Gov. Cuomo (photo: Governor's Office on flickr)

Since his time as attorney general, Governor Andrew Cuomo has painted a picture of New York as a state cluttered by redundant and inefficient municipalities, attributing the state’s notoriously high property taxes in large part to a bureaucratic web of overlapping government services.

Cuomo’s latest attempt to detangle the web is an incentivized competition challenging two or more local governments to come up with a bold consolidation plan as a way to cut spending, increase efficiency, and lower property taxes. This could mean anything from localities deciding to share park maintenance services or fire departments, for example, or a plan to dissolve a smaller government into a larger one.

The program piggybacks on a series of tax caps and rebate programs Cuomo, a second-term Democrat, has initiated since taking office. The prize is $20 million, part of $70 million earmarked for improving government efficiency in the $155.6 billion 2016-2017 state budget.

In theory, streamlining government to ease taxpayers’ burden is a good idea, but it is essential to identify not just any municipal consolidation, but the types most likely to produce taxpayer savings. There is also some debate as to whether, and to what extent, municipal consolidation addresses the underlying causes of the New York’s property tax problem. Furthermore, in more affluent localities, residents often say they prefer to pay higher taxes in exchange for the personal touch of smaller government agencies.

In 2010, when Cuomo was running for governor, property taxes were rising at an unsustainable average rate of 5.7 percent per year, with homeowners in 33 of New York’s 62 counties facing a property tax burden surpassing the national median. Initiatives like the new municipal consolidation challenge have been successful at curbing the upward trend, according to Cuomo’s office.

“Over the past five years, Governor Cuomo has restored fiscal responsibility to the state – reducing costs, cutting red tape and delivering relief for New York taxpayers,” said Cuomo spokesperson Abbey Fashouer. “The Municipal Consolidation Competition marks another step forward in these efforts, incentivizing local governments to find innovative ways to share services, find efficiencies and ensure a stronger, more affordable Empire State for all.”

This latest contest supplements Cuomo’s 2014 property tax “freeze,” which is in reality a credit that incentivizes municipalities to find ways to cut costs and stay within the state’s cap of 2 percent annual increase in property taxes, and is projected to save property taxpayers more than $1.3 billion over three years. Cuomo has also instituted an informal 2 percent cap on annual increases in overall state spending.

The tax “cap,” which in 2017 enters its fourth consecutive year, seeks to prevent municipal and school tax levies from increasing beyond 2 percent or the rate of inflation, whichever is lower. This year, at .68 percent, the increase limit -- which applies to all localities except New York City -- is at a record low, and while this is in one way good news for homeowners, strapped municipalities are bound to feel the strain, according to state Comptroller Thomas DiNapoli.

"In what is becoming the norm, New York’s local governments must cope with extremely limited growth for property taxes to stay within the tax cap,” DiNapoli said in his announcement of this year’s tax cap. “Low inflation has positive effects for consumers, but it also reflects an uncertain economic environment. Local officials have faced growing fixed costs and limited budget options for years, but 2017 will necessitate even tougher financial choices.”

In response, a growing number of localities are voting to override the tax cap, with 26 percent opting out in 2016. Cuomo’s new contest, which targets the state’s 13 largest municipalities outside of New York City -- only cities, towns and villages with populations of at least 50,000 (according to 2010 U.S. Census data) may apply as the lead applicant -- may help mitigate that trend for the coming year.

One such municipality is the City of New Rochelle, which will be forced to break through the tax cap next year to invest in the city’s infrastructure, according City Manager Charles "Chuck" Strome III.

The city’s chief administrative officer, appointed by the New Rochelle City Council, Strome explained that the city has been searching for ways to share services with neighboring municipalities since before Cuomo took office, partnering with neighboring suburbs of Pelham Manor, Mamaroneck and Larchmont on services like street cleaning, snow removal, and sanitation.

“I’m not really moved by competing for prizes. For me, that’s just a show,” Strome said in an interview. “I think the state’s policies recently have been very detrimental to municipalities. We've been doing things in New Rochelle long before there was a prize at the end of the rainbow.”

Rochester, the state’s third largest outside of New York City, sees itself as a leader in the region on municipal consolidation, forming cooperative agreements with the Monroe County and neighboring municipalities on things like 9-1-1 dispatch services, waste management systems, telecommunication providers, and more. Officials there were more amenable to Cuomo’s consolidation contest, but said that the most “low-hanging fruit” has already been identified and implemented.

“Given that we've done a lot of this already, we're a little challenged to find additional opportunities, but we are open to it,” said Chris Wagner, budget director for the City of Rochester.

Cuomo often focuses on the number of municipalities in New York, suggesting overlapping and redundant governments are a main driver of rising property taxes. “The cost, the waste, the inefficiency of our 10,500 local governments is still this state’s financial albatross and that is what is driving up the cost,” Cuomo said during his 2016 State of the State address, on January 14.

While it is true that on average New Yorkers continue to pay some of the largest property tax bills in the country -- 13 percent of the average household income -- there is a lively debate among social theorists about whether fewer, and thus larger, governmental bodies results in more efficiency and lower property tax bills. And, the actual number of “local governments” is up for debate.

Some dispute the 10,500 figure, saying it includes “special tax districts” -- in-town sectioning created out of specific residential needs that are brought on by suburban growth -- which often amounts to paperwork rather than additional government expenditure. (The 2012 U.S. Census of Governments places the number of cities, towns, and villages in New York State at 3,453 -- which is fewer than the national average for states across the country.)

Since Cuomo took office, the number of government service providers has been reduced, though savings produced have been relatively small. For example, since 2011, 18 New York water districts consolidated into five with a projected annual savings of $1.2 million; 72 sewer/wastewater districts consolidated into three, with a projected savings of $522,000; and six fire and fire protection districts consolidated into two fire districts, with a projected annual savings of $959,570; all according to Cuomo’s office.

Full consolidation of services or government entities tends to elicit resistance, so functional consolidation is often the most politically expedient solution for overlapping services.

Functional consolidation, in which similar municipal agencies both remain in existence, but cooperate on whether to perform the same or distinct functions for a larger geographic area, has been shown to save money and improve quality of life. Either one government entity pays the other for services or one agency performs a specific function and the other agency takes on a different function in exchange.

These partnerships are typically evaluated on a case-by-case basis. In 2012, when the Town of Brighton voted to dissolve its understaffed West Brighton fire protection district and contract with the Rochester Fire Department instead, it resulted in savings for both taxpayers in Rochester and Brighton, according to Wagner, the Rochester budget director. “From our experience, it not only helps on the property tax side of things, but it helps to improve planning and response time to a situation,” Wagner said.

Meanwhile, several years ago, a plan for the City of Rochester to combine water supply systems with Monroe County was nixed when it was determined that it would not result in savings, according to Wagner.

E.J. McMahon, president of the Empire Center, a conservative think tank, notes that smaller towns and villages often prefer to see their tax dollars used for a personal, responsive touch from police, fire, and sanitation agencies. However, McMahon says, these more localized services are not the primary driver of New York’s property tax problem. McMahon points a finger instead at state-mandated Medicaid, pension, and education costs.

“Municipal consolidation is not a panacea and it’s kind of a dodge,” McMahon said. “[Cuomo’s] premise is we have too many local governments, and that’s why we have high local taxes, and that’s essentially untrue.”

A better way to slash property taxes, he says, would be to reform New York’s 30-year-old Triborough Amendment, which requires public employers to maintain contractual agreements, including automatic pay increases, for unionized employees after their collective bargaining agreement expires -- a policy that adds $300 million a year to school budgets across the state.

The governor’s administration says it has taken steps to reduce the number of unfunded mandates -- a term used to describe burdensome state requirements that do not come with requisite funding -- establishing a Mandate Relief Council in December 2013. But while rising local school costs are offset by huge amounts of state funding -- in the 2016-2017 budget, the state allocated $24.8 billion for education aid, up 6.5 percent from the prior year -- and the state has tried to to reel in pension growth, municipalities say they are forced to make painful cuts and delay important capital projects to meet the tax cap year after year.

Strome, the city manager, noted that municipal expenses account for only 18 percent of property tax bills in New Rochelle. The bulk of it comes from school and medicaid expenses. “Most people, if they knew the facts, they'd be happy to have multiple trash pickups and police and fire services and acres and acres of parks for $3,000 a year,” he said. “The state has dumped millions of dollars in increased school aid, but municipalities have gotten zero. In my opinion, until the state seriously looks at how it deals with education, we’d never address the property tax problem.”

In other areas, like Nassau County, where residents pay some of the highest property taxes in the country (the average annual property tax bill topped $9,000 in 2013, according to a Zillow report), the imbalance is starker. The Town of Hempstead made several difficult cuts this year, including laying off 36 employees, but only 9 cents per tax dollar homeowners pay goes toward municipal programs and services (incorporated villages pay about 2 cents per tax dollar to the township). More that 60 percent of Hempstead taxes go to schools and libraries, another 16 percent goes the county tax -- which includes Medicaid -- and another 5 percent goes toward special districts (which Cuomo counts among the New York’s 10,500 municipalities). (see map, via the Long Island Index)

In other areas, like Nassau County, where residents pay some of the highest property taxes in the country (the average annual property tax bill topped $9,000 in 2013, according to a Zillow report), the imbalance is starker. The Town of Hempstead made several difficult cuts this year, including laying off 36 employees, but only 9 cents per tax dollar homeowners pay goes toward municipal programs and services (incorporated villages pay about 2 cents per tax dollar to the township). More that 60 percent of Hempstead taxes go to schools and libraries, another 16 percent goes the county tax -- which includes Medicaid -- and another 5 percent goes toward special districts (which Cuomo counts among the New York’s 10,500 municipalities). (see map, via the Long Island Index)

Cuomo’s office disputes the charge that the governor has not addressed education and Medicaid costs. In addition to flooding cities with education aid, the administration notes both the governor’s Medicaid reform efforts have saved taxpayers an estimated $34 billion over the last five years and the Global Medicaid Cap, which eliminated any growth of Medicaid expenses for counties (meaning any amount of spending over counties’ fixed dollar amount is picked up by the state).

“Governor Cuomo has implemented a number of targeted reforms to deliver relief for New York taxpayers – and they are working,” said Fashouer, a Cuomo spokesperson. “Today, taxes are at their lowest level in decades, we’ve capped [growth of] property taxes at 2 percent, we’re making record investments in education while delivering quality healthcare more effectively and efficiently than ever before.”

The most ambitious type of consolidation is full-scale city-county merger, in which a city and the surrounding county combine to create a metropolitan form of government, or a “super” county. Over the last 30 years, major Upstate cities have faced rising poverty rates and an increased dependence on state aid to balance their budgets. Social theorists say that in addition to consolidating duplicate services, city-state consolidation can curb urban sprawl and compel suburbanites to contribute more significantly to services provided by the city, which are utilized by everyone.

Cuomo’s municipal consolidation contest coincides with the ongoing effort to merge the City of Syracuse and Onondaga County, called Consensus. The region was granted $500 million in a similar 2015 state-funded contest, a portion of which Cuomo said was contingent on Syracuse following through on its ambitious consolidation plan.

Studies on whether larger municipalities are actually more efficient have produced mixed findings. A study done 10 years after the 1998 amalgamation of Toronto, for example, indicates that larger governments become more less responsive and more sluggish, resulting in increased costs.

Not that taxpayer savings should be the primary, or only, motivation for large-scale municipal consolidation.

In the case of the Syracuse merger, more equitable distribution of better quality services across the the county is a major focus. One of the most influential advocates for this type of merger is David Rusk, the former mayor of Albuquerque, New Mexico, who long-argued for what he terms an “elastic city” — one free of geographic limitations — which could help rectify economic, social and racial inequities, he says, and encourage greater political participation county-wide. However, in places like Syracuse, people of color who live in the city fear they’ll lose political influence with a larger unified government, while suburbanites feel that the consolidation could dilute their quality of service.

City-county mergers are notoriously difficult to pull off. While there has been some success in other parts of the country, all recent merger attempts in New York, like a proposed Buffalo-Erie merger in the early 2000s, have failed. The state’s only major regional consolidation was in 1898, when the City of New York was formed out of five boroughs, and the Syracuse-area Consensus plan is seen as an experiment of whether a consolidation of this scale can work again.

Cuomo has enthusiastically supported the Syracuse merger, but as Politico reported, the plan is at risk of being derailed by long-standing differences among Cuomo, Onondaga County Executive Joanie Mahoney, and Syracuse’s Mayor Stephanie Miner, and there are still more questions than answers about how it would meet the at times conflicting interests of city residents and suburbanites.

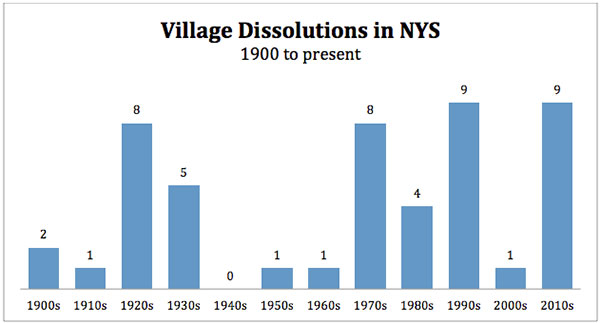

Occasionally, villages vote to dissolve themselves into neighboring municipalities -- since 1921, 47 village governments in New York have dissolved, 10 of them in the past five years, according to a recent Empire Center report (see graph below). As attorney general, Cuomo pushed through a bill easing the village dissolution process and sweetening the pot for eligible villages with a $58,006 “Community Empowerment Tax Credit” when the dissolution is approved.

In these instances, however, the tax savings per household are usually small, and more often than not, villagers resist consolidation, saying they’d prefer to pay slightly higher taxes to retain their community identity and personal touch from local government.

An example of this is the Village of Cayuga Heights (the Ithaca suburb where this reporter grew up), which has its own mayor and government and where residents consistently vote against joining its fire and police services with neighboring municipalities. “I think if we were to say, ‘Oh, let’s just join up with the Village of Lansing,’ we’d be bigger than the city of Ithaca, but we’d lose a lot too,” said Joan Mangione, the village clerk and treasurer. “When our residents come in to pay taxes, they want to feel ‘this is my best tax dollar at work.’”

Despite an attachment to these extra amenities, Cayuga Heights officials tout the village’s extensive record of looking for consolidation opportunities that make sense: it is a partner in Bolton Point, a water supply plant built in 1976 that serves five municipalities and it is represented in Tompkins County Council of Governments (TCCOG), one of two county committees in the state that meet regularly to discuss shared services, including a progressive healthcare consortium that has saved taxpayers millions of dollars.

Other examples of residents electing to pay a higher price tag for uniquely responsive municipal services can be found in many towns, villages and hamlets of Westchester County, where residents consistently pay the highest property taxes in the nation (an average of $13,842 per household in 2013, according to Zillow). The bloated bill is often justified by the county’s exemplary schools -- where between $20,000 and $50,000 a year is spent on each pupil --- and a small town approach from police, fire, and sanitation workers.

Political scientist and SUNY New Paltz professor Gerald Benjamin, a proponent of municipal consolidation, says that these New York municipalities should be more open to compromise.

“Look, we want low costs, we want our services, we have to have a hierarchy of values, and we want democracy -- which we are not always getting, because it’s too complex,” Benjamin said. “If we want all those things, they run into each other; they are not all aligned. Sometimes you are presented a range of desserts at Thanksgiving — but if you eat them all, you are going to get fat.”

***

by Rachel Silberstein, State government reporter, Gotham Gazette

@RachelSilby @GothamGazette