities Education Improvement Act of 2004).

The report is also the first significant study of the core element of the mayor’s overall reform of education -– a highly centralized operation that has created 10 regions out of 32 community school districts and re-structured special education in those 10 regions.

The study says, in sum, no, the department does not yet have an effective management structure. Of 14 findings, nine are negative. Five positive findings applaud the commitment of the agency’s many teachers and specialists to their work. But six of the nine negative findings show structural and management problems:

- “The complex …infrastructure…leads to confusion with respect to roles and responsibilities and does not provide sufficient support to principals and school staff.”

- “The management of special education…is not sufficiently data-driven.”

- Policies and procedures “are not being communicated to personnel in an effective manner.”

- Pre-referral measures “are implemented inconsistently and are often duplicative.”

- “[A]n effective [due process] system is still not in place.”

- Staff development efforts “are insufficient.”

The other negative findings are more conceptual in nature. The authors question the special education medical model that the mayor and chancellor have inherited but also seem to have adopted. The report argues that the model leads to “treatments” by specialists and therefore unnecessary segregation of services. They suggest shifting to a more comprehensive, integrated, and local set of services.

The 2005 Mayor’s Management Report says nothing about these significant management and policy questions (special education in the 2003-2004 school year represented nearly 25 percent of the education budget, or $3.4 billion). The department press release accompanying the study quotes only its statement that the department is “moving NYC in the right direction.” It ignores the specific litany of structural/ management problems.

The mayor’s recent charter revision commission considered (and ultimately tabled) a mayoral initiative to reduce the number of reports. The thinness of the current mayor’s management report indicates that the problem is not too many reports. The problem is too few that are useful.

Glenn Pasanen, who teaches political science at Lehman College, has been in charge of Gotham Gazette's finance topic page since 2001.Â

The Fiscal Crisis After 30 Years

It was a dramatic time, Felix Rohatyn recalled: “Almost daily crises … heroes and villains; us against them." In short, he said, it was “the most rewarding experience of my professional life."

Few people would sound so nostalgic about the fiscal crisis of 1975, a time that saw massive layoffs, piles of garbage in the street because of cutbacks in the Sanitation Department, and a dangerous decrease in police patrols. But of all the experiences in his long life, Rohatyn takes the most satisfaction from his role in saving New York City from bankruptcy.

At the time, the federal government accused the city of handling its money like a heroin addict, focusing only on its next fix -- relying on deceptive accounting, borrowing excessively, and refusing to plan. This led banks to stop lending the city money.

|

Ballot Questions Question 1 -- Amending the state budget process. |

Now, 30 years later, says Rohatyn, the city’s good financial management is taken for granted. It has honestly balanced its budget for over 25 years, and has rebuilt trust among the banks that refused to lend it money in the 1970s. The Financial Control Board -- a state-ordered budget watchdog that Rohatyn helped form -- is given much of the credit for this turnaround.

But with the law that created the Financial Control Board set to expire in 2008, Rohatyn and others are concerned that the city may relapse.

This November, New Yorkers will vote on whether to put some of the practices that the Financial Control Board requires into the city charter. Most budget experts agree that these requirements are good ones. But some worry that without an external monitor New York City will slide back into the habits that caused it so much trouble in the past.

To see what happens when no discipline is imposed on budget makers, many point to New York State. Albany now regularly engages in the kinds of behaviors that the Financial Control Board has weaned the city from.

The state’s budget is also the subject of a referendum this November. If passed, it will change the roles of the governor and the legislature during budget negotiations. This proposal will not directly address financial mismanagement, but its advocates hope that by increasing accountability and transparency, the new budget process will force state officials away from their worst budgetary tendencies. Opponents of the measure, though, say that the amendment will only make such problems worse.

THE 1975 FISCAL CRISIS

New Yorkers continue to debate what drove the city to the brink of bankruptcy in 1975.

Some argue that New York City’s liberal officials borrowed money freely to spend on social programs, while powerful municipal unions forced them to agree to obscenely generous contracts. Others say that a variety of outside factors were a driving factor -- the city was increasingly tied into a world economy that was in shock from the 1973 Arab oil embargo; it was victimized by the banks upon which it relied to buy bonds; the federal government left the city in the lurch.

Some argue that New York City’s liberal officials borrowed money freely to spend on social programs, while powerful municipal unions forced them to agree to obscenely generous contracts. Others say that a variety of outside factors were a driving factor -- the city was increasingly tied into a world economy that was in shock from the 1973 Arab oil embargo; it was victimized by the banks upon which it relied to buy bonds; the federal government left the city in the lurch.

Rohatyn saw enough blame to go around (in pdf format):

"The banks had lent too much and checked too little; the unions took more than the city could afford; the city cooked the books, and borrowed; and the state encouraged this whole exercise," he said.

Whether or not they were the root cause of the crisis, New York City’s financial practices were out of control at that time, say experts. The city was relying excessively on debt; by Rohatyn’s account its short-term debt had risen from about zero in 1970 to $6 billion in 1975. The city relied increasingly on budgetary tricks to balance the budget –- reclassifying operating expenses as capital investments; continuously pushing expenditures onto the following year’s budget; or simply not keeping good enough records to know what was really going on.

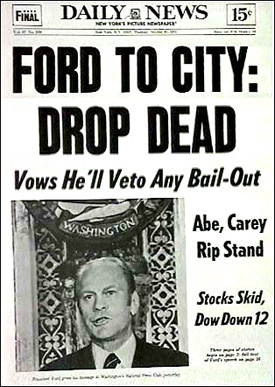

Ken Auletta writes in his book The Streets Were Paved With Gold –- one of numerous books written on the topic -– that the city acted as if it wasn’t bleeding to death when in fact it was hemorrhaging severely. But when first the banks, and then the federal government, declined to bail the city out (the latter prompting one of the most famous tabloid headlines in New York history: FORD TO CITY: DROP DEAD), it became apparent that something needed to be done.

The answer, in Auletta’s words, was “fiscal martial law.”

THE FINANCIAL CONTROL BOARD

To get the city's fiscal matters in order and convince investors to resume the purchase of the city's bonds, New York State established the New York City Emergency Financial Control Board. The board was comprised of the mayor, the governor, the city and state comptrollers, and three private industry experts. It held veto power over the city’s budget.

The board required the city to adopt accepted accounting practices, to end the most egregious budgetary sleights of hand, and to work towards the type of fiscal responsibility that would convince banks to trust New York. The city was able to avoid declaring bankruptcy, and in 1982, banks resumed buying short and long term municipal bonds.

The board’s veto power over the city budget -– the so-called control period -- ended in 1986. Since then, the board has served a monitoring role, with the ability to resume its active role if the city’s budget deficit exceeded $100 million at the end of a fiscal year.

So far, the city has successfully avoided such action.

"The city of New York today, I believe, is probably the best governed in terms of finances," said state comptroller Alan Hevesi. "Our reporting systems, our financial transparency, are probably the best in the country. And that's because of this law [that created the Financial Control Board]."

The board has had several lasting effects on the way the city's budget process works:

Making the Governor a Partner: One of the primary reasons for establishing the financial control board was to force the governor and the mayor to be partners in making sure the city is healthy financially. Because the governor sits on the board, he is directly responsible for the city’s performance. The board also provides the state with a permanent structure for keeping abreast of the city’s finances without creating the tension that can arise from state investigations of specific city practices.

Political Cover: Something that became clear during the 1975 fiscal crisis was that good financial and budgetary practices sometimes run counter to good politics. City officials have an incentive to put off difficult decisions. By forcing officials to make these decisions, the board becomes a willing scapegoat.

"Whatever those decisions are -- taxes, service cuts -- they are going to be unpopular to some sector of the city," said Jeffrey Summer, executive director of the board. "And if we take the blame for it, that's fine, so long as the city does it."

A Culture of Accountability: The board’s most widely cited accomplishment has been to give an air of credibility to the city's budget numbers. New York City's accounting, which has been suspect in the past, is now trustworthy. Because the board requires the city to have a four-year financial plan, officials must also address future consequences of their actions. Good financial management, said Rohatyn, has become “part of the city’s DNA.”

There is a general acknowledgement there is a culture of discipline among city officials that has not existed in the past. Still, some remain skeptical about the durability of this shift.

"There has been a vast change in what people think they can get away with," said E.J. McMahon of the Manhattan Institute. "But has the culture really profoundly changed? No."

THE END OF THE BOARD?

The control board is scheduled to exist until 2033. But in 2008 it will lose its $3 million in annual funding and its ability to impose a control period over the city.

Some think that the board should be allowed to expire, arguing that the city has earned its independence through its performance since the 1975 fiscal crisis. They argue that the city and state comptrollers, the Independent Budget Office, the Citizens Budget Commission are monitoring the city closely enough to make sure it doesn’t backslide -- despite the fact that all of these organizations except the Independent Budget Office existed before the fiscal crisis.

"I think that [the board] has handled itself very well, and I think that when it expires it did a good job and left a legacy, but there's no reason for it to be in business," said former mayor Ed Koch.

Not everyone agrees. Because the board has the option to impose a control period, it alone has the power to force the city to act responsibly. Taking this away, some say, is dangerous.

"This is like talking about allowing just a little sip of table wine in the house of a raging alcoholic who once almost killed himself," said McMahon.

McMahon argues for a “permanent, semi-mothballed” board that can step in if the city performs badly. Both the state and city comptrollers also say that the law that created the board should be extended in some form. (The board itself has no stance on whether it should continue to exist.)

BALLOT QUESTION 4: PROPOSED REVISION TO THE CITY CHARTER

Seemingly in preparation for the board’s expiration, Mayor Michael Bloomberg has proposed revisions to the city’s charter that voters will decide on in November (in .pdf format). These revisions would require the city to balance its budget using generally accepted accounting standards, create a four-year financial plan, and limit the use of short-term debt – all things the board currently requires.

This would give the city added independence while guaranteeing continued financial responsibility, argue proponents: “As there always has been the sense that the city should have more autonomy in self-government, this proposal would create the ability for the city to monitor itself regarding financial matters,” wrote the Women’s City Club of New York in a statement.

Frank Mauro of the Fiscal Policy Institute, however, argues that the provisions become ineffective when there is no one outside the administration specifically assigned to make sure that the city upholds its responsibilities.

Still, other fans of the board don’t necessarily object to the city charter revisions. Deputy City Comptroller Marcia van Wagner says that the revisions encourage good behavior and should be supported; they should just not be used as justification for eliminating the board itself.

“There's no harm in [the revisions],” she said. “But I think what people feel is that there needs to be some kind of discipline that is imposed externally."

NEW YORK STATE’S FISCAL MISMANAGEMENT

In contrast to New York City, New York’s state government has not been forced to answer to an outside entity. The results, say budget experts, have clearly been destructive.

“I think the behavior of the city and the state, in terms of how they run their budget process, has diverged tremendously to where the city now adheres to very high standards, and the state is not adhering to the low standards it has,” said Diana Fortuna of the Citizens Budget Commission.

Among the behaviors cited as particularly dangerous are:

Borrowing for Operating Expenses: While the city has limits on short-term debt, Albany borrows to pay its operating expenses. State comptroller Alan Hevesi refers to this as the “cardinal sin” of finance, and others have likened it to taking out a mortgage to pay for groceries.

Unbalanced Budgets: Unlike city officials, state budget makers are not required to balance the budget according to general accounting principles. Albany regularly runs large deficits.

Outstanding Debt: The state doesn’t have the debt limits imposed on the city, and total outstanding debt in the state is $48 billion. As a result, credit rating agencies give low marks to New York State’s bonds, making borrowing more expensive.

Abuse of Public Authorities: The state borrows large sums of money through the public authorities, removing this money from the budget process completely. Public authorities, funded by the state but outside of the control of voters, have increased their debt by almost seven-fold over 20 years. The 18 largest authorities now have about $120 billion in outstanding debt.

These practices are symptoms of a culture that discourages good fiscal practices in the name of political expediency, says Fortuna. They affect not only the fiscal health of the state itself, but also local governments that are forced to assume greater responsibilities as Albany increasingly shifts the burden for expensive programs onto them.

The state’s dysfunction has become the subject of much attention in the past year. Good government groups, the press, and lawmakers themselves have called for changes in the way the state’s affairs are run. These reforms have not only dealt with the budget process – everything from the non-competitive nature of elections to how committees work to the way lawmakers vote on bills has come under criticism. But with a string of late budgets 20 years long (broken this year), the budget process ranked high on the list of issues to confront.

BALLOT QUESTION 1: PROPOSED STATE BUDGET ADMENDMENT

To address problems in the state’s budget process, legislators and some good government groups are backing an amendment to the state constitution, which will be put to voters this November. While this does not directly require anything specific in terms of financial management, its proponents hope that it will encourage more responsible practices through transparency and accountability.

The main provision transfers power over the budget from the governor to the legislature. Currently, the governor creates an executive budget that lawmakers have limited powers to change. Under the proposed amendment, if no agreement is reached on the budget by the beginning of the fiscal year, then a contingency budget based on the previous year’s budget would go into effect. This would automatically become the basis for the new budget, and the legislature would have more power to amend it. Other provisions would establish an independent budget office whose members are picked by the legislature, and make expenditures that are currently not part of the regular budget part of general budget negotiations.

Supporters of this proposal (in .pdf format), which include good government groups Common Cause and the New York Public Interest Research Group as well as many legislators, say that this amendment will give the public more information about what officials are doing, making them more accountable. It will also bring the balance of power between the governor and the legislature more in line with that of other states, they say, and make sure the budget is on time. The overall effects, they say, will be modest, but will lay the foundation for future reforms.

Critics of the amendment believe the effect will be more profound (download video clip). Among the opponents of the proposal is Citizens Union, (whose sister organization, Citizens Union Foundation publishes Gotham Gazette), the Citizens Budget Commission, the Manhattan Institute, and the Business Council of New York State.

Instead of guaranteeing an early budget, they say, the amendment gives lawmakers a reason not to negotiate with the governor until after the budget deadline, at which point they will have much more power. Had lawmakers been given such power in 1975, some say, upstate legislators would have kept Governor Carey from funding the Financial Emergency Act. Today, they say, this increased power will encourage lawmakers to spend money freely.

While they question the reform’s potential to make a positive impact, critics of the amendment do not question the need for change itself. Almost no one believes the state is handling its financial affairs sensibly.

“Change is very, very badly needed,” said Fortuna.

THE FISCAL CRISIS OF THE 1970s AND THE FINANCIAL CONTROL BOARD

- The Fall and Rise of New York by Felix Rohatyn

- The Coming Emergency and What Can be Done About It by Felix Rohatyn

- A Coalition from City, State, National Levels is Needed to Help new York Overcome its Fiscal, Social Crisis by Felix Rohatyn (video clip)

- Gotham’s Fiscal Crisis: Lessons Unlearned by Fred Siegel and EJ McMahon

BALLOT PROPOSAL FOUR: PROPOSED CITY CHARTER REVISION

NEW YORK STATE’S DYSFUNCTIONAL GOVERNMENT

- Albany’s Dysfunction by Gotham Gazette

- New York State’s Fiscal Condition by State Comptroller Alan Hevesi (in .pdf format)

- The New York State Legislative Process: An Evaluation and Blueprint for Reform by the Brennan Center

BALLOT PROPOSAL ONE: PROPOSED AMENDMENT TO STATE CONSTITUTION

- Text of Ballot Proposal One

- Overview by the Rockefeller Institute

- Vote YES on Budget Reform: The November 2005 Budget Reform Announcement by Common Cause/League of Women Voters/New York Public Interest Research Group(in .pdf format)

- The Runaway Spending Amendment by the Business Council of New York State

- Breaking the Budget in New York State: What’s at Stake in November’s Referendum by Manhattan Institute (video clip)

Mayoral Issue Grid: Finance

FINANCE

New York City’s annual budget will pose a problem for the next mayor. Experts project that the city will face a $4.5 billion deficit in each of the next two years. If the mayor cannot reduce spending, he or she will be forced to raise taxes or generate revenue from fees, fines, or tickets. The property tax is the only tax the mayor and City Council can raise without the approval of the State Legislature.

To reduce the city’s projected budget deficit, Fernando Ferrer says that he will eliminate loopholes in the tax code that he says costs the city $2 billion a year. He also promises to fight for more funding from Albany, particularly Medicaid payments. Ferrer also believes that the commuter tax should be reinstated, which would require the approval of the State Legislature.

While Ferrer says he will not raise taxes to balance the budget, he has proposed a stock transfer tax to help raise $1 billion for education.

Ferrer outlined a property tax rebate plan that would "offer a $100,000 property tax exemption to the approximately 600,000 New York homeowners of coops, condominiums and 1, 2, and 3-family homes valued under $800,000. Every qualified homeowner whose home is valued at $100,000 or more would automatically enjoy $973 in savings. Meanwhile, homeowners with homes valued above $800,000 would continue to receive the $400 rebate."

Renters would also receive relief. Under the HOPE plan, Ferrer would provide "an average annual benefit of $295 to renters living in rent-regulated units who have a household income below $60,000 and at least one child under the age of 18."

Michael Bloomberg says that the city’s budget can be divided into two parts: the spending that the city controls and the spending mandated by the state.

Bloomberg argues he has taken steps to reduce the budget where he can, cutting $4 billion from the budget and reducing the city’s workforce by 15,000 employees.

The city’s projected deficits, he says, are a result of things out of the city’s control, like Medicaid and pensions. He supports Medicaid reform and worked to reduce pension costs.

Although he raised taxes in the past, Bloomberg opposes increases in the income taxes or a tax on Wall Street stock transfers.

RELATED ARTICLES:

- 10 Budget Choices Facing The Next Mayor

- The Mayoral Candidates on Budgets, Taxes and Spending (Forum)

- $50 Billion Budget -- A Shortsighted Use Of Surpluses

- Budget Transparency After The West Side StadiumÂ

Mayoral Issue Grid: Jobs

JOBS

-Top Priority

Although the city’s economy has recovered since the months after the terrorist attacks of September 11, 2001, an estimated 230,000 New Yorkers are unemployed. African-American and Latino males have a particularly difficult time finding a job; 40 percent are unemployed.

The Democratic candidates are focusing most of the attention on small businesses. Small businesses account for 50 percent of all New York City private-sector jobs and generate $4.5 billion in annual city tax revenues.

To help small businesses, Fernando Ferrer proposes a three-month amnesty program to give small businesses the opportunity to pay outstanding fines. He plans to provide real estate assistance, micro-loans, and new programs for women and minority-owned businesses.

He also plans to form a small business advisory council that reports to the mayor, deputy mayor for economic development, and commissioner of the small business department. The panel would make recommendations and proposes policy.

(Read Ferrer’s small business plan)

Michael Bloomberg says he has created 62,000 jobs since July 2003.

He has given tax credits to large corporations like Time Warner, Hearst, the New York Times, and Goldman Sachs to encourage them to build new headquarters in Manhattan.

Bloomberg believes tourism – which is at record levels – is a main engine for job growth.

He has undertaken development projects in Brooklyn, Queens, and Harlem to spur new construction and job growth.

To help small businesses, he opened satellite small business services in each of the five boroughs that offer assistance to owners.

(Read Bloomberg’s job platform)

RELATED ARTICLES:

- Debating Jobs and Economic Development

- In Big Projects, Where Do The Jobs Go?

- Tourism and Jobs

Â

Mayoral Issue Grid: Finance

FINANCE

New York City’s annual budget will pose a problem for the next mayor. Experts project that the city will face a $4.5 billion deficit in each of the next two years. If the mayor cannot reduce spending, he or she will be forced to raise taxes or generate revenue from fees, fines, or tickets. The property tax is the only tax the mayor and City Council can raise without the approval of the State Legislature.

To reduce the city’s projected budget deficit, Fernando Ferrer says that he will eliminate loopholes in the tax code that he says costs the city $2 billion a year. He also promises to fight for more funding from Albany, particularly Medicaid payments. Ferrer also believes that the commuter tax should be reinstated, which would require the approval of the State Legislature.

While Ferrer says he will not raise taxes to balance the budget, he has proposed a stock transfer tax to help raise $1 billion for education.

Ferrer has not outlined any proposed tax cuts.

To reduce the city’s projected deficit, C. Virginia Fields says she will reform the city’s tax code and work toward 100 percent collection of taxes. Fields also believes that the commuter tax should be reinstated, which would require the approval of the State Legislature.

Fields says that “increasing taxes harms our economy” and does not plan to raise taxes to balance the budget.

She opposes an income tax increase and a tax on Wall Street stock transfers.

Fields has not outlined any proposed tax cuts.

To reduce the city’s projected deficit, Gifford Miller says that the mayor must do more to fight for New York City’s “fair share from Washington and Albany.” City taxpayers currently pay $24 billion a year more in taxes than they receive in services from the state and federal government. Miller also proposes a commuter tax of 1.1 percent, which would require the approval of the State Legislature.

While Miller does not want to raise taxes to balance the budget, he has proposed an income tax surcharge on New Yorkers who make more than $500,000 a year to help reduce class size.

He opposes the idea of a tax on Wall Street stock transfers.

Miller has proposed doubling the Earned Income Tax Credit for low income New Yorkers. He also wants to give a renters tax credit to all households that make under $100,000 a year.

To reduce the city’s proposed budget deficit, Anthony Weiner promises to cut $1 to $2 billion a year from the worst-performing city agencies. Weiner also wants to sell government property through an open bidding process, which he says will generate more revenue. He also says he will fight for more aid from Albany and Washington.

Weiner proposes increasing income taxes for those who make more than $1 million a year.

He opposes taxing Wall Street stock transfers.

Weiner has proposed a 10 percent income cut for those making $150,000 or less. (Read Weiner’s tax plans)

Michael Bloomberg says that the city’s budget can be divided into two parts: the spending that the city controls and the spending mandated by the state.

Bloomberg argues he has taken steps to reduce the budget where he can, cutting $4 billion from the budget and reducing the city’s workforce by 15,000 employees.

The city’s projected deficits, he says, are a result of things out of the city’s control, like Medicaid and pensions. He supports Medicaid reform and worked to reduce pension costs.

Although he raised taxes in the past, Bloomberg opposes increases in the income taxes or a tax on Wall Street stock transfers.

RELATED ARTICLES:

- 10 Budget Choices Facing The Next Mayor

- The Mayoral Candidates on Budgets, Taxes and Spending (Forum)

- $50 Billion Budget -- A Shortsighted Use Of Surpluses

- Budget Transparency After The West Side StadiumÂ

Mayoral Issue Grid: Jobs

JOBS

-Top Priority

Although the city’s economy has recovered since the months after the terrorist attacks of September 11, 2001, an estimated 230,000 New Yorkers are unemployed. African-American and Latino males have a particularly difficult time finding a job; 40 percent are unemployed.

The Democratic candidates are focusing most of the attention on small businesses. Small businesses account for 50 percent of all New York City private-sector jobs and generate $4.5 billion in annual city tax revenues.

To help small businesses, Fernando Ferrer proposes a three-month amnesty program to give small businesses the opportunity to pay outstanding fines. He plans to provide real estate assistance, micro-loans, and new programs for women and minority-owned businesses.

He also plans to form a small business advisory council that reports to the mayor, deputy mayor for economic development, and commissioner of the small business department. The panel would make recommendations and proposes policy.

(Read Ferrer’s small business plan)

C. Virginia Fields promises to use the city’s $18.8 billion in annual spending to help small businesses grow. She proposes giving a specific percentage of city contracts to small businesses. She also wants to provide loans and provide training in entrepreneurship.

Fields also wants to grow the biotechnology industry, offering tax incentives for new companies to do research in the city.

Gifford Miller points to his efforts as Speaker of the City Council in creating job training programs, workforce protections, and the “Living Wage” bill, which requires certain city contractors to pay their employees $8.10 an hour, rising to $10.00 per hour by July 2006.

Miller promises to cut taxes for small businesses and expand tax credits for industries in the outer boroughs. He says that the foundations of economic growth are “great neighborhood schools, reliable transportation, and flourishing small businesses.”

Anthony Weiner wants to reduce tickets and fines for small businesses. He also wants to create an ombudsman position at the Department of Business Services to help small business owners.

He would create a $10 million micro-loans program, which gives low interest loans of $100,000 to $200,000 to emerging businesses.

Weiner also promises to increase subsidies for businesses outside of Manhattan. He would require that at least 25 percent of all Economic Development Commission funds be distributed to the boroughs on an equitable basis, by jobs per borough, or population.

He also wants to create a “ShopNYC.com” Web site to help small businesses sell their goods on the Internet.

(Read Weiner’s economic development plan)

Michael Bloomberg says he has created 62,000 jobs since July 2003.

He has given tax credits to large corporations like Time Warner, Hearst, the New York Times, and Goldman Sachs to encourage them to build new headquarters in Manhattan.

Bloomberg believes tourism – which is at record levels – is a main engine for job growth.

He has undertaken development projects in Brooklyn, Queens, and Harlem to spur new construction and job growth.

To help small businesses, he opened satellite small business services in each of the five boroughs that offer assistance to owners.

(Read Bloomberg’s job platform)

RELATED ARTICLES:

- Debating Jobs and Economic Development

- In Big Projects, Where Do The Jobs Go?

- Tourism and Jobs

Â

NY's Ports Booming, But High Costs Of Security Are Eroding Gains

<NYT_BYLINE version="1.0" type=" ">

<NYT_TEXT >

Although the ports of New York and New Jersey have improved their productivity to handle a rising flow of imports, their increased security costs since 9/11 have eroded some of the gains, according to a study released yesterday.

The ports have been booming as they attract a larger share of the goods bound for the Northeast from China and other foreign countries.

But despite huge investments in machinery and computers to improve their efficiency, terminal operators have been hiring at an equally fast pace, according to the report, the first independent study of local port activity since 2001.

The study was commissioned by the New York Shipping Association, whose offices were in the World Trade Center and are now in Iselin, N.J.

The number of jobs at cargo terminals in the ports has increased by more than 29 percent, rising to 20,947 in 2004 from 16,232 in 2000, the report shows.

The volume of cargo flowing through the port increased 27 percent, to 99.9 million tons from 78.6 million tons in 2000.

The growth in productivity in recent years was offset partly by the hiring of additional security guards to screen cargo and workers, the report said.

Frank M. McDonough, president of the association, whose members are shipping companies, terminal operators and stevedores, said they had added about 300 security workers.

The study found that cargo movements through the ports directly supported the equivalent of 122,550 jobs in the region and were indirectly responsible for almost as many jobs in other industries, including wholesale trades, banking and insurance.

The study estimated that the direct and indirect jobs resulted in $12.6 billion in income annually and contributed $5.8 billion in taxes.

It was conducted by researchers at Rutgers University and A. Strauss-Wieder, a consulting firm in Westfield, N.J.

The biggest increases in employment have been in the warehouses and distribution facilities in northern New Jersey, Mr. McDonough said.

Those facilities, way stations for the goods unloaded off ships before they land on store shelves, have added 23,000 jobs since 2000, he said.

Mr. McDonough said the number of stevedores has declined slightly to 2,495, with average salaries of $87,000 a year. About 15 percent are women.

Security has become a big expense since 9/11 as operators like Maher Terminals have had to install radiation portals to check every outgoing cargo container for explosives.

Maher, a family-owned company, is installing a system of gates at its terminal in Elizabeth, N.J., to speed checks on each container and driver entering or leaving the waterfront, said Sam Crane, Maher's vice president for external affairs.

But it will still take at least 35 minutes and, during busy periods, more than an hour, for a truck to drop off an outgoing container and pick up an incoming one, he said.

div>Â

The Mayor's Money

“So most people look at this as a David and Goliath sort of thing,” Fernando Ferrer was saying last month, describing the mayoral race to a group of reporters. “But I do remember my Bible studies, when all the smart money was on Goliath, the guy with the shiniest armor, the biggest guy. All the Philistines were on the sidelines placing bets on their guy. And here was David. And the rest is history.”

To an outsider, it might seem strange for Ferrer to liken Mayor Michael Bloomberg to a nine foot tall Biblical giant – for one thing, the mayor is 5’7’’ (at best), three inches shorter than Ferrer. It is also hard to call Bloomberg a Philistine when he has donated so many millions of dollars of his personal wealth to the arts. But one can understand why Ferrer might feel as though he’s armed only with a slingshot. Ferrer had spent $1.4 million on his campaign at the time of the last campaign finance disclosure in mid-July. Bloomberg had spent $23 million.

If the mayor's campaign looks big and shiny to his opponents, it is for one main reason: his money. Bloomberg has spent about six times the total amount spent by the four major Democratic candidates combined. Indeed, the money he has contributed to his campaign so far is reportedly 40 percent of all the money contributed by anybody and everybody to almost all 200 or so local political campaigns this year.

His television ads alone – which started running in May -- have cost him $8.8 million; no other candidate had even run a TV commercial until Ferrer aired one last week. And if several of his opponents have stumbled lately over their campaign literature, the mayor’s glossy eight-page booklet is even more impressive than it looks: Whole pages of it are different depending on which specific neighborhoods it is being mailed to. Italian neighborhoods get testimony from Rudolph Giuliani; Latino ones get Herman Badillo.

Overall, Bloomberg is expected to spend $100 million -- two and a half times what John Kerry’s campaign spent securing the Democratic nomination for president.

Bloomberg’s billions have become a major campaign issue, as they were in 2001, possibly the only issue that puts the mayor firmly on one side and his challengers united on the other:

- Anthony Weiner’s Web site keeps a running tally of the mayor’s campaign spending, a la the national debt clock. The site also has a video clip entitled “Ideas Not Money,” where Weiner stands in front of a Bloomberg ad and outlines part of his platform;

- Gifford Miller alternately describes the mayor’s campaign spending as “obscene” and “flabbergasting”;

- Conservative Party (and erstwhile Republican Party) mayoral candidate Thomas Ognibene was asked about the major difference between himself and the mayor at last month's mayoral forum on poverty issues (Bloomberg was invited to the forum but did not attend). "He's got $6 billion and I don't," Ognibene replied. "...I think he thinks that the Republican Party and the people of this city are for sale." [Read a transcript of the poverty forum].

- “Bloomberg spent $74 million running for mayor in 2001. That's an enormous amount,” Ferrer said recently. “When the reporters asked him why, he said 'well, I have to get New Yorkers to get to know me.' Now he's going to spend tens of millions of dollars more even than that in an effort to get New Yorkers to forget what kind of mayor he's been in the last three and a half years.”

The incumbent is attacked for his wealth itself, such as in an email sent out by the state’s Democratic Party after it found out how much Bloomberg spent to set up his campaign office: ''Only an out-of-touch billionaire could afford to spend more than $1 million on office remodeling,” the email read. “No amount of campaign propaganda will convince New Yorkers that billionaire Mike Bloomberg understands their cares and concerns."

It's his campaign spending, though, that is generating much of the criticism. In effect, his opponents accuse Bloomberg of trying to buy his office.

But even some of his supporters (and those who keep officially neutral) worry about the long-term effect that his campaign spending might have on a program that, though just 17 years old, is considered in some quarters to be a hallowed institution -- the campaign finance program.

Last week, the city’s Campaign Finance Board sent out $13.4 million to 53 candidates in various city races -- money that many of them would surely say is the only reason they are able to run for office.

Bloomberg has not only opted out of this program; he also has questioned its value.

Gene Russianoff of the New York Public Interest Research Group is (like the city's other good-government gurus) not pleased with Bloomberg’s snub of the program. “At its worst, it certainly chips away at the campaign finance system,” he said.

"I'm not chipping away,” Bloomberg shot back when told of Russianoff’s remark. His wealth, Bloomberg said, gives him a level of independence that his predecessors have not had; he is beholden to nobody. And besides, he added, “I have a right to spend my own money.”

CAMPAIGN FINANCE IN NEW YORK

Campaign finance reform became a major issue in New York City quite suddenly one day in January 1986 when Donald Manes, then borough president of Queens, was found bleeding in his car near Shea Stadium. Manes, who had recently being caught taking bribes from companies seeking city contracts, had slit his wrists with a kitchen knife. He later died of his wounds. For the next several years, the seamier side of New York politics was exposed again and again, with more than 25 public officials indicted on corruption-related charges.

In response to such systemic corruption, Mayor Ed Koch decided to pursue a campaign finance program. While the scandals were not directly related to campaigning, the mayor hoped that tough campaign restrictions would cut down on two problems they had exposed – one, that private interests were using money to influence officials; and two, that the political system was inaccessible to outsiders, who to that point had found it difficult to run for office against well-financed political clubhouses.

“I think there is a perception ... that there's too much of a closed system in which access to government is dependent on access either to private money or the political party apparatus,” said Koch’s Corporation Counsel Peter Zimroth at the time. “I think it is incumbent upon us to look for ways to open up that system to increase the competition, to increase the number of people willing to run for office, to increase the ability of less-rich people in this city to participate in campaigns.”

The Campaign Finance Board was established in 1988. Its program works by offering to supplement the money that candidates raise with public funding if those candidates agree to limit the both what they raise and spend, and to put it all on the record. They are also required to take part in debates. The program, which is often cited as a national model for local campaign finance reform, is lauded for its rigor and its ability to adapt.

In New York, participation has become somewhat of a political imperative, said Democratic political consultant Hank Sheinkopf. The editorial boards of newspapers and good government groups “hold the campaign finance regulations sacrosanct,” he said, “and to cross them by opting out would result in not getting valuable endorsements.”

Evidence of the program’s effectiveness, say its boosters, is the way that it has held officials accountable. Mayors David Dinkins and Rudolph Giuliani were both fined by the program for inappropriate campaign spending. They each struck back – Dinkins by firing then chairman Joseph O’Hare (he was reinstated); and Giuliani by attempting to cut the program’s budget and move it to Brooklyn (he failed).

But if some candidates have bristled at the board’s aggressiveness, increasing numbers have found that the program’s benefits outweigh its burdens. The number of participants rose from 57 in its first year to a high of 353 in 2001 when the program – along with term limits that left an unprecedented number of city offices to open competition – led to a full-scale changing of the guard in city government. This year, 188 candidates are participating; 50 are on the ballot without taking part in the program.

But in 2001 and again this year, there has been much attention dedicated to a certain elephant in the room -- the billionaire who won't participate.

BLOOMBERG: A NEW CHALLENGE

When Michael Bloomberg ran for mayor in 2001, he became the first major candidate to do so without participating in the campaign finance program since its inception. Instead of accepting public funds, Bloomberg spent $74 million out of his own pocket. He edged out Democrat Mark Green, who spent $16 million, about $4.5 million of which came from the campaign finance program.

Because he opted out of the program, Bloomberg could have also chosen not to take part in the Campaign Finance Board’s debates, required of those who take public funds. But Bloomberg did debate Mark Green in 2001, and he says he will debate his Democratic opponent this fall.

Green's campaign complained that it was outgunned in the weeks running up to the 2001 election, and Bloomberg's self-financed campaign caused concern among advocates of campaign finance reform who saw his private wealth as a new challenge to the program’s relevance. “But,” said Rachel Leon of Common Cause, “I believe it is a challenge that the program survived virtually unscathed.”

In assessing whether the program works, said Nicole Gordon, executive director of the Campaign Finance Board, “the question is whether all serious candidates have the opportunity to get their message out.” Paul Ryan of Campaign Legal Center, and author of Statute of Liberty: How New York City’s Campaign Finance Law is Changing the Face of Local Elections, said that in 2001 the program did this: “There were few voters who didn’t know who Mark Green was.”

Still, concerns remained, and, late last year, the City Council made an attempt to address the problem of Bloomberg’s money. They tread carefully. The United States Supreme Court has ruled that mandatory limits on how much a candidate can spend violate the first amendment of the Constitution. The campaign finance program can put such limits only on candidates who receive public money. If someone with access to their own resources rejects public financing, there is little the city can do.

|

|

Over the mayor’s veto, the City Council decided to give participants in the program a higher matching fund if they face high-spending candidates. Bloomberg ’s Democratic opponent in the general election will get $6 in public funding for every $1 he or she raises. The council's law also lifted the expenditure limits for candidates facing a non-participating opponent who spends over a certain threshold, which Bloomberg has already surpassed.

For the first time, all candidates have to disclose their contributions and expenditures, whether they get public financing or not. Information about Bloomberg’s contributors contain no great revelations – a search on the Campaign Finance Board Web site shows ten contributions, all from a city employee named “Bloomberg, Michael R”. But as opposed to 2001, when Bloomberg did not have to disclose what he was spending, the fact that his campaign has spent $412,100 on polling expenses and $53,600 on buttons and stickers this year is now a matter of public knowledge.

There was also a special category created for Bloomberg, who said he didn’t want to take the public’s money: the “limited non-participant.” The council hoped to entice the mayor into accepting spending caps by setting up a program that would give his opponents less money if he did so.

But Bloomberg decided against participating at all, which makes him the first sitting mayor to opt out of the program.

REAL CAMPAIGN REFORM?

When critics attack Bloomberg for his wealth, his spokesman William Cunningham replies with calculated digs at his political opponents: “They are jealous. He made that money, he doesn't take it from any special interests, he doesn't take it from landlords, he doesn't take it from people who have contracts with the city.”

When he is attacked for his campaign spending, Bloomberg questions whether the system is achieving its purposes.

“New York likes to consider itself a national leader in campaign finance reform,” he said in a speech at the Fund for Modern Courts. “But I think it's fair to say that on the most basic criteria, restricting the influence of special interests, we have fallen behind many other jurisdictions.”

Far from opening up elections to outsiders, Bloomberg says, the current electoral process in New York “is an inside baseball game. This is the party bosses, they pick the people in every place.” Real reform, he says, will come with the institution of non-partisan elections – which he pushed for in 2003, unsuccessfully. “Short of that, I don't care how much matching funds [you give someone].

Late last year, Bloomberg took up the cause of restricting funding from city contractors. Regulating so-called pay-to-play has been on the campaign finance board’s list of things to do since 1998, when city voters called for such regulation in a referendum. To date, however, the board has not managed to form a real response.

The mayor recently proposed a plan that would make candidates responsible for disclosing contributions they get from those doing business with the city, and would cap such contributions at $250. The city has moved forward on creating a computer system that would track city contracts of over $100,000. This would not affect the self-financed mayor, but it would be a burden on his opponents.

Civic groups have been receptive to the general idea of the mayor’s proposal, if not the specifics, and the campaign finance board has lauded his administration’s work on establishing a computer database as a good first step.

Investigative journalist Wayne Barrett called the proposal the best opportunity for reform in the program’s history – even if the mayor is pushing it for self-serving reasons.

“To Bloomberg, this proposition offers the added advantage of distracting attention from his own wholesale disregard of decent campaign finance,” he wrote in the Village Voice. “As impure as his plausible motive might be, and as flawed as the versions of his initial plan are, Bloomberg is again reaching outside the box for a transformation of city politics that will, if tried, be appreciated long after he is back to being a billionaire."

Despite a hearing earlier this year, however, the proposal has gained no momentum in the City Council. The campaign finance board doesn’t believe the database of city contractors is ready yet, and has not even formed a solid definition of “doing business with the city.” The mayor’s proposal has been shelved until after the election.

THE FUTURE?

Some say that Bloomberg’s fortune has not undermined the campaign finance system where it really counts. “The fact that the campaign finance program may not be working in an ideal fashion in the mayoral race doesn’t indict the effectiveness of the whole system,” said Paul Ryan. “It’s working for the people who need it most” – the races at the level of City Council.

Others are not as sure: “The question New Yorkers have to ask themselves is do we only want candidates who are independently wealthy, or do we want a system that actually encourages grassroots campaigns?” said Leon of Common Cause.

There are plenty of signs that finding a way to help candidates of modest means compete with self-financed opponents may become a big issue in the future. The United States Senate has long been referred to as a “millionaires club”, where personal wealth is almost a prerequisite for membership. Across the Hudson, two multimillionaires are currently competing for the governor’s seat in New Jersey. And as the Republican Party begins looking for a successor to Governor Pataki, the personal wealth of the potential candidates is being taken into account.

The party is considering grooming billionaire Tom Golisano for a gubernatorial run “if for no other reason than the man is rich," state GOP chair Steven Minarik told reporters late last year. “I would be willing to consider anyone who could bring $100 million to the table."

Related Article

Pushing Papers and Principles (May, 2001 article on the Campaign Finance Board) Â

$50 Billion Budget -- A Shortsighted Use Of Surpluses

The New York City Council and Mayor Michael Bloomberg agreed on a $50.2 billion budget for the 2006 budget a few hours before the fiscal year began on July 1, and, though it is an election year and Speaker Gifford Miller is running against Bloomberg for mayor, they were cordial to each other around the new budget -- some would say too cordial.

In the several weeks before the budget agreement, the good news had turned even better. The surplus for the 2005 fiscal year grew by yet another $300 million, for a total of $3.6 billion.

Such a large surplus offered an opportunity to the mayor and the council to tackle the city's long-term budget problems in a variety of ways:

They could have paid off a good hunk of the city’s capital debt, for example, which would have reduced the debt-service costs (the interest due each year on the money the city has borrowed); similarly, they could have paid in cash for capital projects, such as new affordable housing projects, which would have avoided long-term borrowing costs. Or they could have used some of the surplus to make major improvements, such as buying adequate textbooks for the city's public schools.

Instead, they were each content to take credit for a few minor new programs and some tax cuts. The adopted budget simply postpones any solution to the fiscal problems that the city is going to face very soon: The budget for fiscal year 2007 (which begins next July) is expected to show a deficit of $4.5 billion.

As this year's short-sighted budget was being settled, however, the mayor’s charter revision commission was thinking over the long term, with several proposals for the November ballot.

The Council’s Budget Contribution

Mayor Bloomberg has successfully followed the political and fiscal strategy of former Mayor Rudy Giuliani: putting the council on the defensive by refusing to make many of the council’s favorite programs part of the city’s four-year financial plan. Instead of being “base-lined” in the four-year plan, they become one-year programs, so that each year the council has to start from scratch to restore them. Thus much of the council’s time, energy,and political vision is trapped in this annual political ritual.

The council reportedly wound up adding about $230 million to the mayor’s May budget proposal, which is less than one-half of one percent of the total budget -- most of it to restore funding the mayor had cut from existing council-supported programs. A 65-page council “Adjustments Summary” lists the restorations, initiatives, and enhancements. In an election year when most council members are running for re-election it is no surprise that the new money begins with the council members themselves.

There was, for instance, a $13 million increase in council discretionary spending for youth and senior services in their districts. Each council member got nearly $109,000 for senior services, some 83 percent more than in 2005, and each got nearly $152,000 for youth services, up 48 percent over last year. Among the larger changes:

- An infant mortality reduction program saw a $2.8 million restoration and a $2 million enhancement (the infant mortality rate went up for the first time since 2000).

- An HIV/AIDS prevention and education program got a$2.4 million restoration and a $1 million enhancement.

- A summer youth program received a $6.9 million enhancement.

- An immigration initiative that provides English-language training and legal services got a $1 million restoration and $6.3 million in new money.

- A workforce development program run through the City University saw a $10 million restoration and an $8 million enhancement.

- The council’s tribute to its former speaker, the Peter Vallone scholarships at CUNY – eliminated by the mayor – received $4.4 million in new and $7 million in restored dollars.

The pattern here is clear. Council members identify specific problems in specific neighborhoods and support relatively low-cost programs to help solve them. That makes sense. But citywide, expensive council proposals – such as hiring 1,000 police officers and lowering business taxes – fell by the wayside, perhaps in part by concern about costs of future wage settlements with city workers.

City Revenue Base

As the council and mayor negotiated over hundreds of small programs, the city’s revenue future was ignored. The Independent Budget Office’s May analysis of the executive budget points out that over the next four years total city expenditures are expected to rise by two percent each year -- which seems modest, except that, by contrast, City Hall's total revenues will rise by only half of one percent per year. Thus we have ahead of us multi-billion dollar deficits.

The mayor’s most brilliant tactic in four years of budget-making remains the 18.5 percent property tax increase he pushed through the council in November 2002. (It does not even seem to have harmed him politically.) That rate increase, coupled with a hot real estate economy that has raised property assessments, has produced a surge in revenues. The Independent Budget Office predicts $12.4 billion in property tax revenue for fiscal year 2006, billions more than previously expected.

The budget office expects such revenue to continue to increase through 2009. However, revenue from other taxes -- with the exception of the small-revenue hotel tax -- will increase very little, or actually lose ground. The personal income tax -- the most progressive tax in the city’s control (higher income households pay a higher tax rate) -– averages only a 1.3 percent increase annually over the next four years, in large part because the two higher rates for wealthier households expire at the end of this calendar year.

The combined effect of the surging property tax revenues and flatness in the other taxes, particularly the personal income tax, means a shift in burden from higher-income taxpayers to the rest of the city’s taxpayers.

In spite of the bleak forecast for future revenue, the mayor and council have adopted a budget that in its homeowner tax cuts, sales tax exemptions for clothing under $110, and expiring income tax rates will cost the city well over a billion dollars a year from now on. This reality dwarfs the modest good news in the adopted budget.

Long-Term Thinking From Charter Revision Commission

If the adopted budget does not reflect much long-term rational planning, the mayor’s charter revision commission shows the mayor thinking way ahead. In a July 5 meeting, the commission voted unanimously to place on the November ballot a proposition that would add to the city charter certain budget reporting provisions required now by the state Financial Emergency Act (prompted by the city’s near-bankruptcy in the mid-1970s), requirements that expire in 2008.

The city’s record of more than 20 years of balanced budgets under state oversight is admirable, but some fiscal monitors worry that the absence of any formal state oversight will make city budgeting less open and therefore less accountable. Of particular concern is access to all essential budget information, access that is currently required through the state Financial Control Board.