Subway ridership (photo: Marc A. Hermann / MTA New York City Transit)

We agree with the MTA that its fate hinges on the federal government, which must provide the MTA at least $10 billion in federal emergency funds through the end of 2021 to prevent the end of the New York City region’s mass transit system as we know it.

The MTA’s options without federal aid from its August “doomsday” plan are all terrible. Worse, they are far from exaggerations and are a glimpse into a possible, very grim future. The parade of horribles range from service cuts and fare hikes to chopping major capital investments to wage freezes. Yet all the unthinkable options in the plan together won’t make up the entirety of the agency’s deficits. This means that all of the MTA’s doomsday scenarios together aren’t a complete picture of the possible devastation that would occur to our transit system without federal aid.

If you take all the “doomsday” cuts together, they add up to nearly $15 billion through 2024. In the short-term, however, the MTA would still be short by more than $2 billion through 2021. Looking further into the future, with these cuts and reductions sustained for four painful years, the MTA is still short by more than $1 billion through 2024, given total COVID-related losses of more than $16 billion.

| 2020 | 2021 | 2022 | 2023 | 2024 | Total, 2020-2024 | |

| MTA Deficit from August “Doomsday” Proposal | -$3,198 | -$5,844 | -$3,485 | -$1,776 | -$1,959 | -$16,262 |

| Reinvent Albany Sum of MTA Doomsday Proposals | $2,055 | $4,664 | $2,347 | $2,884 | $2,968 | $14,919 |

| Amount of Deficit Remaining after Using all Doomsday Plan Options | -$1,143 | -$1,180 | -$1,138 | $1,108 | $1,009 | -$1,343 |

The MTA was clear in its August presentation that these are potential cuts and options, but not yet final proposals. Some board members noted that the plan didn’t make up the entirety of the deficit, and a final, balanced budget will need to be adopted by the end of 2020. Without federal funding, the MTA could be forced to turn these possibilities into real, ruinous cuts. In doing our own analysis of the plan, we are seeking to read between the lines of the MTA’s doomsday options and understand exactly what is at stake for riders. Our graph below shows all the MTA’s proposals together.

Not included in the doomsday proposal is any deficit financing in the form of borrowing from the public markets or private banks for operating expenses. The MTA is, however, proposing deferring as many expenses as possible, such as the payroll taxes that would have been due in 2020 as authorized by the federal CARES Act. MTA CFO Bob Foran called the ability to delay this payment “basically an interest-free loan” from the federal government. The MTA is also seeking to defer payments to its employee pension accounts. Paying back these deferrals in 2022-2024 results in the negative values seen in the chart above.

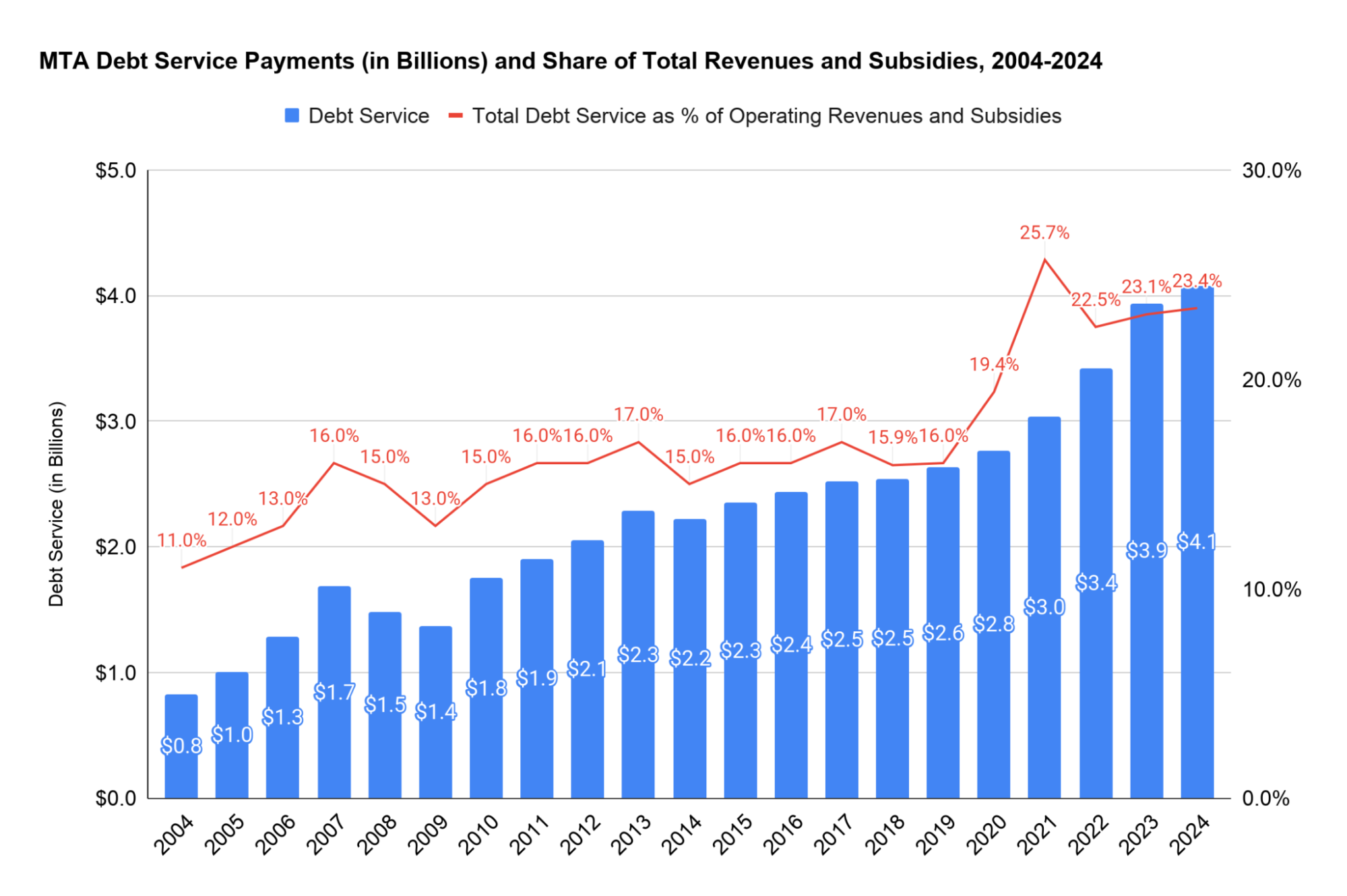

The MTA has already tapped $450 million in short-term bonds from the Federal Reserve’s Municipal Liquidity Facility (MLF), which gave it a better rate than the public market. However, this is less than a nickel on the dollar of what it needs to bridge its deficit through 2021. Borrowing substantially more sums of money to make up the current deficit is a risky endeavor, however. The MTA already has huge debt loads reaching nearly 26% of its expected revenues next year (see below), and taking on more at a time when continual downgrades makes borrowing even more expensive risks crippling the MTA’s future.

Moody’s, in its latest downgrade, specifically noted the possibility of the MTA using deficit financing in its rationale for its downgrade, stating, “While MTA can access deficit financing to alleviate its near-term revenue losses, this solution would be one-time in nature and result in higher debt leverage. Reduced debt capacity would disrupt the timing and implementation of the authority's $55 billion capital program and potentially weaken asset condition and service quality.”

The Fed could substantially improve the MLF with longer-term and lower- or zero-interest loans. This is one way that a limited amount of borrowing wouldn’t put the MTA in an even worse financial situation. Only the federal government has the power to set this type of monetary policy and “print” billions in emergency aid.

Transit Service Cuts and Fare Hikes - $6 Billion through 2024

Possible doomsday service cuts include a 40% reduction on the subways and buses and 50% reduction on the commuter railroads. Yet what would be the most dramatic impact to MTA riders makes a surprisingly small dent on the MTA’s deficit: 40% subway and bus service cuts only amount to $880 million in annual “savings,” 50% commuter railroad service cuts only reduces expenses $160 million a year, and Access-A-Ride cuts would be $65 million a year, together only reducing the deficit by $1.1 billion in 2021. While these cuts together are the largest component of the doomsday plan, the MTA is expected to lose $6 billion in 2021 alone, so these devastating potential service cuts to mass transit are only a small part of the reductions that would need to be made.

The impact of service cuts cannot be minimized, however. Riders Alliance presented their own doomsday map in July, showing visually on the subway map what taking away half of subway service could look like and saying that cuts would be “a crime against the city and its millions of residents, and a deep, self-inflicted wound to the national economy.” These cuts would have real, negative impacts on riders’ commutes, with subway headways (the time between trains arriving) increasing by 8 minutes, and bus headways by 15 minutes. This means longer commutes, and more likelihood of missing job interviews and child-care pickups, and a much slower, worse economic recovery for the region.

While no specific lines were identified for reductions on the subways and buses, the MTA identified two possible commuter rail cuts. Eliminating West of Hudson service on Metro North Railroad would reduce expenses by $25 million annually, and save the MTA $1.2 billion in planned capital costs. Long Island Railroad could also delay even further the start of East Side Access (ESA) service, which would reduce expenses by $250 million. East Side Access was anticipated to start in 2022 after decades of work on the troubled project. Pre-COVID, ESA’s operating costs were expected to be more than what riders would pay in fares for the service, making this choice logical in the short-term, but a head-scratcher in terms of the overall cost/benefit of the project. The State Comptroller said ESA operating costs will reach $205 million in 2023, but raise only $14 million in fare revenue.

The pain of these transit cuts could be exacerbated by a bigger fare hike than already planned. The MTA typically budgets for fare hikes every two years at 4% each, and the MTA’s August doomsday options float an additional 1% hike, meaning there could be fare hikes of 5% each in 2021 and 2023. To increase fares at a time when nearly 20% of NYC residents are unemployed would be another severe blow to the region’s recovery.

Fare hikes would mean a monthly Metrocard could increase to $140 a month in 2023 from $127 today, or a single-ride would rise to $3 from $2.75. Typically the MTA has sought to keep single-ride prices low, however, while increasing monthly and weekly card costs to limit the hardship for low-income individuals who tend to buy single rides. These fare increases would generate about $300 million extra through 2024. This means that riders would essentially be paying even more for much less. And with a system both less reliable and more expensive, concerns about a “death spiral” with more people choosing not to ride the system are real, and these “savings” projections may not fully factor in a large drop in ridership.

Bridge & Tunnels Toll Increases and Workforce Cuts - $2.7B

Additional workforce reductions and toll hikes are also possible for Bridges & Tunnels (B&T), which is a revenue generator for the MTA and will remain so with traffic on the bridges and tunnels down about 12% in September from 2019 as of the writing of this piece. Tolls of an additional $1 beyond planned 4% increases in 2021 and again in 2023 would bring in considerably more than the possible fare hikes for trains and buses at nearly $2 billion through 2024. Additional funds could be raised from eliminating resident discounts ($65 million annual) and implementing peak pricing ($100 million annual).

While B&T is the “cash cow” for the MTA, raising billions to subsidize mass transit service and increased tolls will help to offset the deficit, it is important to remember that the MTA doesn’t control all bridges into Manhattan. It therefore cannot effect the same type of outcome on gridlock reduction and air control improvement as congestion pricing would. “Toll shopping” is a continual problem for communities neighboring free bridges, and the current toll structures of bridges and tunnels across the region is not rational. Federal approval of congestion pricing remains essential. However, the MTA must consider robust toll increases as part of its deficit reduction plan, as it is one of the few revenue sources it controls on its own.

There is no real “service” equivalent resulting from B&T workforce reductions as would occur for mass transit. The 300-person workforce reduction does have consequences, like increased lane closures, delays in responses to non-critical incidents, less customer-facing maintenance such as painting and landscaping, and less frequent customer messages. (It is too late, however, to pull back on the $30 million in colorful tiles for B&T tunnels as ordered by Gov. Cuomo.) But it’s not like the MTA’s bridges and tunnels would be fully closed down to drivers 40-50% more like the service cuts that would be inflicted on mass transit riders, or the Whitestone Bridge would suddenly be closed to all traffic like the potential closure of West of Hudson Service.

Therefore the “pain” felt by drivers of an additional $1 toll is largely at the pocketbook rather than the huge opportunity cost of waiting for unreliable and unaffordable mass transit service. (The New York City Comptroller quantified the economic cost of subway delays in 2017 at the recent height of subway meltdowns as $389 million annually, and it is reasonable to see a 40% service reduction having an even worse economic impact.)

Capital Plan Delays/Reduction - $1.5B through 2024

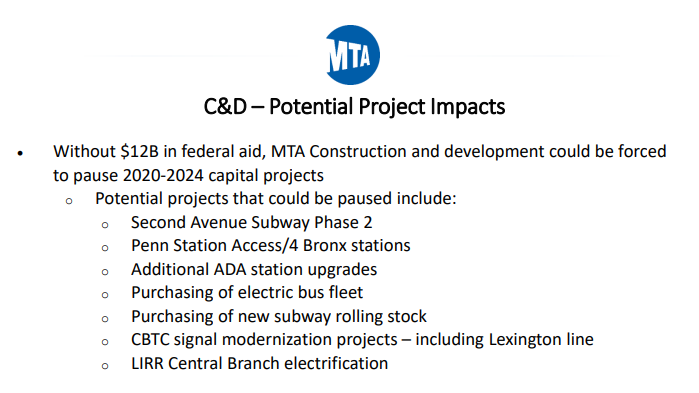

The MTA’s plans also include pausing or reducing the agency’s capital program, which for 2015-2019 is still unfinished, and for 2020-2024 had barely begun. While we have questioned the MTA’s ability to finish its capital plans on time, capital work is essential to keep the system running and there is more than enough decaying infrastructure to fix. The 2020-2024 plan included buying new trains and buses, as well as modern signals to keep trains on schedule, and the MTA’s August doomsday plan indicated that nearly all big-ticket items from the plan are at risk of being “paused”:

A “pause” on the capital plan is only one possible outcome, however, given that the capital funds may be used for operating costs. The Governor and State Legislature in April gave the MTA the ability to use “lockboxed” 2020-2024 capital funds for operating expenses rather than bonding them out for capital projects after sign-off from the MTA Board and the Director of the Division of the Budget (Robert Mujica, who also sits on the MTA Board). Under the current legislation, this would be allowed through 2021, and could be paid back if enough federal funds come through to both plug the operating budget gaps AND pay back money “borrowed” from the capital plan.

Without congestion pricing, the amount of lockbox funds available is less than originally anticipated at just under $1 billion through 2024 according to the MTA’s August document. The MTA also floated spending $674 million in “pay as you go” capital funds on operations. Using capital funds for operating may be a prudent short-term solution, but eventually, the system will simply fall apart if it is not maintained.

The doomsday plan lists so many major projects that could be delayed or cut that it basically says nothing. The process for changing the plan will be rife with politics (much like the adoption of the capital plan itself) and advocates for each of these projects are likely to clash over which are crucial enough to remain in the capital plan. Additionally, changes to the plan will require the sign-off of the Capital Program Review Board, which has appointees from the Governor, state legislative leaders, and New York City Mayor. While the CPRB failed to be formed in December 2019, essentially approving the 2020-2024 plan “by default,” the stakes are even higher now with the possibility of a scaled-back plan, and it seems more likely that the CPRB appointers might want to exercise their votes this time around.

With a reduced capital plan, the MTA’s focus should be on keeping the trains and buses running, not embarking on costly expansion projects whose return on investment is questionable - take East Side Access for example, whose service is on the chopping block because the $11 billion project is going to cost more to run that it will bring in fare revenue, as noted previously.

Workforce and Non-Service Impacts - $4.3 Billion

Given the workforce reductions that could happen with the massive service cuts -- 7,200 for New York City Transit alone -- the MTA has also listed possible reductions to headquarters’ costs like consulting contracts, something that front-line workers and unions have frequently called for. Cutting consulting contracts would save $310 million through 2024 (though consultants often do essential work on IT systems, for example, that would need to be taken up by MTA staff instead), and the MTA has floated other “non-personnel” reductions of $875 million through 2024.

The MTA also listed the possibility of either postponed wage freezes (net of zero, but $536 million in deferred costs through 2022) or permanent ones ($1.1 billion in cuts through 2024). Additional workforce reductions of 1,000 workers would cut costs by $125 million annually.

Overtime cost reduction has been a continual focus of the MTA and more is proposed in the plan at $975 million through 2024. However, with a gutted workforce and a wage freeze ($1.1 billion through 2024), overtime cannot be eliminated entirely and it will be difficult to cut back unless the current workforce is aligned perfectly with the MTA’s needs. With fewer workers available, the goal might be to reduce unplanned overtime, to ensure that the amount budgeted is correct.

Lastly, the MTA is floating deferring a number of employee-related costs. These include payroll taxes originally due in 2020 ($473 million, to be paid back in 2021 and 2022), and pension plan deferrals ($1.8B billion to be paid back 2022-2024). The MTA has also floated using other post-employee benefits (OPEB) trust funds in 2022, freeing up $336 million. However, MTA Chief Financial Officer Bob Foran noted at the August MTA Board presentation that “this is money that was set aside to be invested at a higher return to provide for future health care costs.”

The proceeds from this are unknown in terms of the higher costs MTA would pay without this investment. It is considered best practice to have OPEB trusts, as they will lower costs in the long-term. For all of these items, they are simply helpful for cash flow in the short-term, as the MTA seeks to keep the system running in the absence of federal aid. But eventually these costs will need to be paid back, and the longer the MTA waits for federal funds, the more it will have to resort to measures that risk its ability to provide the type of service that New York City needs for its economic recovery.

***

Rachael Fauss is senior research analyst for Reinvent Albany. On Twitter @RachaelFauss & @ReinventAlbany.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.