Bridging the Achievement Gap Through Real Renewal

(Photo: Michael Appleton/Mayoral Photography Office)

When the New York State Board of Regents met last month, the mood was despondent. “The needle hasn’t moved for minority children in decades,” said Regent Kathy Cashin, decrying the racial achievement gap on the newly-released 2018 state exam scores for students in grades 3-8. The reaction of the Regents ran the usual gamut of hand-wringing, blaming the tests, and calling for more dilatory “analysis.”

And then came the damning report in The New York Times on the failure of New York City’s Renewal schools program. After investing $755 million—nearly the entire annual budget of the San Francisco Unified School District—in the academic improvement of the 94 lowest performing schools, the needle has barely moved there either.

Why the hand-wringing, and why the wasteful investment in programs doomed to fail, when the achievement gap can be closed—for this generation, and with current resources?

Charter schools are dramatically outperforming traditional district schools in the city. In school year 2017-18, New York City public charter schools, enrolling 91% percent children of color, vastly outperformed the rest of the state in both English Language Arts (ELA) and math proficiency, 57 percent to 45 percent and 60 percent to 45 percent, respectively.

Our practices vary, and we don’t always agree on policies. But collectively we are offering a brighter future to 100,000 city students.

Students who attend Ascend Public Charter Schools—a network of 12 schools in central Brooklyn’s most challenged communities—are proving what’s possible.

Brownsville, where we operate five schools, is a community of tremendous potential, but blighted by failed schools. The incarceration rate is the second-highest in the city and a mere 26% of students were found proficient in English. Yet our 5,000 students, 96 percent of whom are black or Latino and 83 percent of whom are from low-income families, not only closed but reversed the achievement gap. Ascend’s African-American students outperformed white students statewide by 7 percentage points in ELA and 2 points in math.

Eschewing the harsh disciplinary practices of “no excuses” schools, Ascend schools offer a rich liberal arts education in a supportive and joyful environment. As our results have climbed, suspension rates have plummeted, down 40% in our lower schools in four years and 28% percent in middle schools.

We commit to making every child feel welcome and cherished. We don’t select students on the way in, nor on the way out. Some, including those affected by homelessness and other traumas, are afforded individual attention for years, and then blossom.

Our schools accomplish all this while holding true to our deepest commitment: to operate truly public schools that enroll all students and operate at district funding levels. All students are enrolled strictly by lottery, we charge no tuition or fees, and most important, we fill every vacant seat through grade 9.

We are but one example of successful charter education. Other networks are posting results as exciting. We are not stuck in the transformational “ice age” that Regent Luis Reyes bemoaned at the recent Regents meeting. Our students—New Yorkers’ students—are not consigned to lives where promise is crushed.

Our education officials are staring a solution in the face.

Yet charter growth may soon stall because of an artificial statutory cap on the number of new charters; only a handful now remain to be awarded statewide. Why not lift the cap? Why not have charters run even half of the Renewal schools to test our methods? Why limit our children’s potential?

***

Steven Wilson is founder and chief executive officer of Ascend Charter Schools.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Protect New Yorkers from Washington’s Cruel Actions, Oppose ‘Public Charge’ Change

(photo via the New York City Council)

When we look from our community in Brooklyn to the New York Harbor, we see the Statue of Liberty, a tangible symbol of America’s great tradition of welcoming immigrants seeking to make a better life. Every day in Sunset Park, Red Hook, Bay Ridge, and elsewhere in Brooklyn we see the contributions new Americans are making to the economic and cultural vitality of our neighborhoods, just as generations of immigrants before them contributed.

But America’s great tradition of diversity and inclusion is under attack by the Trump Administration. From separating parents and children at the border, to travel bans and demonizing immigrants as “others,” this administration is on a campaign to sow division and disunity. The latest salvo in this war against new Americans is a radical proposal to expand the definition of “public charge” and undermine pathways to U.S. citizenship for new Americans.

If the government determines that a person is likely to depend on the government as their main source of support (in other words, to be a “public charge”), it can deny that person admission to the United States or lawful permanent residence. Under the Trump Administration’s new “public charge” proposal, immigrants’ participation in some of the most fundamental programs essential for families’ and children’s health and well-being would count against their chances to enter or remain in the United States. These basic public benefit programs include, among others, the Supplemental Nutrition Assistance Program (SNAP), Medicaid, Medicare Part D, and housing assistance.

The Trump Administration’s “public charge” policy plan represents an unwarranted cost shift from the federal government to state and local governments, to non-profit charities, and to needy families themselves. Denying federal assistance to people when they are in need in no way eliminates hunger, homelessness or deprivation. Our communities will face new burdens in addressing gaps in services.

It is clear that the Trump Administration’s overly broad definition of “public charge” would have far-reaching effects. One in four American children have at least one immigrant parent. In addition to the categories of individuals directly affected by the policy, fear and confusion would cause most immigrants to forgo benefits for all means-tested federal, state, and local programs. The dis-enrollment from public benefits would cause disruption in the lives of millions of needy people, harm individuals’ well-being, and undermine local economies here in New York and across the United States.

We all need to raise our voices against this proposal. And we have an opportunity to do just that. The Trump Administration cannot implement this radical change until after it has considered comments submitted by members of the public. In our democracy, this is an important check on unfettered rulemaking by the executive branch. Help make that check a real one by submitting your comments through regulations.gov by December 10.

Get your neighbors, families and friends to comment as well. Our nation is at its best when people join arms and stand together for the values that have built America.

Join the thousands of people in the Protecting Immigrant Families coalition in speaking out to stop this mean-spirited and harmful potential rules change.

***

Assistant Assembly Speaker Felix W. Ortiz represents parts of Brooklyn. On Twitter @Felixwortiz.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Queens needs a democratic Democratic Party

Queens Democratic Chair Joe Crowley (photo: @repjoecrowley)

I canvassed in my neighborhood for the first time this past summer by approaching people on the street asking if they were registered Democrats. One elderly gentleman took a minute to understand what I was saying, but when he heard the word “Democrat” he smiled and said, “I became a citizen of this country. I am proud to be a Democrat,” and excitedly signed my petition. Voters like this man are truly what make our country and party great.

Our party must reflect the community we live in, and the values we share, otherwise there is no reason to be involved in politics. While I live in a welcoming community, like many in Queens and around the city, our politics can be far from inviting.

I first moved to New York City to attend law school at Fordham after spending seven years in Washington, D.C. I was nervous at first about being in a larger city that sometimes felt very impersonal and overwhelming when I had visited in the past, and worried about feeling like an outsider in my new neighborhood. Luckily, my fears were completely unfounded as I became close with several new friends and neighbors in Astoria, Queens. Before long this neighborhood began to truly feel like home.

I’ve always been interested in politics, and this past January decided to join my local Democratic club to meet more like-minded people and volunteer for progressive candidates. After my first few meetings, however, I soon noticed how opaque the processes of the Queens County Democratic Party could be. We are frequently told at these meetings which candidate the Queens Party endorsed for each office, and are recruited to volunteer for that person even if we’ve never heard of them.

Despite a lot of hard work, many of us are in the dark as to how the endorsement and nomination processes work. As a result I began working with another group of local Democratic activists, the New Queens Democrats, which recruited its members to run for the party’s county committee in our neighborhoods, to open up this process.

The county committee, the utmost local form of party representation, ordinarily has thousands of vacant seats, the perfect opening to build change from the ground up in Queens. The platform of New Queens Democrats is straightforward – we call for more transparency and community participation in the party's decision-making so that the party leaders are more accountable to the people they purport to represent.

After collecting signatures throughout our election districts, the New Queens Democrats gathered our petitions and turned them in to the Board of Elections. Surprisingly, our petitions were deemed defective due to minor technical errors, and we went to court. We figured that the Board of Elections, seeing how dedicated we were, would decide to help us correct our petitions so that we could get to work representing our communities on the party committee.

That’s not what happened.

The Board of Elections is made up of ten commissioners who are chosen by the same party officials we were trying to convince to open their doors to us. The Board fought tooth and nail to keep members of the New Queens Democrats off the ballot, using taxpayer money to successfully appeal a court order that had gone in our favor.

Next, an article in the New York Times informed us that the Queens Democratic Party had nominated its own people for positions on county committee, often without the candidates' consent. These “candidates” included a homebound woman in her eighties and a former Queens resident who moved to Florida two years ago – both of whom had no idea they were on the ballot or what the county committee even is.

The final slap in the face came on Election Day. I woke up at 6 a.m. to go to my polling place, where I discovered that I was, in fact, on the ballot (although my name was horrendously misspelled). The momentary excitement of being able to represent this community ended when our attorney reported to us later that day that even though we were technically on the ballot, the Board of Elections would not be counting any of our votes. The Board used the Appellate Division’s order allowing them to keep us off the ballot as justification for not counting the votes, preventing us from joining the committee.

Change is desperately needed, even in one of the most supposedly progressive cities in the United States. Despite all this, I’m very optimistic about the future of our local party. The primary victories of Alexandria Ocasio-Cortez, Jessica Ramos, Catalina Cruz, and John Liu earlier this year have shown that Queens voters will no longer stand for politics dictated by secret handshakes and backroom deals.

Our party must open its doors to all members of our community, with political leadership worthy of the everyday voters who make our neighborhoods strong. The next county committee elections will be in 2020, and we will be ready.

***

Ryan A. Partelow is a member of the New Queens Democrats and a student at Fordham Law School. He lives in Astoria, Queens. On Twitter @RyanPartelow.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

The Ups and Downs of Excelsior Scholarship’s Freshman Year and What Comes Next

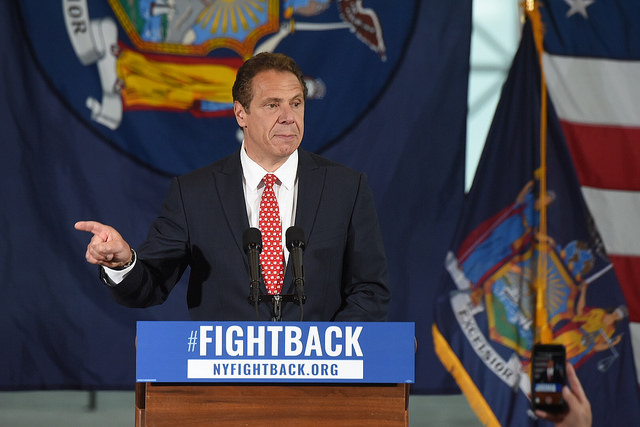

Gov. Cuomo celebrates Excelsior (photo via the Governor's Office)

The Excelsior Scholarship is a little over a year old, which makes it a good time to take stock. In October 2017 as the program launched, Governor Andrew Cuomo proclaimed, “Our first-in-the-nation Excelsior Scholarship is designed so more New Yorkers go to college tuition-free and receive the education they deserve to reach their full potential." Now that the program is in its third semester, we can explore the program’s freshman year experience to assess its impact, successes, and struggles. Who has benefited the most? Who hasn’t? And what elements need fixing?

The Inaugural Class

In Fall 2017, 20,086 students were awarded Excelsior scholarships and attended SUNY and CUNY colleges tuition-free.

Excelsior is a “last dollar” program, which means that awards are made only after accounting for other grant aid received, namely federal Pell grants and grants from the New York State Tuition Assistance Program (TAP).

Low-income SUNY and CUNY students typically receive enough aid from Pell and TAP to cover all or most of their tuition costs, so Excelsior funds have primarily gone to middle-class students, as designed by Gov. Cuomo. For the 2017-2018 academic year, the maximum family income threshold was $100,000, which increased to $110,000 for 2018-2019, and will rise to $125,000 for 2019-2020.

The creation of the Excelsior program brought much-needed relief to students and families caught in the middle-class college affordability squeeze, neither eligible for much financial aid nor easily able to pay the rising tuition and fee amounts at CUNY and SUNY.

Ghennah Forde, a junior at Brooklyn College, was one of Excelsior’s inaugural beneficiaries. During her freshman year, Ghennah and her parents, who identify as middle-class, struggled to pay Ghennah’s college expenses. Her mom’s salary from working in a hospital’s pathology lab and her father’s from working in a rehabilitation facility’s kitchen were too high for Ghennah to quality for Pell aid. After accounting for a TAP award of $500 per year, Ghennah had a tuition balance of approximately $6,000. “Financial aid was not on my side,” she says. When the Excelsior Scholarship award came through, she says, it was “such a blessing.”

Another Excelsior beneficiary, Ryan Walsh, received small amounts of Pell and TAP during his first two years as a commuter student at the State University of New York at Albany. When he began his freshman year, he had $16,000 in family savings for college-related expenses, but that money was mostly gone by the end of his sophomore year. Looking ahead to his junior year, Ryan saw looming a big tuition bill and car insurance and mobile phone charges. “Money was stressing me out a lot,” he says.

When Ryan’s dad heard about Cuomo’s proposal for the Excelsior Scholarship, it was a lifeline and a much-needed financial bailout. “Right when I ran out of money,” Ryan says, “the Excelsior Scholarship was announced.” Once Ryan got confirmation that Excelsior would cover his junior year tuition, he says, “I was so happy.” Receiving Excelsior eased his financial stresses. Now instead of panicking about money, Ryan worries about his upcoming graduation and breaking into the entertainment journalism industry.

Low-income students have gained little financially from Excelsior, yet the governor and others have made the argument that low-income students benefit from the program’s simple message that anyone, regardless of family income, can go to college for free. Excelsior may be motivating more students, including low-income students, to prepare for and enroll in college, though it’s impossible to know. For Fall 2018, CUNY’s freshman enrollment increased to 39,938 students from 38,162 in Fall 2017, a gain of 4.0%. CUNY officials attribute the increase to two factors, including Excelsior and also an initiative waiving CUNY’s $65 freshman application fee for public school students. The increase may be the result of these and/or any number of factors, including that some students may now be choosing CUNY who otherwise would have chosen private institutions. SUNY has not yet released Fall 2018 freshman enrollment numbers.

CUNY vs. SUNY

The 20,086 students who received Excelsior in Fall 2017 are a sizable group, yet they only represent 3.2% of the state’s total population of SUNY and CUNY students, which exceeds 630,000. Excelsior is barely a presence on some campuses. In Fall 2017, just 34 students received the grant at the 7,200-student CUNY Hostos Community College. Indeed, according to a report released in August 2018 by the Center for an Urban Future (CUF), a New York City-based policy think tank, only 0.8% of CUNY community college students received Excelsior.

The CUF report indicates that students who attend SUNY bachelor’s-granting institutions benefit at much higher rates. At these institutions, approximately 6.8% of all undergraduates received Excelsior in Fall 2017. At SUNY Albany, where Ryan attends, more than 8% of the in-state resident students received Excelsior.

The uneven distribution of Excelsior funds does not sit well with CUNY advocates. State Senator Liz Krueger, a Manhattan Democrat, says, “From the very beginning, I suspected that Excelsior wouldn’t prove as valuable for your average CUNY student as for SUNY full-time students.” At an August rally protesting Excelsior’s limitations, New York City Council Member and CUNY Hunter College alumnae Inez Barron declared, “Governor Cuomo is playing a shell game.”

The Heavy Credit Accumulation Requirement

Excelsior includes a controversial provision: students must earn 30 credits each year to receive and maintain the scholarship. This stipulation has effectively disqualified part-time students and students who are not on track to graduate within two years from associate degree programs and within four years from bachelor’s degrees programs. In a statement provided to Politico, Don Kaplan, a spokesperson for Governor Cuomo, defended the requirement as “incentivizing on-time graduation.”

The credit requirement has had stimulating effects on both Ghennah and Ryan. Ryan says, “I definitely have been more motivated. I want to make sure that I don’t lose the scholarship.”

Ghennah was well-aware of the 30-credit mandate when she applied for and accepted her Excelsior award. Feeling the pressure of Excelsior, she enrolled in and successfully completed 32 credits during her sophomore year. Now that she is a junior, she is on track to have 90-plus credits by the end of the current academic year and has planned out her courses on a color-coded spreadsheet so that she will graduate at the end of her fourth year, something only achieved by 27% of Brooklyn College students.

Yet Ghennah and Ryan are just two data points in a crowd of some 20,086 Excelsior recipients. To better understand whether Excelsior is bolstering credit accumulation and on-time completion at CUNY and SUNY colleges, the State’s Higher Education Services Corporation (HESC) should release detailed Excelsior data to the public and to researchers. Thus far, HESC has released only basic Excelsior data, and belatedly so. Information on the Fall 2017 beneficiaries was released in July 2018, and information on the Spring 2018 beneficiaries has not yet been released as of mid-October.

Implementation Woes

New public sector programs often encounter implementation road-bumps, yet Excelsior's first year was particularly rough.

HESC admittedly had especially tight time constraints. The Legislature voted in support of Excelsior in April 2017, just months before the start of the academic year. Only after the HESC Board met in May and approved of the program’s regulations could the agency issue the online application, which it did in early June, requiring submissions by late July. This meant that the official eligibility criteria and application procedures only had two months to filter down to CUNY and SUNY students, most of whom were off campus, and prospective students.

With a lack of clarity as to who was eligible, many students applied for Excelsior who neither needed nor were eligible for it. Of the 91,961 Excelsior applicants for Fall 2017, up to 28,362 did not need to complete the application, as they were already eligible for other grant aid to fully cover their tuition costs. Another 43,513 applicants were denied for failing to meet the eligibility criteria, with most of them—36,095—rejected because they did not meet the requirement of having earned 30 credits per year for each year of prior collegiate study.

Assembly Member Deborah Glick, a Manhattan Democrat and chair of the Assembly education committee, asked a Cuomo representative during a December 2017 hearing, "Did we do so much when it came to letting people know that the program existed but not enough in letting people know what the criteria was and raised false hopes?" Cuomo’s representative replied, “I don't think we did.”

One Excelsior requirement that has yet to be well-communicated requires recipients who complete less than 30 credits during a full academic year to pay back the second semester of their Excelsior aid. The main HESC Excelsior website buries this requirement in a long list of FAQs. Given that the “payback” requirement is non-intuitive and unprecedented in financial aid program design, one would expect that it would be featured more prominently on the website and in HESC communications.

In August 2018, at a HESC Board Meeting, Sarah Buell, a SUNY financial aid officer speaking as a member of the SUNY Financial Aid Professionals group, expressed the frustrations of the group when she said, “We have gone months without formal written guidance.” According to Buell, SUNY financial aid officers were struggling with how to answer basic questions from students and parents about Excelsior’s regulations and about HESC’s processing of applications.

The following day, SUNY Chancellor Kristina M. Johnson’s office sent a memo to campuses directing their financial aid officers not to speak with the media.

Denied Excelsior

Razieh Arabi is one of the students who applied for Excelsior aid and was denied. A 37-year-old single mother, Razieh applied for Excelsior as she was transferring to CUNY Baruch College after having completed an associate degree at CUNY Queensborough Community College (QCC) with a GPA of 3.93.

What happened? Because Razieh had taken three years to complete her Queensborough degree, having begun as a part-time student, and also because she had attended a proprietary college before Queensborough, she was deemed off-track and ineligible for Excelsior. When she received the denial letter, she says, “Despite all the hope the program provided, it felt like everything was falling apart for me.”

HESC’s regulations were explicit that the 30 credits per year requirement was retroactive, and the application asks detailed college history questions, yet Razieh says that she was not aware that her past enrollment history would disqualify her. When she applied, she thought that an accomplished student like herself was naturally eligible for the program. “If I’m not qualified, then who is qualified?” she asks. (Graduating in three years from Queensborough after beginning as a part-time student was a remarkable feat by Razieh given that QCC has a 22.6% three-year graduation rate for students who begin full-time.)

Since being denied Excelsior, Razieh has become an activist for reforms to the program. At the rally held in late August, at which Council Member Barron spoke, Razieh addressed the crowd. “Governor Cuomo should make critical reforms to the Excelsior Scholarship program,” she said. “If you are making a promise, then rise up to the challenge and don’t deliver just an empty promise.”

Razieh tells the story of her Excelsior denial with elements of tragedy, comedy, and anger. She had already felt wronged by the proprietary college sector that had wasted her time and money and by the federal financial aid formula that limited her aid while at Queensborough. Now she considered herself wronged by the retroactivity of a standard that she could have never known about, lacking the ability to see into the future, before Excelsior existed.

Excelsior’s Future

As more and more students get caught up in Excelsior’s complex rules, the program is being exposed as a complicated financial aid initiative, just like Pell and TAP, and it may come to be seen as punitive, too, due to the payback requirement. Though HESC has said that the payback stipulation will be waived for students who miss the 30-credit cutoff because of documented hardships, the guidance is limited on which hardship appeals will be accepted and which won’t. A death of a parent clearly qualifies for a successful appeal, but will a stressful relationship breakup combined with family problems and a terrible summer session chemistry class be enough for a student with 27 credits due to an F in that chemistry class to maintain the scholarship via an appeal? The guidance is not definitive.

Another requirement of Excelsior is that beneficiaries must stay in-state following graduation for the same number of years as they received the scholarship, lest their awards convert into loans. The requirement has been equated with indentured servitude. While both Ghennah and Ryan plan to stay in-state following graduation, other students will likely feel trapped.

Despite all its failures and flaws, few are calling for Excelsior to be rolled back. Instead, Excelsior has become established policy. Senator Krueger says, “It’s very rare that you create a program that can be taken advantage of by people who are above the poverty level. Those programs don’t get taken away.”

Advocates of expanding financial aid in New York State, like Tom Hilliard, who wrote the CUF report, say that Excelsior is the base from which incremental reforms can be made, reforms that make the promise of “free college” more real to more students. Hilliard has called for reducing the onerous 30-credit burden, eliminating its retroactivity provisions, and getting rid of the requirement that graduates remain in-state.

Senator Krueger says, “We need to amend and improve Excelsior. Full-time is an unrealistic ask, and we need to offer flexibility to students who can’t go full-time.”

Echoing Krueger, State Senator Luis Sepulveda, Bronx Democrat, adds, “Excelsior has to be tweaked so that it can help a larger body of students, especially those who also need to work.”

This fall, Sepulveda plans to introduce, with other Democratic colleagues, a bill to modify the 30-credit requirement. The bill may adopt TAP’s satisfactory academic progress standards, or, at a minimum, according to Sepulveda, it will authorize HESC to count developmental education course credits, which are typically non-credited, towards the 30-credit threshold.

Krueger and Sepulveda both consider the conversation about Excelsior to be part of a larger one about how to provide quality public higher education to state residents. Among other initiatives, Sepulveda calls for extending state financial aid to summer sessions, initiating a micro-grant program for emergency expenses, instituting a guided pathways system across CUNY and SUNY, and increasing base aid to colleges so that more sections of required courses can be offered. As Krueger says, “If we’re not putting more money into our universities, we’re actually risking the quality of the education that [Excelsior awardees] are getting.”

Both Krueger and Sepulveda say that after the November election—in which Democrats are poised to gain control of the State Senate—there will likely be enough votes to pass changes to Excelsior, and Sepulveda projects that the governor will support some reforms. “If this is something that the governor deems reasonable,” he said, “I believe that he will give it a hard look.” If Sepulveda is right, Excelsior’s junior year may well look different from its freshman and sophomore years.

***

Eric Neutuch is a freelance journalist.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

What Happens Next? A Service-Provider on the Mass Bail Out

(photo: Office of Queens Borough President Melinda Katz [CJ])

The Mass Bail Out action is currently underway, attempting to post bail for women and youth on Rikers Island and in city jails throughout New York. At last count, there were about 243 women held in jail because they cannot afford bail -- not because they’ve been proven guilty of their charges. We think this is an incredible and necessary effort rooted in the quest for justice.

The only legal reason to hold a person on bail is to ensure they return to court, but research proves time and again that most people return to court on their own, especially women. This includes people bailed out by charitable bail funds. In fact, the Bronx and Brooklyn bail funds have been operating for over a decade and the people they serve return for their court dates 95 percent of the time.

Further, women in jail are more likely than men to be the primary caretakers of their children, to have survived histories of violence and abuse, to be battling drug addiction and mental illness, and to live in poverty; circumstances only exacerbated when isolated on Rikers Island (or in any jail or prison). To theorize that women are less a danger to themselves or others in jail is to erase their agency and to ignore the many needs we neglect to meet as a community.

New Yorkers have a responsibility to reimagine the criminal justice system and to set an example for the rest of the country. At the Women's Prison Association (WPA), we envision a community where our reliance on incarceration as the default response to crime has been replaced by constructive, community-driven responses. Women come to WPA from Rikers every day. Partnering with the Mass Bail Out simply means providing the same services to more women at once.

There has been a plan set in place for every woman thus far, including transportation to safe housing, connection to health care, legal support, and provision of emergency needs like food and clothing. WPA's social workers are meeting these women at Rikers with tailored service plans and nonjudgmental support. Every day our staff work hard to meet the immediate and long-term needs of our clients, and I am proud of the tireless effort extended throughout this movement. These are supports every New Yorker should have available to them.

WPA is 173 years old. We are familiar with the misconceptions around our work and similar efforts toward social progress like the Mass Bail Out. Critical to our vision of a world with fewer jails and prisons is the belief that all human beings have the capacity for change and that every individual can be accountable for her actions and the results. We support the freedom of these women and teens, so that they can imagine and realize law-abiding, self-directed, and satisfying lives in the community, possible with our support and that of the city at large.

***

Georgia Lerner is Executive Director at the Women’s Prison Association, which works with women at all stages of criminal justice involvement. On Twitter @Georgia_Lerner & @WPA_NYC.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

A Misguided Mandate in Reforming the City Property Tax System

Mayor de Blasio & Speaker Johnson hold a town hall (photo: Ed Reed/Mayor's Office)

This May, Mayor Bill de Blasio and City Council Speaker Corey Johnson announced an advisory commission to recommend reforms to New York City’s property tax system. According to its website, the commission is charged with “developing proposals to make the system simpler, clearer, and fairer.” However, it has also been given the mandate to do so in a way that is revenue neutral -- a goal that is both counterproductive and unnecessary.

For eight years, I had the good fortune to serve as the Press Secretary for the New York City Department of Finance. Every year, between September and February, I would meet at least weekly with the team of senior assessors to try to understand how the market had changed over the past year, what new rules and laws had taken effect, what changes we were making internally, and how all of this would impact property owners. For every change made, some property owners benefitted and others did not.

“Revenue neutral” is a political term that implies that when the City makes a change to the system, it’s not being done to raise your property tax bill, even though it might. If it is unfair now, and the system is changed to be more equitable, virtually everyone will either have to pay more or pay less. When the impact is not neutral for anyone at the end of the day, saying it is just obscures the administration's stated intention that the City does not end up with less money to spend come budget season.

The commission will make its job a great deal easier if it does away with this artificial constraint. Without giving due consideration to the revenue side of reform, commissioners would be free to think about the issues that would result in real equity among property owners. They could explore the option of including owner-occupied co-ops and condos in Class 1 (along with 1-, 2-, and 3-family homes) and valuing them based on their sales price, where most experts have agreed they belong for the past 25 years, without worrying that the change would bankrupt the City. They could even consider more progressive ideas, like valuing investor-owned residential properties as the income producing properties they are.

For people who buy a home to live in, the value is in the sale price of their property. For people who buy a home to use as a rental or an Airbnb, the value is in income-producing capacity of the property. Because investors can capitalize on both, the revenue flows and the appreciation of a property’s market value, they are frequently willing to pay more than the average homebuyer. This, in turn, drives up market values in neighborhoods and makes it more difficult for current residents to buy a home.

Owning a home is the greatest wealth-building opportunity that residents in this country have, and we should make sure our system does not inadvertently inhibit the ability of New Yorkers to own their home just because they would use it differently from an investor.

Without the revenue neutral constraint, the Commission could also give real consideration to reforming the State-mandated tax caps that have created disparities between rich and poor neighborhoods, which are currently the basis for a lawsuit claiming the system is biased against low-income residents and people of color.

These are not the only ideas out there for making the system fair, and the Mayor and the City Council should be commended for creating a commission and for holding public hearings to gather New York City’s collective wisdom to consider for their final proposal. However, neither these, nor any other changes can be seriously considered through a revenue neutral lens.

That is not to say that the City cannot implement a revenue neutral change to the property tax, however.

Assessments are only one input into a property tax bill, and the City’s goal should be to make sure that those assessments are accurate and fair. The other major input into this equation is the tax rate, which can be raised or lowered by the Mayor and City Council as they see fit during the annual budget process. If the Mayor and City Council are serious about holding the line on property tax revenue, they already hold that power. No commission necessary.

***

Owen Stone is a government performance and innovation expert who served at the New York City Department of Finance from 2006 to 2014. On Twitter @owenstone.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

New York City Residents and Economy are Generating an Increasingly Large Share of State Government Resources

(photo: Mike Groll/Office of Governor Andrew M. Cuomo)

New York City and its economy have been growing at an extraordinary pace in recent years - it is quite clear that the city is generating jobs, development, and wealth. It continues to have major problems - affordable housing and homelessness crises, a deteriorated mass transit system, and nearly 20% of its population still trapped in poverty - but its overall economy has been growing.

This growth is occurring in the context of a set of perennial questions, both during state budget season when the allocation of resources across the state is decided every winter, and during campaign season, when most of the competitive legislative districts, especially for the State Senate this election year, are actually outside New York City.

Those questions are: What is the place of New York City in the state economy? Is the city a drain on the resources of the rest of the state’s residents, or a net contributor to the rest of the state? Should the city be forced to pay more to the state, or less? In the campaigns outside the city, a standard Republican refrain is to persuade voters to stick with the Republicans or lose power to “New York City Democrats,“ which presumably means there is a danger to out-of-city residents that more of their tax dollars will be spent on urban problems.

Ideally, of course, the state’s policies should allocate resources based on meeting the needs of all the people of the state in every region, rather than merely sending back equal amounts of money to the communities the dollars came from on the basis of how much they contributed in taxes. But one thing is true: the idea that New York City is a drain on the resources of the rest of the state’s regions and residents is absolutely not accurate.

The Rockefeller Institute of Government, a research institute affiliated with the State University of New York, in 2011 analyzed the basic question of where the money for New York State comes from by region, and where it is then spent by region, and confirmed that New York City is a net contributor to the state of New York as a whole. The data came from the State 2009-10 Fiscal Year, nine years ago. This article looks at trends since that time, but the evidence only shows that New York City residents and the city economy are providing an ever larger share of the State’s resources.

The City’s Status in 2009

The New York City economy’s strength in providing revenue to the state might seem intuitively obvious these days, but more surprising is that the Rockefeller Institute study showed that the city does not receive in spending its per capita share of the state’s population. As a member of the state Assembly at budget hearings over the years, I would listen to Republican state senators complain about the Medicaid program, and, guess what, they were right! Maybe not about the program’s overall value or burden, but about the fact that a lot of money in that program does go to New York City, which took 62% of the expenditure of the state-funds-only part of the Medicaid program. It was practically everything else that went the other way, with less funding to New York City and more elsewhere.

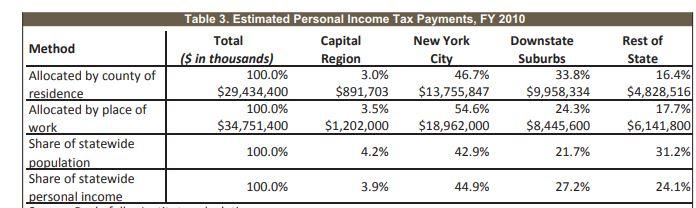

When you added in the state universities, the state prisons, and psychiatric hospitals, other state hospitals, the road, bridge, and highway spending, and even state aid to elementary and secondary education, the totality of the expenditures brought the city’s share of the state-funds-only budget to 40% of spending, while the city’s share of the population then was 42.9%, as pictured in this table from the study:

“Giving and Getting: Regional Distribution of Revenue & Spending in the NY State Budget, Fiscal Year 2009-10,” Rockefeller Institute of Government 2011

Local Assistance grants in the table above included both the Medicaid program and Aid to Education, revenue sharing, community colleges, and property tax relief spending (where the state gave school districts money in compensation for lost revenue from the STAR property tax exemptions for homeowners, where the districts lost funds). The average of all of the Local Assistance programs came to 49% for the city, but in two other large categories of spending, State agencies and State Capital Projects, the City amounted to less than one quarter of the spending, resulting in the overall 40% share.

The City’s Contribution to State Resources in 2009

The source of the state’s tax and other revenues, even in 2009, exceeded New York City’s per capita share of the state’s population, whether calculated from the residents of the city only, or the city as a place of work (Rockefeller study):

![]()

![]()

The city economy’s share of the state’s tax and other receipts in 2009 (48.7%) is partly explained by the large number of New Jersey, Connecticut, and other non-residents who work in the City and pay nonresident income taxes. About 14% of the state’s income taxes come from nonresidents. The city residents’ share of state revenues also exceeded its share of the population in 2009 (45.1 vs. 42.9), reflecting a combination of some very high-income and low-income taxpayers and residents. The city’s overall status in the state in terms of income and shares in 2009 is also reflected in this table:

New York City’s Status Today

The city’s economy is now providing a far higher share of state revenue than in 2009, during the national recession. I estimate the share based on residency now reaches 50%, and the share as a place of work reaches 53% or more.

In 2009, the city’s share of the state’s employment was 43%, but the City has gained 715,000 jobs out of 977,000 gained statewide between 2009 and 2017, according to state labor department data, and now stands at over 46% of state employment. The city was home to 44.9% of the state’s personal income in 2009, produced 45.1 % of state revenue from its residents, and 48.7% of state revenue as a place of work (Rockefeller study). A New York State Assembly economic report showed the city’s status as of 2016.

New York State Assembly 2018 Economic and Revenue Report

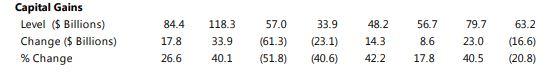

According to the Assembly economic report, the city’s share of the state’s personal income was 46.6% in 2016, higher than the 44.9% in 2009. If the same proportion for resident revenue share and place of work share held from 2009 to 2016, the city share of state revenue rises to 46.8% as a place of residence, and 50.4% as a place of work. Personal income statistics do not include capital gains income, but it is a source of income tax revenue. Capital gains income was severely depressed in 2009 due to the recession. In 2018, several billion more dollars in income tax revenue from capital gains, heavily concentrated among wealthy New York City residents, has significantly increased New York City’s share of state revenue, above and beyond the general growth in jobs and income. The following table from the state Division of the Budget shows the impact of the recession:

New York State Division of Budget, Economic & Revenue Outlook, 2012-2013, p.145

![]()

The table shows the spectacular $84 billion drop in capital gains in New York between 2007 and 2009 -- from $118 to $33.9 billion -- and the Rockefeller Institute report data reflects the low level of tax revenue from that year.

What about now?

New York State Division of Budget, Economic & Revenue Outlook, 2018-2019, p.111

![]()

Capital gains realizations for income tax purposes have risen $66 billion since 2009 to the 2019 state estimate, from $33.9 to $100.2 billion.

What does that mean for New York City?

The state Division of the Budget estimates that the top 1% of New York taxpayers pay 42-43% of the state’s income tax liability. What about in the city? A New York City Independent Budget Office study of city tax returns showed that in 2014 the top 1% of New York City residents paid $9.9 billion in state income taxes, which is about 60% of the tax liability of the top 1% of New York State taxpayers that year. Division of Budget figures also show that the top 1% of taxpayers have about 80% of capital gains income, meaning most of the tax revenue from capital gains comes from the wealthiest taxpayers. Income taxes provide 60% of state tax revenue.

The New York City Economy Share of State Tax & Other Receipts Now Reaches 53% or More

I estimate that when New York’s tax rates on upper-income and super-wealthy taxpayers are applied to the extra $66 billion in capital gains income, the city’s share of total state revenue moves up two-and-a-half percentage points, reflecting about $2.5 billion more paid in income taxes from capital gains out of an additional roughly $4.5 billion in income taxes from capital gains paid statewide -- using $78 billion in receipts in 2009 and $106 billion in 2019 as the bases for the calculations. An extra two-and-a-half points bring the city’s share from 50.4% to about 53% of total revenue payments. The overall concentration of growth in New York City likely also brought in more sales tax, real estate transfer tax, and other revenue, bringing the share to more than 53% of state revenue, ten points higher than the city’s 43% share of the state population. On the resident side the share should be at least 50%.

The State Spending Side Today

On the spending side of the equation I don’t believe there are significant differences from 2009 in terms of percentages. There have been many changes in the ensuing years but they tend to cancel each other out.

New York City’s revenue sharing from the state, which was $246 million in 2009, was eliminated that year. The state enacted a new property tax relief program worth $1 billion a year that provides rebates exclusively outside New York City, in addition to the STAR program. Governor Cuomo and the Legislature agreed in 2012 to a 2% property tax increase cap for municipalities outside New York City, along with an agreement for the state to absorb all additional local government Medicaid expenses above their 2012 spending base, including New York City’s obligation. This freeze on local Medicaid spending had the effect of helping both the city and the counties outside the city in the same proportion as the overall regional expenditure for the Medicaid program. The city’s gain from the Medicaid freeze was offset by the loss of revenue sharing and the added property tax relief spending outside the city on a regional allocation basis.

In 2014 Mayor de Blasio sought and won a universal full-day prekindergarten program, worth $300 million a year from the state. But the money ended up incorporated in the city’s overall share of Aid to Education, which stayed at the same 39% of total aid from the state as it had been for years before that.

In 2016 the state approved a new Capital Spending program for the MTA, but the State Senate insisted on parity for Highway, Road, and Bridge spending, and a capital program of $27 billion for road and bridge work was adopted at the same time, most of which is spent outside the city. The state received more than $10 billion in funds from legal settlements with financial institutions related to recession-era wrongdoing, and applied large portions of the funds to upstate economic development and infrastructure projects.

The state also cut taxes extensively during the Cuomo years, including corporate, estate, and income taxes (a high rate was maintained on incomes now above $2.1 million per year), but these policies tended to concentrate tax payments into the upper income brackets and thus concentrate them in the city, as discussed above.

How these changes will affect future budgets is uncertain, but the facts are that the New York City economy keeps generating a larger share of state resources while the city does not receive an outsize proportion of state spending.

***

Jim Brennan was a member of the New York State Assembly for 32 years, where he chaired four committees. On Twitter @JimBrennanNY.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

[Updated] Can Democrats win the state Senate? How progressive is Cuomo? New Yorkers are about to find out

Gov. Cuomo (photo via New York Democratic Party)

This op-ed is an updated version of a previously published column, now accounting for the October 32-day Pre-General Campaign Financial Disclosure and incorporating other new information, including reader feedback from the original version, previously published in Gotham Gazette October 2.

In the November 6 general election, New York Democrats have a historic opportunity to take control of the state Senate. If this happens, Democrats would control both houses of the state Legislature for only the third time in the last 100 years, unlocking years of bottled up progressive legislation passed by the Democratically-controlled Assembly but blocked by the Republican-controlled Senate.

Assuming Governor Andrew Cuomo, a Democrat, wins reelection as he is expected to, a number of these bills may very well land on his desk, including those related to universal health care; election, voting and campaign finance reforms; reproductive health rights; equal education funding for city schools; equal protections for LGBT and disabled people; carbon emissions elimination; immigration protections, including making New York a sanctuary state; and criminal justice reforms.

Recent history might temper optimism, however. New York Democratic voters chose the status quo over the bold reforms represented by the Cynthia Nixon-Jumaane Williams-Zephyr Teachout slate in September’s primaries and in last year’s constitutional convention ballot referendum. In the 2016 state Senate races, 98% of incumbents were re-elected.

We’ll soon see how powerful New York’s blue wave really is, both on Election Day and in the legislative session that will follow beginning in January. A few key questions:

But didn’t progressives just defeat the IDC?

Sort of and it’s insufficient.

Before the primary, there were actually more “Democrats” in the state Senate than Republicans, even though the GOP conference held a 40-23, then 32-31 majority in the 63-seat chamber.

Nine Democrats were either part of the Republican conference or in a power-sharing agreement via the Independent Democratic Conference (IDC), giving the GOP a majority for the recent two-year legislative session (and prior) and preventing progressive legislation from reaching the Senate floor. Eight of those senators were members of the IDC, which did rejoin the “mainline” Democratic conference in April, after a new state budget had been passed, which led to the 32-31 GOP majority for the final months of the session that ended in June.

In the September 13 primary, six former IDC members were defeated. The ninth rogue Democrat, Senator Simcha Felder of Brooklyn, has been part of the Republican Conference for multiple terms, and was even reelected in 2016 on both the Democratic and Republican ballot lines. He won his primary challenge last month.

Despite losing in the Democratic primary, all six defeated former IDC members are likely to remain on November’s ballot on other party lines, often the Independence Party and/or Women’s Equality Party. The October filings indicate that the six defeated IDC members did not have any meaningful campaign activity in the post-primary weeks, but Senator Tony Avella has declared he is campaigning to win in the general election, and neither Senator Jeff Klein nor Senator Jesse Hamilton has formally declared their intentions. Democratic Party leaders may try to reward defeated IDC members -- like former conference leader Klein and Hamilton -- with judgeships to keep them from actively campaigning.

Surviving former IDC Senators David Carlucci and Diane Savino, along with Felder, will almost certainly win re-election in November.

What do Democrats really need to do?

Net one seat. If Democrats flip just one GOP-held Senate seat and hold onto those they currently have, then Democrats will have a real 32-31 majority heading into next year. Competitive Senate races exist on Long Island and upstate, including several districts where Democrats failed to run any candidate at all in 2016.

What’s possible?

Flipping ten seats. My most optimistic scenario has Democrats flipping ten GOP-held seats and holding onto their own, for a 41-22 majority.

If the primaries were any indicator, November turnout will be high, which will benefit Democrats due to their two-to-one registration advantage across the state. Primary turnout more than doubled since the last comparable election in 2014. In Long Island’s Nassau and Suffolk counties, Democratic primary turnout actually tripled from 2014 to this year.

Democrats are mounting competitive races in the five GOP-held districts where the current officeholder is retiring. In 2012, Obama carried all of those districts; In 2016, Clinton carried one and Trump won by 6% or less in the other four. Democrats are also contesting several other races where the Republican incumbent is seen as beatable.

Below is my list for the best opportunities for Democrats to flip GOP-held Senate seats, categorized as “Most likely to flip,” “Highly competitive,” and “Long-shots.” You can see the full detailed spreadsheet here.

In compiling this list, I considered voter registration differential, popularity as measured by the number of individual campaign contributors, money including party funding, voting results by state Senate in the two most recent presidential elections, the power of incumbency, and signals of grassroots activism.

Money matters -- to pay for campaign staff, advertising, get-out-the-vote efforts, and more. The table above includes the most recent Board of Elections campaign disclosures, filed by October 1. Grassroots support can certainly counteract big money, as IDC challenger Alessandra Biaggi demonstrated in her primary defeat of former IDC leader Klein, but it’s difficult to conceive how other candidates could overcome comparable odds. Klein outspent Biaggi nearly seven-to-one -- $2.8 million to Biaggi’s $414,457 -- but Biaggi raised money from 47 times the number of contributors that Klein had.

Past voter preferences matter, especially since they don’t necessarily follow in line with voter registration data. The 2012 presidential election was more reflective of deeply felt beliefs in these districts, which had with one exception solid pluralities for Obama. Democratic voters who stayed home may have contributed to the mixed results of the 2016 election. By this year, 2016’s GOP victories didn’t deter -- and perhaps motivated -- Democratic contributors and may have awakened Democrats who came out in droves to vote in this year’s primaries. In addition, changing demographics have also affected these districts in ways that potentially favor progressive Democratic candidates.

Party money also matters. Both Democrats and Republicans have state Senate campaign committees, which have injected money into select races as shown on my chart. The full extent of Cuomo’s financial support remains to be seen.

What’s the rundown on the races?

James Skoufis vs. Tom Basile (SD-39): Assemblymember Skoufis has a solid lead in every respect that should offset the weak Democratic performance in the past presidential elections. The significant GOP support for Basile signals the party’s concern. Even after the GOP’s $288,300 investment, Skoufis had a commanding 9.5 times more money as of the most recent filing.

Jen Lunsford vs. Rich Funke (SD-55); Anna Kaplan vs. Elaine Phillips (SD-7), Karen Smythe vs. Sue Serino (SD-41): These three races occur in districts with vulnerable GOP incumbents. In all three, huge Democratic Party enrollment and presidential voting advantages could overcome GOP funding advantages. In SD-7, the GOP is concerned enough to invest $254,500 to prop up incumbent Senator Phillips.

Jeremy Cooney vs. Joseph Robach (SD-56): Jeremy Cooney has everything going for him -- but money. He’s in a heavily Democratic district that came out big for Obama and Clinton. His grassroots popularity is reflected in the number of individual donations. But his relatively low cash balance against a well-funded incumbent, Senator Robach, is so large that the GOP seems to have decided Robach doesn’t need additional help.

Jim Gaughran vs. Carl Marcellino (SD-5): This district may define the red-to-blue wave as it is one of the few in the country that flipped from voting Republican to Democrat between the 2012 and 2016 presidential elections, perhaps indicating a demographic shift. As of September, Gaughran and Marcellino had roughly the same balance remaining in their campaign accounts, motivating both parties to pony up for the final weeks of the campaign. GOP support gives Marcellino an edge in overall funding that Gaughran’s enthusiastic grassroots supporters can overcome, especially since Marcellino only won by 1.2% in 2016 over Gaughran.

Jen Metzger vs. Annie Rabbitt (SD-42) and Monica Martinez vs. Dean Murray (SD-3): Both of these districts were solid Trump districts in 2016 after having been solid Obama districts in 2012. Both enjoy large Democratic majorities and no incumbents. Metzger and Martinez are also winning the hearts and dollars of individual contributors over their GOP opponents. Metzger’s impressive overall campaign funding advantage of 1.8 times Rabbitt is solid; Martinez’s deficit to Murray of 1.4 times her fundraising can also be surmounted by a strong grassroots effort down the stretch.

Andrew Gounardes vs. Marty Golden (SD-22): This Southern Brooklyn seat represents why many GOP-held districts are vulnerable. Since 2012, when incumbent Republican Senator Golden won his last competitive race, the district’s demographics have changed dramatically. Today, 40% of residents are now people of color, especially Asian and Hispanic; and 43% are immigrants, primarily Asian, eastern European, and Mexican. Residents work in blue-collar industries like transportation, wholesale, and construction. Virtually every racial group earns less than the median for New York State. These changes create the setting for the red-to-blue opportunity for progressive Democrat Gounardes, Golden’s opponent in 2012.

In less than 30 days between the post-primary and the October filings, Gounardes has substantially narrowed the funding gap with Golden after having spent significantly during a hard-fought Democratic primary. Golden’s 7 times funding advantage shunk to 2.3 times with the help of the state Senate campaign fund. The lopsided Democratic registration advantage in the district is a red herring; some of the district’s constituents register as Democrats in order to have a say in New York City primaries, but vote GOP in the general election. Many registered Democrats in the district have voted Republican in mayoral and other elections for years. [Disclosure: I’m a member of Gounardes’ finance committee.]

Aaron Gladd vs. Daphne Jordan (SD-43): This district is a conundrum. The GOP enjoys a strong registration advantage but went for Obama in 2012 and narrowly chose Trump in 2016. Gladd’s advantage in contributors and overall funding sufficiently concerns the GOP enough to drop money to support Jordan.

Lou D’Amaro vs. Phil Boyle (SD-4) and John Mannion vs. Bob Antonacci (SD-50): In both races, the GOP is winning on number of contributors and overall funding balance going into the final weeks of the election. Mannion’s situation may be so bleak that the Democrats have thrown a pile of cash into this race, while the GOP, smelling a potential win, has also invested.

Kevin Thomas vs. Kemp Hannon (SD-6) and Pete Harckham vs. Terrence Murphy (SD-40): It’s very hard to imagine that Thomas and Harckham can overcome the massive campaign balance deficits as compared to their GOP opponents in the waning weeks of the election.

Aren’t there Democrats at risk?

Incumbent Democrats appear safe. John Brooks in Senate District 8 on Long Island is often mentioned as a potential risk, probably due to his narrow 214-vote (0.2%) win in 2016 over then-incumbent GOP Senator Michael Venditto. But now-incumbent Brooks has a solid fundraising lead over his GOP challenger, Jeff Pravato, in a district that went for Obama and Clinton and has a solid Democratic voter registration advantage.

Democrats need to ensure that primary victors Rachel May in SD-53 and Alessandra Biaggi in SD-34, both of whom beat IDC members, continue their momentum through November. The IDC incumbents they defeated are likely to appear on other ballot lines and have significant money. May’s opponent, David Valesky, reported a $340,038 post-primary balance to May’s $41,209, though he has recently declared that he will not campaign in the general. Biaggi’s opponent, former IDC leader Klein, reported a post-primary balance of $497,267 and has not indicated his plans for the general election.

On October 8, former IDC Senator Avella of Queens, who lost in the Democratic primary to John Liu, announced that he will actively campaign in a long-shot attempt to win the November election on the Independence Party and Women’s Equality Party lines. As of the recent filing, Liu had a 3.3 times funding advantage over Avella and an energized and active campaign operation.

So what’s going to happen?

On November 6, Democrats will take control of the New York State Senate with a solid majority that Republicans cannot hold back. This, along with holding onto a wide majority in the Assembly, will likely result in a steady stream of progressive legislation on the governor’s desk to sign, giving Cuomo the opportunity to make history New York has been waiting for.

***

Art Chang is a writer, thinker and strategist at the intersection of technology and government. He is a former board member of New York City’s Campaign Finance Board, where he led the creation of NYC Votes and Voting.NYC. On Twitter @achangnyc.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

In Need of Partners: Affordability Gap Too Large for New York City to Cover Alone

(photo: @NYCHousing)

New York City is a city of renters, and affordable housing is a perennial concern of New Yorkers. Under Mayor Bill de Blasio, the city has committed an unprecedented level of resources to create and preserve affordable housing units and make critical repairs at the New York City Housing Authority (NYCHA). But is it realistic to think the city can address affordability for all rent-burdened New Yorkers?

A new report from Citizens Budget Commission (CBC) indicates rental burdens have not improved since 2014, and are most severe for low-income single households, particularly single seniors. The most effective programs for providing low-income, affordable housing have been federally funded; the city cannot handle the affordability problem on its own.

CBC analysis of data from the 2017 Housing Vacancy Survey (HVS) shows more than 921,000 renter households in New York City, or 44 percent of all renters, pay at least 30 percent of their income in rent, even after accounting for the value of federal rental housing vouchers and Supplemental Nutrition Assistance Program benefits (food stamps). Twenty-two percent of households – more than 462,000 families and single adults – are severely rent burdened, which means they pay 50 percent or more of their income in rent.

Severe rent burdens disproportionately affect single households: 35 percent of single seniors, 27 percent of single households, and 26 percent of single-parent households were low-income and severely burdened. In contrast, about 15 percent of households with multiple adults were low-income and severely burdened.

These findings are largely unchanged from the last time the HVS was conducted in 2014. The share of rent-burdened households increased to 44 percent from 42 percent, while the share of severely burdened remained unchanged. Severe burdens increased slightly among low-income single households and seniors.

The primary challenge in tackling the “affordability gap” is that the lowest income households require subsidies to supplement what they can afford to pay in rent. Historically, federal housing programs have been most effective at addressing these needs. According to the 2017 HVS, two-thirds of the lowest income households that are not rent burdened either reside in federally-subsidized public housing or receive Section 8 Housing Choice Vouchers. Most of the remaining third benefit from some other form of subsidy from the city, state or federal governments.

While city government has a role to play in addressing rental burdens, it is unrealistic to expect the city to close the gap on its own. The number of extremely and very low income New York City households that pay half their income in rent exceeds the mayor’s entire 300,000-unit housing plan. Meanwhile, NYCHA faces a $32 billion capital need, and its public housing units are in the worst condition of all rental housing in the city. The cost of addressing these challenges vastly exceeds the city’s financial resources. Any meaningful response to preserve public housing and address the housing needs of severely rent burdened New Yorkers will require willing partners in Albany and Washington.

***

Sean Campion is a senior research associate for Citizens Budget Commission. On Twitter @cbcny.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

Unlocking the Key to Real Affordable Housing in New York City

(photo: @NYCHousing)

Let’s say you’re a single mother of one child with an annual income of $45,000 looking for a two-bedroom apartment in Brooklyn. Off to a seemingly good start, you found a wonderful “affordable housing” unit, but the monthly rent is $2,700 with an annual salary requirement of $95,000. This is definitely out of reach, so you try to find a studio apartment and hope for the best. You find an “affordable” studio apartment, this time in Queens -- but you need at least a $75,000 salary for a monthly rent of $2,200. This isn’t affordable either. What gives?

One of Mayor Bill de Blasio’s main priorities, since taking office in 2014, is to build more affordable housing at a rate never seen before in New York City. Last year, the mayor announced his plan to boost production of affordable housing to 25,000 apartments annually by 2021, and set a new goal of 300,000 apartments by 2026. These terms and numbers, along with the language the mayor uses in celebrating his affordable housing achievements, give the perception that people will be able to stay in the neighborhoods they grew up in and halt displacement. But how “affordable” are these homes?

A simple look at New York City Housing Connect, the online portal to access applications for affordable housing, proves these homes are not as affordable and attainable as one may think.

Who’s to blame? Congress, in part.

Why are many of these apartments considered “affordable” if you need to make almost six figures to even apply? An especially vexing question given that the median income in New York City is roughly $33,000.

The short answer is “area median income,” also known as AMI, a statistic officially calculated by the U.S. Department of Housing and Urban Development (HUD). AMIs for New York City are calculated too high to begin with, and then the city sets “affordable rates” for many apartments well above AMI.

Some of New York City’s affordable housing in new constructions is targeted at income levels as high as 165% of the AMI, making it unattainable for low- or middle-income households. And AMI for the city is high on its own because it actually includes incomes from other counties outside of the city, those from individuals in Westchester, Rockland, and Putnam counties, all of which are home to higher average incomes. Thus, New York City’s AMI for 2018 is $93,900 for a family of three.

Why are these suburban counties included in an AMI for the region, rather than the five boroughs alone? HUD uses Metropolitan Statistical Areas (MSAs), which are based on commuting patterns determined by the federal government and often include counties far beyond an area’s urban core. Further, HUD has no formal mechanism for cities to challenge their AMI. New York’s AMI is 20 percent higher than actual median incomes in the city. This is flat out wrong and leads to New Yorkers being priced out of their homes and neighborhoods.

The very same apartments intended for low-income New Yorkers are being handed over to upper middle-class individuals and families. The city allocates millions of dollars for affordable housing projects, yet these projects are directed at the wrong people!

Some of this is by the mayor’s choice; de Blasio has decided to target more units at a broad range of affordability requirements than fewer units at lower rents.

But still, AMI is an essential component. Why can’t New York just change its AMI laws? Because AMI is determined through federal law and would require an act of Congress. Rep. Jose Serrano of the Bronx wrote a letter back in 2015 to then-HUD Secretary Julian Castro, expressing his support for a change in AMI calculation for New York City. However, Congress has not taken any action to actually mandate the reassessment of the city’s AMI.

Some have argued that changing AMI will make affordable housing development less financially viable and thus less appealing for developers to construct. The financing of affordable housing often depends on government subsidies to developers, though, so the equations are not simple ones. And, there are always questions about number of units versus depth of affordability. If AMIs were lowered to more accurately reflect need in New York City and make “affordable” apartments truly affordable to more tenants, some instances may call for a combination of developers accepting less profit and/or government offering more incentives.

There might be some hope for action in New York. Adjusting AMI may require congressional action, but that hasn’t stopped state elected officials from introducing legislation to address this issue. State Senator Michael Gianaris and Assembly Member Brian Barnwell, both Queens Democrats, have a bill pending in the state Legislature that would mandate developers calculate AMI based on ZIP code. It might not do much to reduce skyrocketing rents citywide, but this policy would definitely pave the way to a more affordable and transparent affordable housing system. The bill is still in committee, but considering the very real likelihood of a Democratic-controlled State Senate in January via the November elections, there might be a real chance for an overhaul of the current system and an outcome of meaningful change.

***

David Aronov is a graduate student at NYU’s Robert F. Wagner Graduate School of Public Service and Director of Community Relations for New York City Council Member Karen Koslowitz (the views expressed here are the author’s alone).

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.

In Brooklyn Democratic Party, Democracy is Healthier Than Some Would Have You Think

Frank Seddio & Senator Persaud (photo: Frank Seddio on Facebook)

Democracy in action can be messy, but the election law as well as state and local party rules are clear when it comes to how governments and political parties carry out their business. And despite the cathartic and frantic attempts by the New Kings Democrats to claim that party “bosses” thwarted their attempts to take over the Brooklyn Democratic County Committee, the fact is they did not have the votes.

They are focused on proxies, which allow elected committee members to have their voices heard if they cannot, for one reason or another, attend the semi-annual committee meeting. While the NKD complain that party leaders held the vast majority of proxies, their protestations fail to acknowledge that they worked very hard to collect proxies, mailing to everyone on the County Committee list seeking support for themselves. They failed.

Frank Seddio, the chair of the party’s Executive Committee, thanks to the hard work of many local clubs, received around 600 of those proxies from County Committee members who believed he would best represent their interests. The NKD, despite their best efforts, claimed they had 130.

I say “claimed” because those who complain the County Committee meeting started two-and-a-half hours late – implying there were some nefarious deeds going on behind the scenes to thwart democracy – know that the sole reason for the delay was because the NKD leaders failed to bring in their proxies at an appropriate time. They did not bring their proxies to the meeting hall until 90 minutes after the meeting was scheduled to start. Attorney volunteers had to sort them through a “bar-code system” that forced everyone in the hall to wait, but party leaders agreed to stipulate that they had 130 proxies so the meeting could start without waiting the additional two hours it might have taken to complete entry of the proxies into the system.

Even though many of the NKD proxies turned out to be invalid for a variety of required reasons, that did not change the fact that the party leadership stipulated and allowed the facially defective proxies to be counted. When combined with the votes of members in the room and the proxies each side held, the supporters of the current party leadership far outvoted those who wanted to seize control.

And since the County Committee is an entity whose activities in organizing the party’s structure and business is set out in state election law, failure to complete the committee’s business effectively would have put the party out of business, blocking it from nominating candidates to appear on the party’s line in elections.

The law is clear. A proxy is the voice of a “person,” someone who previously ran for a position on County Committee, but could not attend the meeting for reasons that could include health, work, family responsibilities, etc. I am amazed to hear that it is somehow undemocratic to allow their voices to be heard via his or her proxy, especially when the NKD worked so hard to gather proxies but apparently lack the support among party members to gather enough to alter the voting outcomes.

The NKD activists and leaders fail to mention that party leaders have acceded to virtually every one of their proposals for rules reform, and welcomed a proposal at the most recent County Committee meeting by Assemblymember Robert Carroll, a respected reformer, to change the proxy rules to require they be carried by another committee member from the same Assembly district. That will go to the rules committee for consideration, the same rules committee that approved every one of the reformers’ proposed changes last time they made them. Being open to ideas through robust discourse is not a novel idea. The district leaders have done just that for many years.

Nonetheless, for some it seems as it just feels better to simply not take yes for an answer, and instead to make up for their lack of broad support at the grassroots level by yelling, screaming, and disrupting the meeting.

We understand that Democratic politics has long been marked by factional family fights, a sign that, in the words of the chair, the party is “alive, exciting, and worth fighting over.” And we understand there is a generational challenge to party leadership, since many in the room started in politics as insurgents themselves challenging the party leadership at the time they entered the fight.

But there is an old lawyer expression that seems to apply here. When you have the facts on your side, pound the facts. When you have the law on your side, pound the law. When you have neither, pound the table.

Intra-party fights take place under the rules of the party, and that includes allowing proxies so Committee members who cannot attend have their voices represented. And make no mistake—it is a voice. That is why the NKD worked so hard to collect proxies, and why the party’s district leaders do so as well.

When they have enough votes to elect their chosen leaders, we will graciously respect the results and work with them to elect Democrats in order to push an agenda to benefit the people of Brooklyn, which is why we are all in this together in the first place.

From my perspective, we must continually work harder to reach everyone throughout every corner of the borough and in between, and remember we are all in this together.

***

Frank Carone, a partner in Brooklyn’s Abrams Fensterman law firm, is the law secretary of the Brooklyn Democratic Party.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.