New York's Now Beleaguered Financial Workforce - Tables

Table 1.

|

|||||

| Finance |

230,366

|

247,143

|

7.28%

|

||

| Other Sectors |

1,380,109

|

1,571,381

|

13.86%

|

||

| Percent in Finance |

14.30%

|

13.59%

|

|||

| Outer Boroughs | |||||

| Finance |

39,717

|

39,562

|

-0.39%

|

||

| Other Sectors |

1,115,297

|

1,387,362

|

24.39%

|

||

| Percent in Finance |

3.44%

|

2.77%

|

|||

| New York City | |||||

| Finance |

270,083

|

286,705

|

6.15%

|

||

| Other Sectors |

2,495,406

|

2,958,743

|

18.57%

|

||

| Percent in Finance |

9.77%

|

8.83%

|

|||

| Rest of Metro Area | |||||

| Finance |

163,613

|

188,191

|

15.02%

|

||

| Other Sectors |

3,147,039

|

3,344,789

|

6.28%

|

||

| Percent in Finance |

4.94%

|

5.33%

|

|||

| Total NY Metro | |||||

| Finance |

433,696

|

474,896

|

9.50%

|

||

| Other Sectors |

2,495,425

|

2,958,762

|

18.57%

|

||

| Percent in Finance |

7.14%

|

7.01%

|

Table 2.

|

Table 3.

Table 4.

|

New York's Now Beleaguered Financial Workforce

New York City is reeling from the Crash of 2008. Unemployment in the city has increased from 5.1 percent in May 2008 to 8.9 percent in May 2009. New York City's Independent Budget Office predicts a substantial decline in employment and revenue for the next three fiscal years.

The Bloomberg boom has become the Bloomberg bust, and it may be with us for the next several years. Furthermore, as the city recovers it seems unrealistic to expect that the finance sector, the city's economic driver, will soon regain its full luster. It may well be a long, long time before it once again spins off new high paying jobs in finance, much less in industries that cater to finance and generates the billions in tax revenues that the city and state have come to depend upon. A close look at the finance industry in New York reveals not only what everyone know -- that it paid well -- but that the largesse extended to people in a variety of occupations, who will now all bear the brunt of its decline.

Blowing Up the Bubble

Through 2007, the finance sector rode a wave fueled by its packaging of mortgages as derivatives, creating and selling insurance for these mortgages and securities, rating these instruments as triple A, and selling them through financial institutions to various funds and institutions worldwide. Indeed, many in finance made literally millions, some multi-millions, doing this business. The lawyers handling the deals also became wealthy.

As analysts and journalists explore the wreckage wreaked by the finance sector upon the city, the country and global economy, it is now obvious that much of the prosperity was based upon a huge bubble. The bubble generated billions of dollars in bonuses, profits and tax revenues, and thousands of jobs. The growth and prosperity of this sector really began as the city emerged from the crash of 1987, through the 1990s, and rose again after the tech crash in 2000 and 9/11.

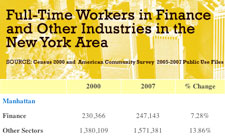

Just before the meltdown the finance sector employed some 475,000 full-time workers in the New York metropolitan area, including parts of New Jersey and Connecticut, Long Island and the northern suburbs in New York State. Of these, 287,000 or 64 percent worked in New York City. Of the city workers, 86 percent worked in Manhattan.

Interestingly, though, while jobs in finance increased by 7 percent from 2001 to 2007, the number of jobs in all other sectors increased by even more. In 2007, jobs in finance accounted for 7.01 percent of all jobs in the metropolitan area, down slightly from 7.14 percent in 200.

(Table 1has information on the full-time employment of workers in the finance sector between 2000 and 2007).

The crash and meltdown have led to the unraveling of much of the finance sector. All investment banks have now become conventional banks, Lehman and Bear Stearns are no more, Merrill Lynch is part of the Bank of America, Wachovia of Wells Fargo and many banks have announced layoffs, and most are now partially owned by the U.S. government. Though Goldman seems to have dodged much of the bullet, as has JP Morgan Chase, the same cannot be said of Citigroup and some of the other large banks, former investment banks, brokerages and insurance companies, such as AIG.

The Finance Workforce

The financial area lost 37,400 jobs in the metropolitan area from May 2008 to May 2009, decreasing 4.7 percent, the Bureau of Labor Statistics has reported. "Over the year, New York City shed the most financial activities jobs since September 2002 with the city's securities, commodity contracts, and investments industry accounting for almost 60 percent of the area's job contraction in the sector," the bureau found.

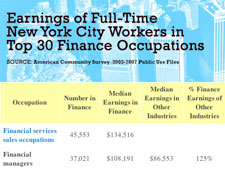

As finance led the city and region into a boom, it is now leading them into the most serious economic downturn since the Great Depression. As Table 2 shows, jobs in finance cover a wide array of occupations. Many jobs are sales jobs; others are directly related to finance and management. For instance, sales was the number one occupation in finance followed by financial managers, and other financial specialists were number three. However the top 30 finance occupations includes computer professionals; secretaries; software developers; office supervisors; bank tellers; guards, watchmen and doorkeepers; receptionists and other garden variety occupations. Obviously, the need for salesman and managers has substantially declined. But the reductions in finance also include the other ancillary occupations that supported the industry.

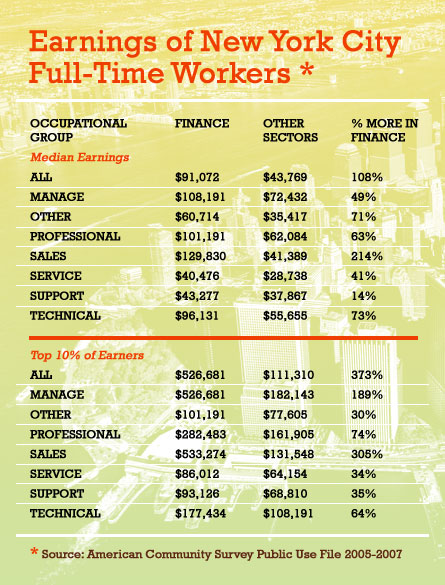

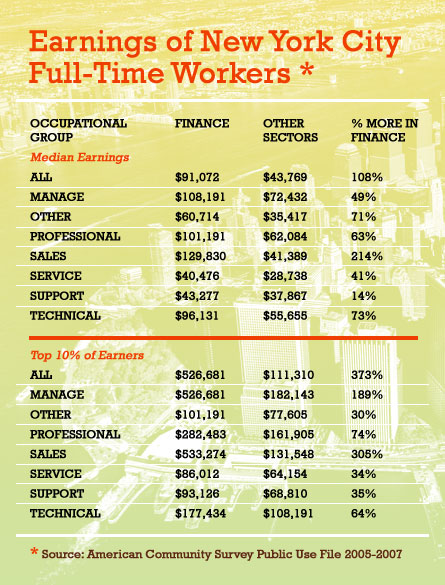

In general, as table 3, above, shows, these jobs in finance paid better than similar work in other sectors.

Grouping the occupations, one finds that for all types of jobs, the median earnings in finance were higher, often substantially higher than in other sectors. Indeed, for all full time workers, finance median earnings were more than double those in other industries, and for the top 10 percent of earners, finance paid almost five times as much as other sectors. Many finance jobs were in sales and management, two areas where earnings were much higher for those in finance, however all workers were paid more in this sector, even support staff, which paid 14 percent more than their counterparts in other fields.

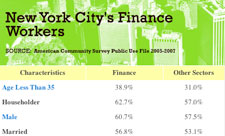

Aside from being very highly paid, compared to others, those working in finance were different in other ways, as Table 4 shows. They are younger than the average New York City worker and more likely to be male, live with a spouse and reside in an owner occupied dwelling. More of them are white and Asian and fewer are black, Hispanic or multi-racial. They are less likely to be foreign born and much more likely to be college grads -- 69.4 percent versus 42.3 percent. In short, they were richer, whiter, and more educated than other city workers.

The decline of the finance sector is now in full swing. Already, about 10 percent of the finance jobs have been lost. More are being lost daily. Manhattan and the tonier sections of Brooklyn have faced sharp declines in housing prices, and even in rent. Laid-off financial executives and sales people are looking for other lines of work.

The collateral damage of both the bubble and bust will affect all New Yorkers. Those such as high-end car dealers, real estate developers and the like, along with restaurant owners and even storefronts selling Chinese take-out already have been affected. Though some New Yorkers may get satisfaction from seeing the finance sector and its rich employees take a beating, in fact, all of us will be worse off from the crash. Because even if the gains may be seen as "ill gotten," we all depended upon them. Replacing or rebuilding the sector will not bring back the days of wine and roses. Soon the boom of the early 21st century may be just a distant memory, as we all learn to live with much more straitened circumstances.

Andrew Beveridge, professor of sociology at Queens College and the Graduate Center of CUNY and instigator of www.socialexplorer.com, has been in charge of the demographic topic page since January 2001.

Documenting the Undocumented

At a community center in Sunnyside, Rosalva Rodriguez, a Colombian immigrant, sits working on a quilting pattern. The room is filled with the sound of consecutive Bingo numbers, called in both Spanish and English to an elderly crowd.

Rodriguez of Woodhaven talks openly about her immigration status. She says she has a green card, and her sons are both citizens. She's extremely knowledgeable about the upcoming 2010 Census, citing its implications and benefits, and says that she will, of course, participate.

But Rodriguez is a rarity among New York's hard-to-count immigrant community.

Many are scared to share their information, reported the U.S. Census Bureau at a recent press briefing. But on a survey where population is directly tied to federal funding and congressional representation, New York officials and organizations want to ensure every person is accounted for. In particular, calculating the city's estimated 500,000 undocumented immigrants has proven to be a substantial hurdle in achieving accuracy. For many of these individuals, the 2010 Census represents a murky unknown -- a vast question mark, which many fear could lead to a one-way ticket home.

"They are scared to participate because they think this survey will work to deport them," says Rodriguez in Spanish.

Adds a woman quilting beside her, "They think the information collected from the census will later go to immigration [enforcement], and then immigration will tell on them."

This is the exact mentality the Census Bureau is trying to combat. On June 2, a coalition of immigrant organizations, government officials and census representatives held a press conference for ethnic and community media.

The panel urged the 50-some reporters to get the word out to their constituents, allay their fears and promote the benefits of taking part in the national count.

"I want to assure you that participating in the census is safe," said Allison Cenac, senior officer in the New York regional census office. "We just want to get New York City counted… No one will be deported or lose their homes."

Why Do It?

Not only safe, officials said it is highly advantageous for undocumented immigrants to take part, since their involvement would lead directly to increased federal monies for services used daily by non-citizens, such as subways, hospitals and schools. Officials reiterated that the information would not be handed to other government agencies, and that sharing of census data was a punishable offense.

Though the census won't be mailed out until March of next year, the bureau has already started an aggressive campaign to reach undocumented individuals, according to Stacey Cumberbatch, the New York City census coordinator. They've partnered with local grassroots and immigration nonprofits to tailor their outreach to specific ethnic and religious communities. In addressing the wide range of languages -- 146 are spoken in city public schools -- the Census Bureau has translated their website into 18 and will mail out language guides on how to obtain a form in 59 languages, said Cumberbatch.

To increase response among all demographics, the form is the shortest in a participant's census history, and it does not include questions about social security numbers or income. Census representatives are also stressing the role of ethnic and community newspapers in getting the word out.

"No one can get this information to your communities like you guys can," said Juana Ponce de Leon, the executive director of New York Community Media Alliance.

By using these trusted, local mediums as outlets, the bureau is hoping they will get the message across to hard-to-count communities. If not, said one official, the effect would be "devastating."

"If undocumented folks do not participate they do not exist," said Cumberbatch.

Why Not?

An overwhelming number of organizations and politicians have heeded the call of the Census Bureau and have urged participation in their communities.

But Reverend Miguel Rivera, chairman and chief executive officer of the National Coalition of Latino Clergy and Christian Leaders, is leading a boycott against the national count. His organization represents over 20,000 pastors in 34 states, who are asking their undocumented constituents to protest the census unless "comprehensive immigration reform" is established first. Rivera claimed one million members, about a quarter of the group's affiliates, have already expressed support.

"Yes, our presence here and an accurate count are very important, but only if we have the same rights as everyone else," said Rivera. "The reality is, for the last eight years, and many more, we have been waiting for some solution."

Rivera said a boycott would have occurred with or without his help. He argued, however, that an official protest pushed by the coalition would effectively "bring the immigration issue to the forefront of dialogue" and "finally put pressure on Congress." Additionally, he claimed there are no benefits for the participation of undocumented immigrants in the census, aside from allocation of resources to public schools.

Census organizers and community groups promoting an accurate count are calling the movement counter-productive and illogical.

"It's slightly absurd," said Alan Kaplan, civic and electoral participation program coordinator for the New York Immigration Coalition. "It will lead to an undercount of a population which desperately needs to be counted correctly in order to show their power, their strength, and get their federal dollars."

Marlene Cintron, executive director of the New York State Senate Puerto Rican/Latino Caucus, echoed the point, emphasizing the political value of the census.

"This effort threatens to undermine our badly needed representation at all levels of government," said Cintron. "It's extremely important that all of us be counted so we receive… a bigger share of individuals that will represent us."

But, Rivera contended, this is the exact point he takes issue with. He said that since undocumented immigrants are counted, yet cannot vote, they are not able to choose who is representing him. The result, he said, is an increase of delegates pushing an anti-immigration agenda in areas with a strong conservative base, like parts of Long Island.

"The people who actually get to vote are the ones who are grateful for that effort from undocumented people," said Rivera.

Back in Sunnyside, Rodriguez says she understands why Latinos would join this boycott, considering restrictive laws and the aggressive policies of agencies like the Immigrations and Customs Enforcement.

"It's logical. It's logical that people think this because they have seen what the government has done," she says. "They have seen two men at the door at four in the morning…" she adds, her voice trailing off.

Kaplan said regardless of the national clergy coalition's support, in the end, their efforts will hurt their own communities.

"Whatever media coverage, whatever their gain, it's going to be discounted by the fact that their communities will be underrepresented."

Counting Everyone

According to a 2008 report by the Pew Hispanic Center, there are 11.9 million "unauthorized immigrants" living in the U.S. Though Hispanics constitute about three quarters of that figure, Kaplan said it's critical that efforts to count non-citizens reach even the smallest factions.

"We're not only dealing with Latinos in the city. We're dealing with small groups who aren't necessarily being reached out to," he said.

Kaplan named other groups like the African population in Staten Island and South Asian and Arab immigrants in Queens -- each present specific challenges to be counted.

Lester Farthing, director of the regional census office, said that the attacks of September 11, 2001 produced a particularly difficult problem for an accurate count.

"We realize our greatest challenge is working against the fears of what happened with 9/11," said Farthing.

Mohammed Razvi, executive director of the Council of Peoples Organization agreed that the aftermath of the attacks created an atmosphere of distrust among South Asians toward the government.

"They already had a misconception and the atrocities that occurred after 9/11 where people were apprehended just because of their name, without a warrant or any wrongdoing made it even more of an uphill battle," he said.

Razvi said this further compounded their tendency of being underrepresented.

"We are so unbelievably undercounted. I think we were undercounted for almost 100,000 people [in 2000]," said Razvi. He offered a reason: "I think this is the misconception of people coming from a third world country that the government coming and taking your information is a dangerous thing."

Razvi is working against this fallacy by holding town meetings, talking to imams and recruiting community members to become census representatives.

Getting the attention of each diverse group, said Cumberbatch, needs a different approach.

"It may be the mosque, it may be the soccer league," she said. "It's where people live, work, play, worship. We try to look at for different groups on how to access."

Don't Look Back

It appears undocumented immigration participation in the 2010 Census comes down to one thing.

"It's trust. That's it and nothing else," said Razvi. "That's the way to move forward. It's unfortunate that these are the communities that need the most services that they are entitled to but lack of involvement in the census hinders the service that they will be given."

Cintron said this is why organizations, politicians and the government have started galvanizing support nine months before the first census is mailed out.

"It's going to impact us for ten whole years and that's why we want to start this now and why we're having this conversation now. We have to figure out ways to get people interested."