Gov. Hochul presenting her budget (photo: Mike Groll/Office of Governor Kathy Hochul)

Pandemic Dollars + Improved Tax Receipts = Plenty to Spend

Governor Kathy Hochul released the New York State Executive Budget on January 18, 2022, setting the framework for an adopted budget before April 1 of this year by the Legislature and governor. The state is astonishingly flush with money, both federal pandemic relief funds and dramatically-improved tax receipts.

The Division of the Budget is predicting healthy surpluses in state funds alone, with over $5 billion in the current fiscal year, 2022, over $6 billion in the coming budget year, FY 2023, and surpluses for the entire planning horizon through FY 2027, even after all the federal pandemic relief funds are finally spent in FY 2025.

There’s plenty to spend. The governor’s budget includes an undesignated $2 billion “Pandemic Assistance Fund” from the current fiscal year state surplus to be negotiated with the Legislature. There is a $2.2 billion property tax rebate proposed to be distributed to homeowners this fall, and $1.2 billion for bonuses for health care workers to reward their work during the covid pandemic and retain their employment.

All of these items are funded from the state surpluses and don’t lock in any new spending commitments!

There is also $12.75 billion in federal pandemic assistance from the 2021 Biden Rescue Plan that the state is permitted to spend pursuant to federal approval of a New York plan. The Hochul administration has not yet specified that plan.

Budget Takeaways and a Paradox

Two major factors are driving the budget that seem a paradox, while there’s an opportunity for Governor Hochul and the new Mayor of New York City, Eric Adams, to collaborate in a way that political enemies Andrew Cuomo and Bill de Blasio did not.

While it’s an extraordinarily liberal spending plan, the paradox is that it’s a plan to avoid spending too much in case New York’s problems take a turn for the worse. Meanwhile, Hochul and Adams can collaborate to operationalize the subsidies needed for ambitious affordable housing programs that are not conceptualized in the current budget.

A Liberal Spending Plan

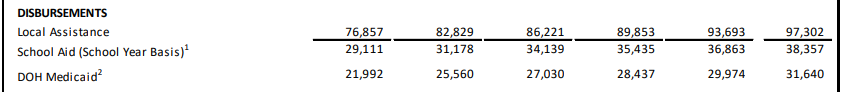

Below are planned expenses over the next four years for education and health care, the two largest parts of the budget, from state operating funds (see p. 84, NYS DOB 5-Year Financial Plan); the numbers are in 1000s:

FISCAL YEAR ’22 ’23 ’24 ’25 ’26 ‘27

Starting in FY 2023, school aid increases from $31.178 billion to $38.357 billion, about $7.2 billion, over four years, nearly 6% a year. There is also $13 billion in federal pandemic relief funds available for schools to be spent over several years.

State Medicaid spending, growing from over $25 billion in FY 2023 to $31.6 billion in FY 2027, is covering health care expenses for 7.7 million New York residents, more than one-third of the state’s population. The State Medicaid spending is only showing the state government’s share of the program. Total Medicaid expenses including federal and local government shares currently exceed $90 billion a year and are anticipated to reach $100 billion in 2027.

But Caution Over New York’s Uncertain Future: Weak Economic and Employment Recovery

The second takeaway is the deep caution in the plan, based on the risks of New York’s uncertain future. New York’s “pot of gold” is occurring despite the fact that the state’s employment recovery is the second lowest across the country since the pandemic low in April 2020 (only Hawaii, also a heavily tourism-dependent state, has a weaker recovery). Spending like the property tax rebate referred to above, from the state’s surpluses, are one-time expenses intended not to recur. In fact, the plan for the surpluses over the next few years is to save most of the money and put it into reserves.

State budget director Robert Mujica, who also held the position under former Governor Cuomo, argues that New York State was badly prepared for the three 21st Century calamities that forced big cutbacks for government in New York. First, 9/11, then the 2008-9 Great Recession, and, of course, the COVID-19 Pandemic.

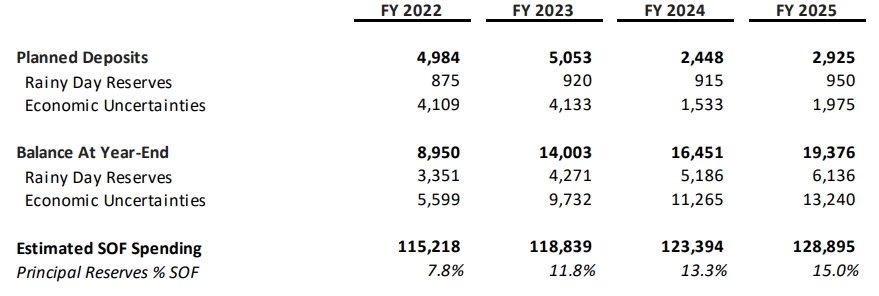

The plan is to bring the state’s reserves to 15% of state operating funds spending (p. 18, DOB 5-Year Plan):

Reserves at the end of the current year, FY 2022, are expected to be $8.9 billion and the plan is for them to grow to over $10 billion by FY 2025, and later reach over $19 billion. New York could then cope with a recession or another pandemic. Mr. Mujica makes no mention in the rationale for major increases in reserves of a dangerous out-migration of residents or the subset of wealthy taxpayers fleeing the state.

Large out-migration from the state was a fact in 2021, however. The U.S. Census reported that the state lost 319,000 residents between July 1,2020, and July 1, 2021, the most in the nation, although Washington, DC had a higher percentage decrease.

New York lost 352,000 to domestic out-migration, while international migration, a major source of population gain of over 100,000 a year to New York for decades, slowed to a minimal increase, 18,000. Trump-era immigration policies and the temporary closure of U.S. borders due to covid slowed international migration dramatically to the whole country, not just New York.

New York raised income taxes last year on the state’s wealthiest taxpayers (those earning more than $2.2 million married filing jointly). Budget director Mujica was asked last month if the increase was driving departures from New York, and said, “We haven’t seen any evidence of that.” He said the federal cap on deductions for state and local taxes could be a larger factor.

New York residents have been moving to the south and the west for decades; the question is whether the out-migration is a step-up from normal and poses a risk to the economy, and whether immigration trends will reverse so that New York can depend on that usual boon to its population and fortunes. Despite Mr. Mujica’s seeming lack of concern, I am sure the Division of the Budget will be intensely monitoring how many wealthy taxpayers are filing returns this year and years after, and how many residents are leaving.

Despite long-standing outmigration from New York, we just experienced an 800,000 population gain in the state, three-quarters of which was in New York City, from 2010 to 2020, according to the U.S. Census. And some of the recent drop could be temporary due to covid. Taxpayers who have moved out of state, to New Jersey or Connecticut, or even other states whose employment remains linked to New York, can still be paying income taxes here because their employer’s base is here.

A Massive Unemployment Tax Liability

A dilemma for the state and its employers is a $9.3 billion outstanding liability to the federal government for a loan taken by New York to help pay unemployment claims during the pandemic, when the need was massive.

Under normal Unemployment Insurance Law, when layoffs occur, employers have their unemployment insurance rates and taxes rise to replenish the state’s Unemployment Trust Funds. Since so many employees were laid off during the pandemic, that means steep rises in unemployment taxes for thousands of New York businesses to help make the Trust Funds whole.

According to a report by State Comptroller Tom DiNapoli, tax increases of $1 billion in 2022 are set and will increase over several years. The report discusses several ways the federal government has authorized states to repay the loaned funds, including one-time options involving the use of general state funds, the use of federal covid relief funds, and even issuing state bonds to help provide relief for businesses. The Empire Center for Public Policy has urged Governor Hochul to use some of the $12.75 billion in federal covid relief funds available to the state to help businesses repay this extraordinary obligation.

For the moment, the dichotomy between the largesse in the state’s treasury and the relatively weak employment gains is explained by the fact that the incomes of the state’s wealthiest and most affluent taxpayers, boosted by gains in the stock market, have held up during the pandemic, along with extra money from the income tax increase in 2021.

A Bonus: Proposed Budget Creates an Opportunity for NYS & NYC to Collaborate on Affordable Housing

There is a real opportunity for Governor Hochul and Mayor Adams to collaborate around housing. The governor’s budget plan includes a new $4.5 billion housing capital plan with intentions to produce or preserve 100,000 affordable units, including 10,000 new supportive housing units, over five years. Although Mayor Adams has not put together his own housing plan, Mayor de Blasio’s Housing 2.0 plan is ongoing, with thousands of low- and moderate-income housing units still anticipated.

While in many cases affordable units can be cross-subsidized with market-rate units in development projects, cash subsidies are essential for poor, needy, and working class New Yorkers and both the governor’s and the city’s housing development plans, including whatever ambition is expressed by the new mayor, will need operational subsidies as the units come on line.

The New York Housing Conference has endorsed the state government creating a Universal Rental Assistance program similar to the federal government’s Section 8 Housing Voucher Program.

New York City’s Section 8 waiting list has 30,000 households, and the city received 8,000 emergency Section 8 vouchers in the federal American Rescue Plan. If the city’s Section 8 waiting list is 30,000, I estimate the rest of the state could have 20,000 households on Section 8 waiting lists in various municipal housing authorities. In December, Governor Hochul signed legislation to supplement the city’s emergency rental subsidy for those experiencing homelessness to bring it to the federal Section 8 level, and there is $100 million in the budget for this program, named Transitional Rental Assistance.

It could cost $1 billion a year to fund 50,000 rental assistance vouchers and set-aside housing units for homeless New Yorkers. The governor could request (and even compel) the city to share costs for the vouchers in the city. With joint funding and integrated planning, new low- and moderate-income units and vouchers can bring major relief. The state and city could start down this path, always hoping for the federal government to come through with additional vouchers of its own.

The state is planning to add over $10 billion to its reserves to reach $19 billion in the next three years. The goal is great, but does the state really need to put all of that money aside? Clearly it could partially fund a state housing voucher plan with some of the money it intends to put into reserves. The surpluses are anticipated to continue past 2025, and it will take time to implement 50,000 new vouchers. If migration out of state clearly begins to impair the economy, or if another recession occurs, the state and city can put on the brakes on this or other spending.

Overall, the governor’s executive budget is sensible, but with the state in such great fiscal shape right now, it is not too risky to add this one major new program -- a state housing voucher to reduce homelessness -- and keep its ultimate cost under control.

***

Jim Brennan was a member of the New York State Assembly for 32 years, where he chaired four committees. On Twitter @JimBrennanNY.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.